Real Estate 101 The Benefits of Investing in Real Estate (Free Money Finance)

Post on: 30 Март, 2015 No Comment

Categories

September 21, 2012

Real Estate 101: The Benefits of Investing in Real Estate

The following is a guest post by FMF reader Apex. He has been investing in rental real estate for more than four years and is authoring a Real Estate 101 series (click here to begin the series ), posting every Friday, based on his experiences.  The series is designed to give prospective investors the basic tools they need to succeed.

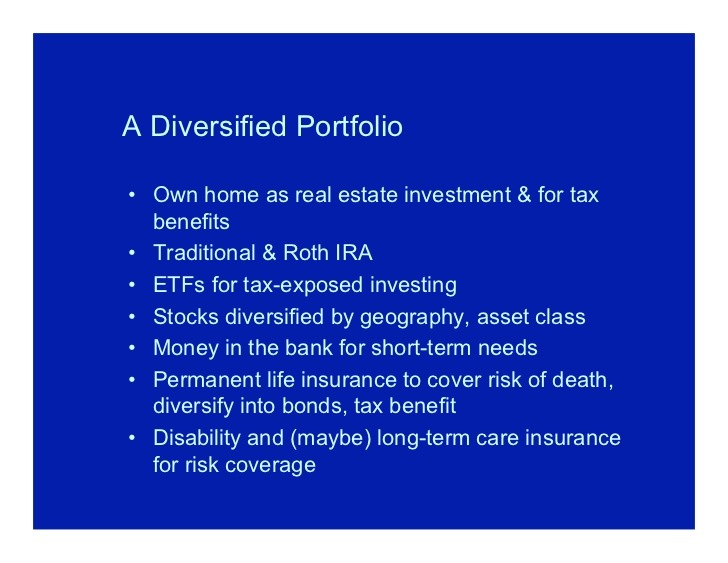

There are two concepts that are mentioned regularly in the investing world.  Those concepts are diversification and asset allocation.  Both of these involve spreading your investments around to mitigate risk while trying to get a higher return than might be achieved with safer investments.

Real estate is often mentioned as a portion of a well diversified portfolio.  For most people this involves investing in something like a Real Estate Investment Trust known as a REIT which trades just like a stock and is truly a pure real estate investment for the investor.

However, actually purchasing income producing property is not the same as investing in a REIT.  When you own property and manage it for income you are actually both an investor and a business owner.  As a managing investor and not a silent partner, you are able to exercise some level of control over the type of returns you get by setting the criteria of the properties you will purchase.  As a business owner you are able to provide some labor and manage the business to control costs and provide stability which increases the safety of the investment.  If you invest in a REIT, you do not control the value of what you are buying, and you cannot run any numbers to ensure the type of return you will get.  This makes the investment inherently less safe.  You are also paying someone else to make investment decisions, to find capital, and to perform all the daily operations of the business.  That cost will remove the higher than average return that real estate can offer.  If you are looking for a pure investment where you put in no labor or management and reap higher than typical returns with low risk, you can keep looking.  If that existed, I assure you, we would all be invested in it and sipping our Pina Coladas on a beach somewhere.  It does not exist.

But when you own and operate a real estate investment business you are in a position to do something that almost no other investment offers.  Namely, to reap higher than average returns with lower than average risk.

Before I get into the reasons, let me define very specifically what type of real estate investment I mean and what type I do not.  There are three characteristics that must exist to meet my definition of high return/low risk real estate investing.

1. You own property directly or have an ownership interest in specific properties.

2. That property produces a regular income that exceeds your expenses.

3. You provide some level of labor or management necessary to run this as a business rather than as a pure investment.

There are many valid ways to invest in real estate.  Some examples include REITs, Tenancy in Common investments, and buying property to fix and resell known as flipping.  None of these meet all three of my criteria and so they are not what I will be discussing here.  This series will be focused exclusively on purchasing individual properties, either houses or apartments, renting them out for income and managing that enterprise as a business.

Below I will offer a list of what I think are the most significant benefits of investing in income producing real estate.  These benefits come together in a way that allows real estate to offer higher returns than typical investments like stocks, better safety than typical high return investments by being run as a business, and yet requires less labor than a typical business.

1. The income stream it produces tends to be extremely stable and predictable.   Rents tend to slowly rise over time but even during tough economic times they tend to be fairly stable, falling only modestly.  You won’t find yourself wondering how much income your properties will produce next year.  They will produce very close to what they produced last year.  If they don’t, they are being poorly managed.

2. The income stream is partially passive.  It’s not as passive as a stock dividend but it is far more passive than running a traditional business.  If you hire outside management it will reduce your income stream some, but it can then be even more passive.  It is important to note however that it should never be 100% passive.  If you have no idea what is going on with your business, you have lost the safety buffer the business is designed to provide.

3. The underlying property will typically appreciate over time. This is in addition to the income stream.  As the property appreciates rents will tend to rise with it meaning that your income stream will also grow over time.  Both of these act as a hedge against inflation.  Unlike the more typical items offered as inflation hedges such as gold, real estate gives you income while you wait.  Gold just sits there.

