Portfolio 21 Fund Snapshot

Post on: 16 Март, 2015 No Comment

About Portfolio 21

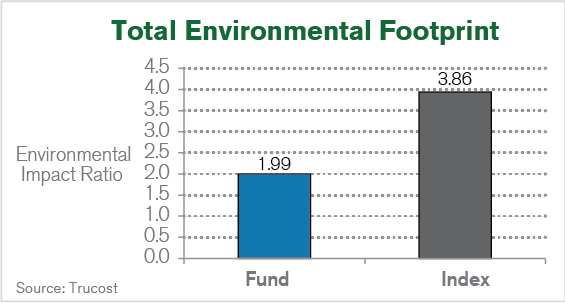

Portfolio 21 is a global equity mutual fund designed to be a low-turnover, multi-cap, core portfolio. The fund invests in companies designing environmentally superior products, using renewable energy, and developing efficient production methods.

Performance as of 12/31/14

Fund Characteristicsas of 12/31/14

One year turnover

The Price-Earnings ratio, or P/E. is the current market price of a company share divided by the earnings per share of the company. The Price-to-Book ratio, or P/B. compares a company’s book value to its current market price. Standard deviation is applied to the annual rate of return of an investment to measure the investment’s volatility. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund’s alpha. Information Ratio is a ratio of portfolio returns above the returns of a benchmark (usually an index) to the volatility of those returns. The information ratio (IR) measures a portfolio manager’s ability to generate excess returns relative to a benchmark.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 44 country indices comprising 23 developed and 21 emerging market country indices. An investment cannot be made directly in an index. Returns reported reflect the net total return index, which reinvests dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 877-351-4115, or visiting portfolio21.com. Read it carefully before investing.

Portfolio 21 Global Equity Fund may invest in foreign securities, which are subject to the risks of currency fluctuations, political and economic instability and differences in accounting methods. Investing in foreign securities is riskier than investing in domestic securities. The fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Portfolio 21’s environmental policy could cause it to make or avoid investments that could result in the portfolio underperforming similar funds that do not have an environmental policy. There are no assurances that the fund will achieve its objective and/or strategy.

Portfolio 21 Global Equity Fund is distributed by Quasar Distributors, LLC