Property Valuation FAQ s Answered

Post on: 16 Март, 2015 No Comment

Share

- Share on Facebook Tweet this post Pin this post Share this post

It may seem like yet another expense, but a property valuation could also be a necessity for your successful real estate purchase.

Benefiting the buyer and seller, a property valuation can help you to assess the current value of a property in an open and competitive real estate market.

What is a property valuation?

A property valuation is generally conducted on a request by you, or a lending institution (such as a bank) who is is looking to fund the purchase of a property.

Normally produced as a report, a property valuation includes property information rates, size of the land and building, physical details on the construction and condition of the dwelling, details on any immediate issues that may need addressing as well as information on comparative sales in the area.

When would I need to get a property valuation?

The most common time you will hear people discussing house valuations are when lending institutions are financing a certain property – it is an essential part of the home loan application process.

If you are obtaining a mortgage or refinancing, a bank requires a valuation to ensure the security value of a property covers the loan. If anything happens and the mortgage is unpaid, the bank needs to be confident that it can recover any outstanding amount owing on the property if it had to re-sell it.

The lending institutions usually use their own nominated panel or preferred licensed property valuers.

The other times when you may need or want a valuation is if you are selling a house, or before you make an offer .

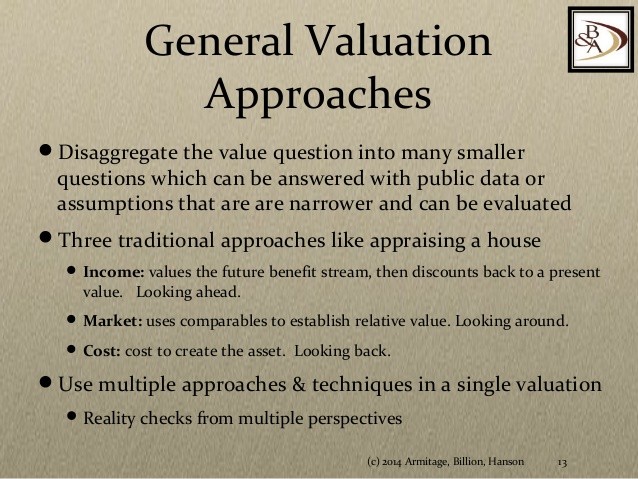

How do valuers come up with a figure?

For a valuer to do their job, they generally need to visit the property, measure it and note details on the building structure and its condition, any structural faults, rooms and layout and their presentation and fitouts, fixtures and fittings, and any improvements.

They also make notes on the property’s vehicle access and any garages, carports or out buildings.

Often the valuation will include photos of the property highlighting certain features.

Once they have visited the property, they also look at planning restrictions and council zoning and its relative location. The valuer then compares all these attributes to recent comparable sales in the surrounding area before coming up with the magic figure.

What is the difference between licensed valuers and real estate agents’ appraisals?

Real estate agents often give you an appraisal on your property when trying to gain your listing. They base their appraisals on other sales in the area and their experience. Remember, real estate agents are working for the vendor (which could be you) who pays the commission on the price they achieve, not the official valuation.

This is different from a valuation carried out by a licensed valuer, who has to base their report on facts as they are legally responsible for the information they provide.

A property sale may fall over on a valuation if the property’s value doesn’t come close to the agreed sale price. A buyer, on behalf of their lender, could deem the finance clause is reason the property can’t go ‘unconditional’. They may either decide to exit the contract or re-negotiate.

How can I increase my house value?

If you are looking to sell your house in the future and want to know what might help when the property is valued, here are some helpful pointers.

- You can’t change your property’s location but you can change the house itself. Think about a renovation or extending the floor area of the house. Can you add a bathroom, bedroom or entertaining area? What about improving your indoor-outdoor flow?

- Make sure the property is well presented. Can you tidy up the garden or remove any untidy trees or structures? Are their any views that can be taken advantage of or can you make vehicle access easier?

- Give your important rooms the bathroom and kitchen a mini makeover. It can often be fairly cost effective to update cabinetry, the bench top, light fittings and fixtures. Even a quick lick of paint can do wonders!

- Do you have covered areas for vehicles? Can you add a carport or garage?

- Give your property a general tidy up. If your block and house are neat and tidy and look well maintained, it is likely to benefit the valuation.

If you are thinking of selling your home or property but not yet ready to commission a property valuation you can get a free suburb report containing the sold prices of properties similar to yours, plus local median property prices and a snapshot of the area’s property supply and demand to help you better understand the estimated value of your property.