Property Tax Deduction

Post on: 11 Май, 2015 No Comment

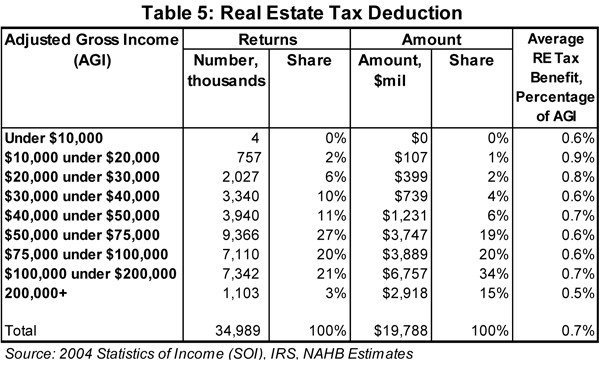

Homeowners can deduct real estate taxes on Schedule A

Deducting Property Taxes

Individuals can deduct the cost of property taxes assessed on the properties they own. The amount that’s deducted is the amount paid by the property owner, including any payments made through an escrow account at settlement or closing. Some people pay their property taxes through an escrow account included with their mortgage payments. In this case, the amount that can be deducted is the amount that the lender actually paid for property taxes from the escrow account. Property taxes are reported as an itemized deduction on Schedule A.

Most state and local governments charge an annual tax on the value of real property. This is called a real estate tax. You can deduct the tax if it is assessed uniformly at a like rate on all real property throughout the community. The proceeds must be for general community or governmental purposes and not be a payment for a special privilege granted or service rendered to you. (Publication 530)

Property Taxes Paid Through Escrow Accounts

When property taxes are paid through an escrow account attached to a mortgage loan, the property owner can deduct only the amount paid out of the escrow account for property taxes. The IRS explains:

Escrow accounts. Many monthly house payments include an amount placed in escrow (put in the care of a third party) for real estate taxes. You may not be able to deduct the total you pay into the escrow account. You can deduct only the real estate taxes that the lender actually paid from escrow to the taxing authority. Your real estate tax bill will show this amount. (Publication 530)

Allocating Property Taxes When Real Estate is Sold

When real estate is bought and sold, property taxes are split between the seller and the buyer. The IRS provides specific guidance on how to determine the amount of property taxes allocated to the buyer and to the seller:

Real estate taxes paid at settlement or closing. Real estate taxes are generally divided so that you and the seller each pay taxes for the part of the property tax year you owned the home. Your share of these taxes is fully deductible if you itemize your deductions. (Publication 530)

Certain Charges on Property Tax Bills are Non-Deductible

Sometimes a property tax bill includes charges or fees for services or assessments for local benefits. These are not deductible as property taxes. Also not deductible are transfer or stamp taxes or assessments made by a homeowner’s association.

Service charges include things like water service, trash service, and services performed by the government that are related specifically to the property. An itemized charge for services assessed against specific property or certain people is not a tax, even if the charge is paid to the taxing authority (Publication 17).

Assessments for local benefits mean charges on your property tax bill that are for local benefits that tend to increase the value of your property. Local benefits include the construction of streets, sidewalks, or water and sewer systems (Publication 530). Because these expenses are related to increasing the value of your property, these expenses are not deductible as property taxes. Instead, these expenses increase your cost basis in the property. For more details, see Publication 551, Basis of Assets. especially the section on Increases to Basis .