Quitclaim Deed Overview

Post on: 6 Май, 2015 No Comment

Talk to a Local Residential Real Estate — Buy / Sell Attorney

A quitclaim deed is a type of deed that transfers an interest in real property, like a house, vacant land or a mobile home. The person giving the property is the grantor. The person receiving the property is the grantee. Quitclaim deeds are sometimes referred to as quit claim or quick claim deeds.

Quitclaim Deed

The most important thing about a quitclaim deed is that the grantor doesn’t make any warranties, guarantees or promises about the property. Essentially, the grantor is saying in a quitclaim deed that he’s conveying whatever interest he may have in the property, which could be no interest at all to a perfect title. This is the complete opposite of a warranty deed in which the grantor transfers property with a guarantee of clear title.

When to Use a Quitclaim Deed

Quitclaim deeds are typically used to address existing or possible questions about a property’s title. A quitclaim deed is also known as a deed of release. If there’s the possibility that someone could have a claim to the property, such as a divorced or divorcing spouse, or there’s a problem with the title, maybe a paid-off loan that wasn’t properly released, a quitclaim deed can be used to resolve something that would be a cloud or defect in the title. Such clouds can affect value and the ability to sell property.

In a tax sale, a local government or taxing body is selling a property in order to collect unpaid taxes. Through a quitclaim deed, the government conveys to the tax sale buyer the interest it gained in the property under state tax foreclosure laws, and no more.

Also, a person transferring real property to their living trust uses a quitclaim deed.

Warranty deeds are generally used in the sale or purchase of a home. A warranty deed provides guarantees or warranties that the property has good title and is free of liens.

Reversing a Quitclaim Deed

Reversing a quitclaim deed is extremely difficult. Once a quitclaim deed is signed and delivered, the grantor doesn’t own the property. The transfer is final and can’t be reversed unless the grantee quitclaims the property back. If the grantee (person who received the property) doesn’t agree, the grantor must prove the transfer was invalid by showing that the deed was signed under threats, external pressure or because the grantee lied.

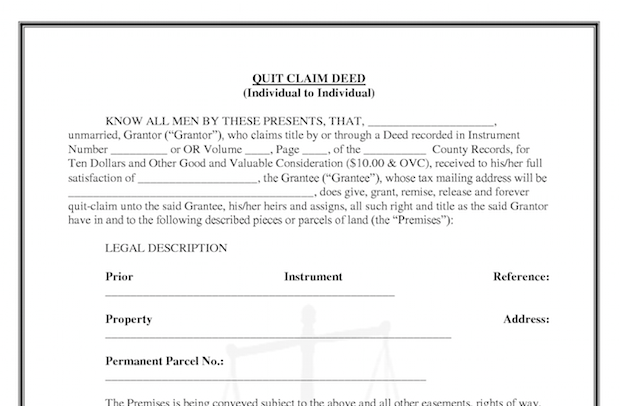

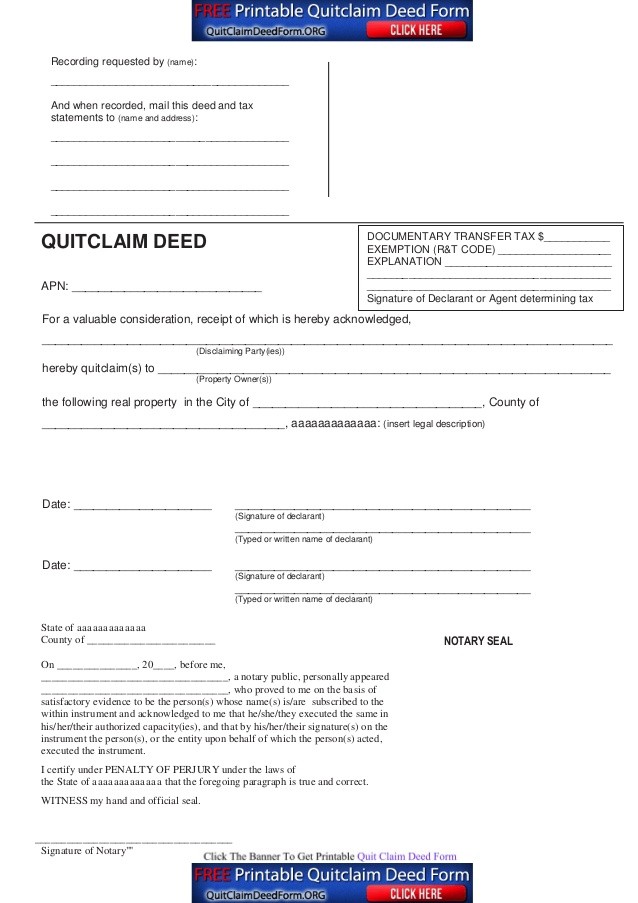

Quitclaim Deed Requirements

Each state has specific requirements for completing a quitclaim deed. Generally, every state requires the following information:

- Grantor and grantee names

- Legal description of the property — not just the address

- County name where the property is located

- Consideration — the actual purchase price paid or if a gift, then a small dollar value

- Signature of a notary public

- Grantor’s signature

In some states, the grantee must also sign the quitclaim deed. A few states require the signatures of witnesses. After completing a quitclaim deed, it must be filed in the land records office in the county where the property is located.

Questions for Your Attorney

- I’m getting divorced. Does signing a quitclaim deed remove me from the mortgage?

- Can there be more than one grantor or grantee on a quitclaim deed?

- I want to put my kids on the title to my house with me but I want to be the majority owner. Can I give unequal shares of ownership in a quitclaim deed?

- Should I accept a quitclaim deed if I’m buying a house?