Qualified Personal Residence Trust

Post on: 24 Июль, 2015 No Comment

Viewpoints on Financial Planning

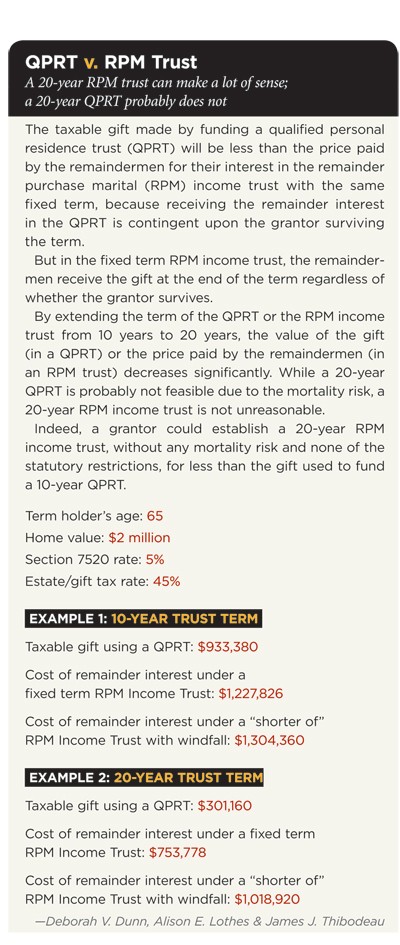

A qualified personal residence trust is ideal for anyone who has a substantial estate and is expected to face future transfer taxes.

One of the best tools to manage future transfer tax liability for wealthy families is a qualified personal residence trust (QPRT). A QPRT allows one to make greater use of their gift tax exemption ($5.34 million in 2014). IRS regulations provide a ready road map to accomplish an effective transfer that can save significant future gift and/or estate taxes. It is ideal for anyone who has a substantial estate and is expected to face future transfer taxes. For the purpose of a QPRT, a home can be either a primary residence or a second home (i.e. beach house, lake house, mountain house).

A QPRT is a lifetime transfer of a personal residence (primary or second home) in exchange for continued rent-free use of the residence for the trust term. Assuming that the grantor survives the trust term, the residence either passes outright to the beneficiaries of the trust or can remain in trust for their benefit. Essentially, a successful QPRT allows one to reduce the gift or estate tax cost of transferring a residence by leveraging the $5.34 million (2014 limit) gift tax exemption.

Example: Betty, age 60, transfers her mountain home ($1 million market value) to a QPRT. She retains the right to utilize the home as her residence for 20 years. Assuming she outlives the 20-year trust term, the house would pass to her two children. If the 7520 rate in the month of the gift is 2.2% (January 2014), the initial taxable gift would be valued at about $375,430. So long as Bettys lifetime taxable gifts have not exceeded $5.34 million (2014 limit), no federal gift tax would be payable (some states may impose a tax), although she would have to file a federal gift tax return. In any event, if Betty survives for the full trust term, the residence will pass to her two children with no additional gift or estate tax inclusion.

Assuming the mountain home was worth $2 million at that time, Betty would have been able to transfer a $2 million residence to her children at a transfer tax inclusion of $375,430. Because a QPRT is a future interest gift, the $14,000 annual gift exclusion is not available.

FREQUENTLY ASKED QUESTIONS

1. When should one utilize a QPRT?

A QPRT is an effective estate freeze technique and is most applicable to taxpayers with estates that would exceed the applicable exclusion ($5.34 million in 2014). It is a tax-efficient means of intra-family home transfer. During the QPRT term, the grantor can continue to utilize the residence on a rent-free basis. Because it is specifically allowed under tax regulations, there is little tax risk.

If the grantor does not outlive the trust term, the then fair market value of the home is brought back into his or her estate while the earlier taxable gift is removed. Assuming the grantor survives the trust term, the grantor may be permitted to lease the residence back from the beneficiaries (presumably family members). Lease payments are another means to benefit heirs without any further gift or estate tax consequences. Essentially, a QPRT is an estate planning technique with virtually no downside estate planning risk.

2. What are the requirements to qualify a residence transfer for QPRT tax treatment?

Only a principal residence or other personal residences, such as a vacation home, are eligible for QPRT tax treatment. A single individual can have no more than two QPRTs. Married couples are permitted up to three QPRTs. Other than a residence, a QPRT can have only a limited amount of cash to cover the cost of a home purchase, improvements and mortgage payments to be incurred over the next six months. Neither the grantor nor his or her spouse is permitted to repurchase the residence from the QPRT during the trust term or even thereafter.

Finally, if the residence is sold during the trust term, the sale proceeds must be either re-invested into a new residence within two years or the QPRT will either have to terminate and distribute assets to the grantor or convert to a grantor retained annuity trust (GRAT).

3. What is the transfer tax treatment of a QPRT transfer?

The transfer of a residence to a QPRT is a taxable gift that would not qualify for the $14,000 annual gift exclusion as it is treated as a future interest transfer. The valuation of this transfer is dependent upon several factors including term of the trust, life expectancy of the grantor and an interest rate factor based upon an IRS 7520 rate for the month of the transfer. QPRTs work best in a high interest rate environment as a higher rate reduces the taxable gift portion of the transfer.

The older the grantor and the longer the trust term, the smaller the taxable gift. However, the grantor must outlive the trust term. Accordingly, personal and family medical history of the grantor should be a focus of QPRT planning.

4. What impact does a mortgage have on a QPRT transfer?

While you can transfer a residence with a mortgage to a QPRT it does complicate the tax benefits significantly. QPRT regulations even allow for cash to be transferred to a QPRT to fund up to 6 months of mortgage payments. Where a residence subject to a mortgage is transferred to a QPRT, the grantor has made a gift of only the equity in the property and not the full market value.

As subsequent principal payments are made on the mortgage, the grantor would be treated as making additional taxable gifts that would be measured by the same calculation method described in FAQ #3. There are no issues on the interest portion that should remain deductible in most cases under income tax rules. To alleviate the future gift tax consequences, it is generally best to transfer a non-mortgaged residence to a QPRT.

5. What income tax consequences are associated with a QPRT?

A QPRT grantor is treated as the owner of the residence for the stated trust term. Accordingly, he or she is eligible to deduct real estate taxes and the interest portion of the mortgage. A sale of the residence during the trust term may also qualify for the home sale exclusion of gain ($250,000 if single and $500,000 if jointly-owned) if the applicable home sale ownership rules are satisfied. Because a QPRT transfer is treated as a gift, the beneficiarys basis is generally equal to the grantors basis. The potential income taxes due on sale by the beneficiaries must be weighed against the potential estate tax savings.

SUMMARY

Because a QPRT does not impact the senior generations productive property holdings, it is oftentimes a favored vehicle for intra-family transfers. A QPRT is ideal for vacation or second home transfers and affords significant upside from a wealth transfer perspective with minimal downside risk.