PPT International Parity Conditions PowerPoint presentation

Post on: 27 Июль, 2015 No Comment

International Parity Conditions

Parity Conditions provide an intuitive explanation of the movement of prices and. NOTE Parity Conditions are expected to hold in the long-run, but not always in. PowerPoint PPT presentation

Title: International Parity Conditions

International Parity Conditions

- Reading Chapter 4

Class Outline

- Introduction to Parity Conditions

- Absolute Relative Purchasing Power Parity

- Real Exchange Rate

- Fisher Effect (FE)

- International Fisher Effect (IFE)

- Unbiased Forward Rate (UFR)

- Interest Rate Parity (IRP)

- Covered Interest Arbitrage

- Currency Forecasting gt PROJECT

Introduction

- Managers of multinational firms, international

investors, importers and exporters, and

government officials must deal with these

fundamental issues

exchange rate?

understand the economic fundamentals of

international finance, known as parity conditions.

Parity Conditions

- Parity Conditions provide an intuitive

explanation of the movement of prices and

interest rates in different markets in relation

to exchange rates.

assumption of Perfect Capital Markets (PCM).

the long-run, but not always in the short term.

is the Law of One Price (LOP).

should be the same in all markets (assuming no

transactions costs).

good in the cheap market and reselling it in the

The Law of One Price

from the relative local product prices

LOP Example

- Pwheat, Aust 4/bushel and Pwheat, UK

The Big Mac Index

- The most famous test is The Economist magazines

Big Mac Hamburger standard.

(No Transcript)

Research on the Big Mac Index

- Pakko and Pollard (1996) conclude that Big Mac

PPP holds in the long-run, but currencies can

deviate from it for lengthy periods. They note

several reasons why the Big Mac index may be

flawed

utilities, labor) are also inputs that affect

Relative Purchasing Power Parity

should exactly offset any inflation differential

between two countries

Percentage change in domestic prices

Relative PPP

- We can also write

Relative PPP

- Relative PPP implies that the change in the

exchange rate will offset the difference between

the relative inflation of two countries.

in domestic and foreign price levels respectively

and ?s to the percentage change in the exchange

rate.

PPP predicts the domestic currency should

depreciate (appreciate).

Relative PPP Example

- Given inflation rates of 5 and 10 in Australia

and the UK respectively, what is the prediction

of PPP with regards to A/GBP exchange rate?

countries with high rates of inflation will see

their currencies depreciate against those with

low rates of inflation.

How well does PPP work?

- We have seen that the strictest version of PPP

that all goods and financial assets obey the law

of one price is demonstrably false.

relative inflation rates and changes in exchange

rates.

decline (gain) in purchasing power see the

sharpest erosion (appreciation) in their foreign

exchange values.

Relative Purchasing Power Parity

- Applications of Relative PPP

- Forecasting future spot exchange rates.

- Calculating appreciation in real exchange

Real Exchange Rate

- Appreciation/depreciation in the real exchange

rate measures deviations from PPP.

correctly. The competitiveness of this country

The Fisher Effect

of the future rate of inflation, not what

inflation has been in the past.

The International Fisher Effect

- The International Fisher Effect (also called

Fisher-open) states that the spot exchange rate

should change to adjust for differences in

Tests of the International Fisher Effect

- Empirical tests lend some support to the

relationship postulated by the international

Fisher effect (currencies with high interest

rates tend to depreciate and currencies with low

interest rates tend to appreciate), although

Unbiased Forward Rate (UFR)

- Some forecasters believe that for the major

floating currencies, foreign exchange markets are

efficient and forward exchange rates are

unbiased predictors of future exchange rates.

that the forward exchange rate, quoted at time t

for delivery at time t1, is equal to the

expected value of the spot exchange rate at time

Unbiased Forward Rate (UFR)

- An unbiased predictor, however, does not mean the

Empirical Tests of UFR

- A consensus is developing that rejects the

efficient market hypothesis.

unbiased predictor of the future spot rate and

that it does pay to use resources in an attempt

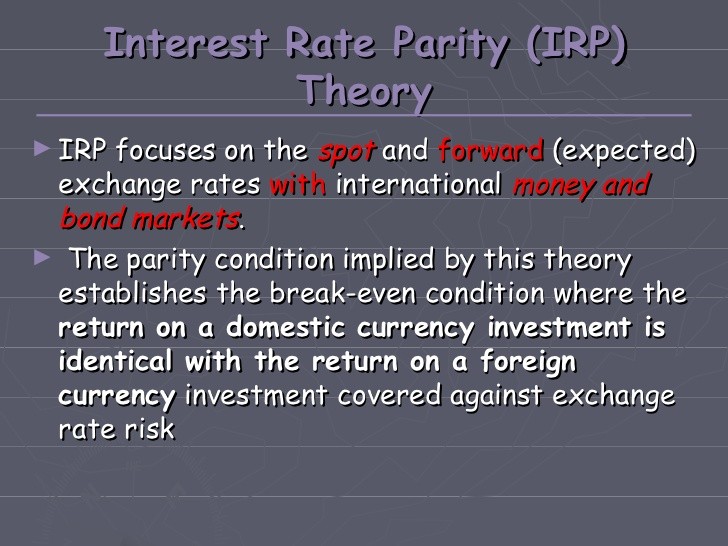

Approximation of IRP

- In general, the currency trading at a forward

premium (discount) is the one from the country

with the lower (higher) interest rate.

Interest Rate Parity Why It Holds

- This must hold by arbitrage. Otherwise riskless

profits could be made. This is known as covered

interest arbitrage (CIA) and occurs whenever IRP

does not hold. CIA can involve the following

steps

currency in the spot market

interest-bearing instrument and then

exchange rate at which to convert the foreign

currency proceeds back to the domestic currency.

Covered Interest Arbitrage Example

- The annual interest rate in the AUS and UK are 5

and 8 respectively. The current spot rate is

1.50/ and the 1 year forward rate is 1.48/.

Can arbitrage profits be made?

years time)