Proshares Launches Inverse Euro Etf 2015

Post on: 16 Апрель, 2015 No Comment

3A%2F%2Fwww.proshares.com%2F?w=250 /% news heading. Certain Commodity and Global ProShares ETFs Affected by Shift to Daylight Saving Time on 3/8/2015. SeekingAlpha contributor says it may be time to

3A%2F%2Fseekingalpha.com%2F?w=250 /% By Patrick Watson. Some people just can’t get enough leverage, apparently. Today ProShares unveiled eight new ETFs offering long and inverse exposure to popular

3A%2F%2Fetfdb.com%2F?w=250 /% ProShares launched three new inverse ETFs on Thursday, bringing the number of single inverse equity and bond ETFs to 14. The new funds are the first to

3A%2F%2Fetf.stock-encyclopedia.com%2F?w=250 /% This is the opposite/inverse investment product to the ProShares Ultra Euro ETF (ULE). ETF charts and further information:

3A%2F%2Fseekingalpha.com%2F?w=250 /% ProShares UltraShort Euro seeks daily investment results, before fees and expenses, that correspond to twice (200%) the inverse (opposite) of the daily performance of

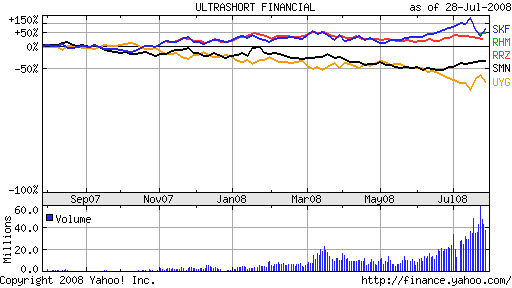

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% View the basic SKF stock chart on Yahoo! Finance. Change the date range, chart type and compare ProShares UltraShort Financials against other companies.

3A%2F%2Fetfdb.com%2F?w=250 /% ProShares, a leading provider of leveraged and inverse ETFs, announced the launch on Friday of the first ETFs with leveraged and inverse exposure to the

3A%2F%2Fetf.about.com%2F?w=250 /% While this is not every inverse ETF in the investing universe, this a pretty comprehensive list of the major (and most popular) inverse ETFs and even inverse ETNs.

3A%2F%2Fetf.about.com%2F?w=250 /% Two of the most popular types of ETFs nowadays are leveraged ETFs and inverse ETFs. And capitalizing on this trend, a lot of ETF providers are now creating funds that

3A%2F%2Fetf.stock-encyclopedia.com%2F?w=250 /% Leveraged ETFs use derivitives to achieve a higher percentage return on a given investment than could be obtained by investing directly. For example, if an investment

3A%2F%2Fwww.zacks.com%2F?w=250 /% ProShares, a leader in inverse and leveraged ETFs, has launched its latest product in the currency space, targeting the in focus euro. The new fund, the ProShares Short Euro ETF (EUFX — ETF report), looks to give investors inverse daily exposure to the

3A%2F%2Fetfdailynews.com%2F?w=250 /% Eric Dutram: ProShares, a leader in inverse and leveraged ETFs, has launched its latest product in the currency space, targeting the in focus euro. The new fund, the ProShares Short Euro ETF (NYSEARCA:EUFX), looks to give investors inverse daily exposure

3A%2F%2Fwww.nasdaq.com%2F?w=250 /% ProShares, a leader in inverse and leveraged ETFs, has launched its latest product in the currency space, targeting the in focus euro. The new fund, the ProShares Short Euro ETF ( EUFX), looks to give investors inverse daily exposure to the performance of

3A%2F%2Fwww.businesswire.com%2F?w=250 /% variation of an ETF with inverse exposure to the euro.” ProShares, a premier provider of alternative exchange traded funds (ETFs), announced today the launch of ProShares Short Euro (NYSE: EUFX), the first -1x euro ETF in the United States.

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% ProShares, a leader in inverse and leveraged ETFs, has launched its latest product in the currency space, targeting the in focus euro. The new fund, the ProShares Short Euro ETF (EUFX), looks to give investors inverse daily exposure to the performance of

3A%2F%2Fwww.reuters.com%2F?w=250 /% “Concerns over Europe have driven nearly $1 billion 1 of assets into our -2x euro ETF, EUO, since its launch ProShares’ investment advisor. “We are launching EUFX in response to investor requests for an additional variation of an ETF with inverse

3A%2F%2Fwww.etfstrategy.co.uk%2F?w=250 /% ProShares, a US-based provider of alternative ETFs, has announced the launch of the ProShares Short Euro requests for an additional variation of an ETF with inverse exposure to the euro.” The timing of this short euro product looks astute.

3A%2F%2Fetfdb.com%2F?w=250 /% ProShares launched three new inverse ETFs on Thursday, bringing the number of single inverse equity and bond ETFs to 14. The new funds are the first to offer single inverse exposure to Chinese equities, real estate, and the basic materials sector.

3A%2F%2Fseekingalpha.com%2F?w=250 /% Today ProShares brought out three new inverse For a long time, ETF sponsors tended to roll out new funds either one at a time or as groups with some sort of connection to each other. Lately we are seeing more of these polyglot launches and filings.