4. There are tax benefits to investing in real estate that are not available with most investments.   The most valuable is the tax deduction allowed for depreciation of the property.  As a result of this it is very common for the investment to generate considerable net income while only half or even less is taxable.  It was not uncommon in the past to have a net taxable loss after depreciation, but that was because higher priced properties resulted in lower net profitability.  A properly purchased property today should not be in that situation.  Either way, until a property is fully depreciated, a portion of the income generated each year will not be taxed.

Those are all fairly good benefits to investing in real estate.  But I consider those to be the weakest benefits.  The next two are the big ones.

5. Rental properties when purchased correctly generate significant cash flow.   If purchased with 100% cash then the cash flow is going to approximate the cap rate and that rate tends to run between 5-10% depending on the type of property and where we are in the real estate cycle.  Currently many properties are able to produce numbers near the high end of that range or even above it.  These are very strong numbers.  Remember that this doesn’t count the appreciation of the property.  This is just cash that you put into your pocket every year; cash that is not all taxable due to deprecation; cash that will be generated reliably year after year with no significant reduction, but slow consistent increases.

The cash flow a property generates is the single most important thing about real estate investing.  If an era of real estate investing offered no properties that could generate good cash flow such as the early 2000’s I would simply not be a buyer of any additional real estate in that environment.  Keep in mind, however, that properties you already own will continue to perform as they always have regardless of the inability of new properties to do so.

The reason this is so critically important is because this is the reason why real estate investing can be both stable and low risk.  Refusing to buy properties that do not offer strong cash flow will keep you out of investment trouble.  There is no shortage of people who have lost a lot of money investing in real estate, but not people who had properties that were generating significant cash flow.  I cannot stress this enough.  Successful safe real estate investing revolves around cash flow.  You should never purchase properties with appreciation as your primary objective.  Your business runs on cash and cash flow not on appreciation.  It is so important that it can almost be your only measure of success and safety.  Cash flow is king!

With cap rates of 5-10% and some very modest appreciation such as 2% you are looking at stable repeatable returns of 7-12% per year.  With more typical long term appreciation of 3-4% you are looking at returns of 8-14%.  That’s a pretty high total return considering the level of safety and stability it has.

While cash flow is absolutely critical and by far the most important aspect of real estate investing, the last benefit is the most powerful and the most beneficial.

6. As good as the returns in real estate are when investing with cash, they can be compounded significantly by using leverage.   The word leverage immediately brings with it the presumption of risk, often high risk.  While gains are increased, losses are as well.  A fractional loss in value can mean a 100% loss of your investment.  Certainly leverage cannot be used in a safe and responsible way, especially with an investment that is being touted as low risk…right?

Anyone who has ever had a mortgage on their house has used leverage.  Most people use far higher levels of leverage on their house than is typical in real estate investing.  If you have an FHA loan you can purchase a property with as little as 3.5% down and 50% of that goes to pay a fee to HUD.  That means you have only put 1.75% towards the purchase of your house, which is a leverage ratio of more than 50 to 1.  If the value of your house were to drop by 2% you would be technically insolvent on the property.  You would have lost 100% of your initial investment in your house.  Underwater is the term we hear used today to describe people in this situation.

But on an investment property you typically cannot purchase one with less than 20% or 25% down.  In the not too distant past you could get properties with much less down than that but it will be a while before that is possible again.  These are leverage ratios of 3 or 4 to 1.  It would take a 20-25% loss in value for the property to be insolvent or underwater.  That has only happened once in the last 50 years and we just finished going through it.  The odds of it happening again from these levels is remote.

But there is a far more important reason that makes this kind of leverage inherently safe and that is the cash flow of the property.  Even if a property you had purchased were to suffer a reduction in value that erased 100% or more of your initial investment, the strong cash flow from the property will render such an event nearly irrelevant to the operation of your business because your business doesn’t operate on the value of its assets but on the power of the income it produces.  That is why cash flow is so critical, and why you should always purchase primarily for cash flow and not appreciation.

Furthermore you are paying down principal on your mortgage every month.  Your cash flow is continuing to buy that property regardless of what happens to its value from year to year.  At the end of the mortgage you will own the property free and clear and have made significant profit from it each year as well regardless of what happened to the value of the property in the mean time.  So the risks to this leverage are minimal, but the benefits can be dramatic.

The returns mentioned in the cash flow section can currently be more than doubled, perhaps tripled with the use of 3 or 4 to 1 leverage.  And these returns are not just for one year, or two.  They are repeatable every year, year after year.  Now to be fair, if you do not take those gains and purchase more properties with them they will not compound, the same way a dividend on a stock will not compound if you do not reinvest it.  But if you do reinvest it you can continue to create these returns, compounded, year after year, until such time as the real estate cycle no longer allows you to purchase properties with solid cash flow.

When you put all these reasons together investing in real estate stands apart from nearly every other type of investment.  That’s not to say real estate investing is risk free.  You as the investor are still responsible for making wise choices and running the business in a responsible fashion.  Many investors have failed at this task in spectacular fashion in the past few years.  But if you do it right, it’s one of the best legal investments available.