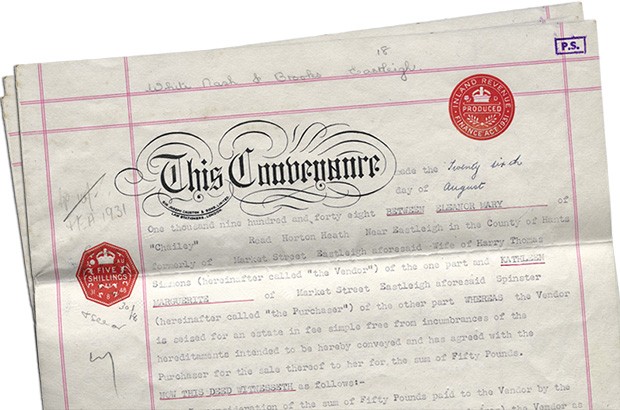

Property Deeds for Residential Properties Explained

Post on: 29 Апрель, 2015 No Comment

Talk to a Lawyer

Real Estate Deeds

A property deed transfer occurs when an ownership interest in real estate is transferred from one party to another. The parties involved are the grantor and the grantee. If you are the grantee, it is important to review the deed carefully to make sure there are no errors.

The following information must be included in a property deed:

- Names of Grantor and Grantee

- Consideration

- Legal description of property

- Life Estate

- Tenants in Common

- Community Property

- Reservations and Exceptions

- Encumbrances

- Guarantees

Elements of a Valid and Enforceable Deed

In order for a deed to be valid and legally enforceable, the deed must meet the following requirements:

- Must be in writing and convey title to real property.

- Signed by the grantor. Grantor’s signature should be notarized.

- There must be a grantor and grantee.

- The grantor must be legally competent to enter into legal contracts.

- There must be a legal description of the property.

- The deed should be recorded for legal notice purposes to establish priority and the sequence of ownership. However, deeds are valid even if they are not recorded.

- Acceptance and delivery. The grantee must accept the deed.

Title Insurance

Although title insurance is not required, it is highly recommended to ensure that the property chain of title is clear of defects. Lenders always require a property title report and title insurance before closing a loan. A title examiner must first do a title search and prepare a report reflecting any exceptions to the title insurance. Such exceptions include encroachments such as building encroachments or fences and easements such as access or utility easements. Exceptions are excluded from title insurance coverage unless an endorsement is purchased. Some states do not have endorsements for easements and encroachments. The property tile report also reflects current taxes and any liens such as prior mortgages or mechanic’s liens which must be paid and satisfied prior to the closing

A property deed transfer is complicated. It is recommended that you consult with a real estate lawyer when transferring real property. Consult your case for free with a Real Estate Attorney.

Types of Property Deeds

General Warranty Deed

A general warranty deed is the most common type of property deed that is used to convey the transfer and title of real estate. This type of deed is similar to a grant deed, except the general warranty deed contains three guarantees instead of two guarantees. The guarantor warrants and guarantees that the grantor owns the title free and clear of any defects from the time the grantor owned the property back to prior ownerships of the property, that there are no liens or encumbrances other than stated in the deed or which the grantor has informed the grantee about, and the grantor will defend the title of the property against third party claims.

Quitclaim Deed

Quitclaim deeds convey an interest of the Grantor in the property to another party. There are no warranties made by the grantor that the title is good or that the property is free or claim from liens or encumbrances. Quitclaim deeds are used frequently to transfer property interests from one spouse to another. They are also used to clear up any clouds in the title from a third party claiming an interest in the property.

Special or Limited Warranty Deed

With a special or limited warranty deed, the Grantor only warrants any title defect from the time the Grantor took possession of the property, but not prior.

Fiduciary Deed

A fiduciary deed is used when there is a guardianship or conservatorship involving real property transfer. The trustee or executor of the estate has authority to sell property that belongs to the estate. The fiduciary must be acting in the best interests of the principals for the court to grant a fiduciary deed.

Security Deed

A security deed transfers legal title to a lender during the term of the security of a note in connection with a mortgage.

Release Deed (Reconveyance)

A reconveyance deed removes the original lien that a lender placed on the property. The lender will record a release deed or reconveyance deed the borrower pays off the mortgage and note in full.

Grant Deed

Grant Deeds are similar to warranty deeds and contain the following two guarantees:

- That the property has not been sold to anyone else.

- There are no encumbrances other than those disclosed by the seller (grantor) to the buyer (grantee).

Tax deeds are issued by municipalities when a property is sold for back taxes. The tax deed is used to convey the property title to the new buyer.

Bargain and Sale Deed

A bargain and sale deed guarantees that the grantor has title, but does not guarantee that the title is free of defects. The bargain and sale deed is used at a sheriff’s foreclosure sale auction or at a tax auction. Basically you are buying land and don’t know if there are any encumbrances on the land, unless stated in the deed. A bargain and sale deed can contain warranties and covenants if they are stated specifically in the deed. A bargain and sale deed with covenants guarantees that the buyer is buying a property that is free and clear of indebtedness.

Gift Deed

Gift deeds are used with regard to a transfer of real estate between relatives where no exchange of money has taken place.

Deed in Lieu of Foreclosure

A deed in lieu of foreclosure is used when a borrower is in default on their mortgage to avoid foreclosure. The borrower signs over the deed to the lender, returning the property and walks away not owing the lender any more money on their mortgage. A deed in lieu of foreclosure could show up as a negative item on your credit report. However, it is not as serious as a foreclosure.