Preferred Stock

Post on: 16 Март, 2015 No Comment

Preferred Stock

Entries to the Retained Earnings Account, Book Value

Earnings Per Share, Other

Preferred Stock

When it comes to dividends and liquidation, the owners of preferred stock have preferential treatment over the owners of common stock. Preferred stockholders receive their dividends before the common stockholders receive theirs. In other words, if the corporation does not declare and pay the dividends to preferred stock, there cannot be a dividend on the common stock. In return for these preferences, the preferred stockholders usually give up the right to share in the corporation’s earnings that are in excess of their dividends.

To illustrate how preferred stock works, let’s assume a corporation has issued preferred stock with a stated annual dividend of $9 per year. The holders of these preferred shares must receive the $9 per share dividend each year before the common stockholders can receive a penny in dividends. But the preferred shareholders will get no more than the $9 dividend, even if the corporation’s net income increases a hundredfold. (Participating preferred stock is an exception and will be discussed later.) In times of inflation, owning preferred stock with a fixed dividend and no maturity or redemption date makes preferred shares less attractive than its name implies.

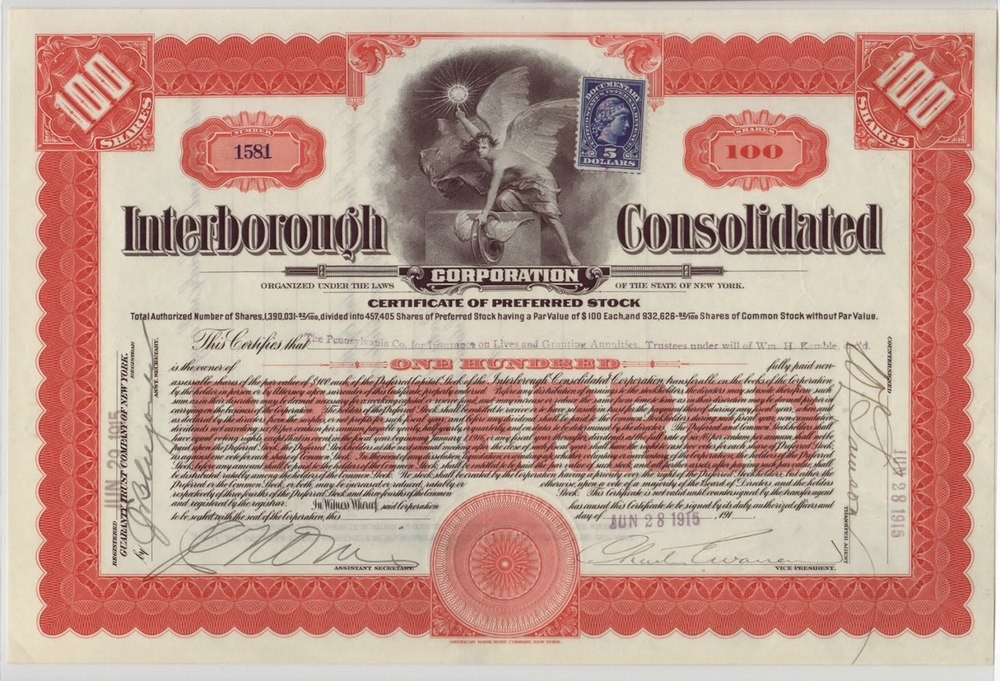

Par Value of Preferred Stock

The dividend on preferred stock is usually stated as a percentage of par value. Hence, the par value of preferred stock has some economic significance. For example, if a corporation issues 9% preferred stock with a par value of $100, the preferred stockholder will receive a dividend of $9 (9% times $100) per share per year. If the corporation issues 10% preferred stock having a par value of $25, the stock will pay a dividend of $2.50 (10% times $25) per year. In each of these examples the par value is meaningful because it is a factor in determining the dividend amounts.

If the dividend percentage on the preferred stock is close to the rate demanded by the financial markets, the preferred stock will sell at a price that is close to its par value. In other words, a 9% preferred stock with a par value of $50 being issued or traded in a market demanding 9% would sell for $50. On the other hand, if the market demands 8.9% and the stock is a 9% preferred stock with a par value of $50, then the stock will sell for slightly more than $50 as investors see an advantage in these shares.

Issuing Preferred Stock

To comply with state regulations, the par value of preferred stock is recorded in its own paid-in capital account Preferred Stock. If the corporation receives more than the par amount, the amount greater than par will be recorded in another account such as Paid-in Capital in Excess of Par — Preferred Stock. For example, if one share of 9% preferred stock having a par value of $100 is sold for $101, the following entry will be made.

Features Offered in Preferred Stock

Corporations are able to offer a variety of features in their preferred stock, with the goal of making the stock more attractive to potential investors. All of the characteristics of each preferred stock issue are contained in a document called an indenture .

Nonparticipating vs. Participating

Generally speaking, preferred stockholders only receive their stated dividends and nothing more. If a preferred stock is described as 10% preferred stock with a par value of $100, then its dividend will be $10 per year (whether the corporation’s earnings were $10 million or $10 billion). Preferred stock that earns no more than its stated dividend is the norm; it is known as nonparticipating preferred stock.

Occasionally a corporation issues participating preferred stock. Participating preferred stock allows for dividends greater than the stated dividend. Since this feature is unusual, it is prudent to assume that all preferred stock is nonparticipating unless it is clearly stated otherwise.

If a preferred stock is noncumulative . its dividends will not be in arrears if a corporation omits dividends. That is, the corporation need not make up any omitted dividends on noncumulative preferred stock before declaring dividends. However, the noncumulative preferred stock must be given its current year dividend before the common stock can get a dividend.