Porter s Five Forces Model (Competitive Analysis)

Post on: 16 Март, 2015 No Comment

Porter five forces model, developed by Michael E.Porter of Harvard University in 1979, holds the purpose to analyze the industry in order to determine the level of intensity regarding the competition and attractiveness of the industry. The attractiveness of an industry is measured in terms of profit; more profitability means a more attractive industry and low profitability means a low attractive industry.

Porter referred to these forces as micro environment rather than macro environment because these forces are nearest in the sense of affecting the organization. Organizations have to re-assess the market if any of the forces change, it does not necessary that the organization should leave the industry if the profitability is low, because most of the organization are making good profits by applying their core competencies to gain competitive edge over their rivals and increase their profits.

The word Strategy is very common in this advanced era of the business and technological world, it is used even in our daily life routine, you may have heard at times that lots of people discuss about strategies (plans) to achieve something. You must be thinking that strategies are developed in dreams or common sense by higher management of the company but that is not the case, even the best of the strategies always comes after proper evaluation of internal and external environment of the company.

The strategies are made by strategists to achieve objective or goals to allow the business to compete in industry. Porter five forces model of competitive analysis is a widely used approach for developing strategies in many industries. The intensity of competition varies across the industries. The intensity of competition is higher in low return industry as compared to high return industry due to less requirement for capital and common products that require minimum R & D (Research & Development) and efforts for production.

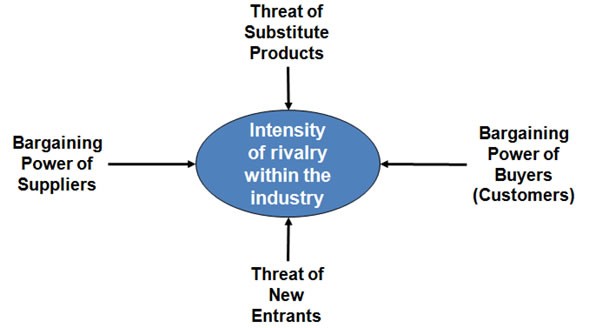

According to Porter, the nature of competitiveness in a given industry can be viewed as a composite of the following five forces:

Rivalry among competitive firms

Potential entry of new competitors

Potential development of substitute products

Bargaining power of suppliers

Bargaining power of consumers

Rivalry Among Competitive Firms

Rivalry among competing firms is the most powerful of the five competitive forces i-e the ongoing war between the firms competing in the same industry for gaining customer share in order to increase their revenues and profits. The competition is more intense if the firm pursues strategies that gives it a competitive advantage over the strategies pursued by its rivals.

Developing new strategies is easier than retaining the uniqueness of the strategies so as to gain a competitive edge over the rivals in the industry. Changes in strategy by one firm may be met with retaliatory countermoves, such as lowering the prices, enhancing quality, adding features, providing services, extending warranties and increasing advertising.

- In the telecommunication industry, firms are lowering their prices in order to increase their consumer call ratio by minimizing their per minute profit margin but this strategy is increasing the overall company revenues.

- In the past few years a number of new features were added in the mobiles, now it not only gives the functionality of cell phone but we are also able to take pictures, make videos, watch streaming and use Internet. The firms like Nokia, Siemens, Samsung and other are following each others strategies to minimize the differentiation in the product so customer can easily switch brands.

- In the past television companies offered maximum one year warranty but now due to the tough competition in the media market, players as Samsung, LG, Haier, Philips and others enter in the market with their high quality products in order to compete with Sony, thats the reason customers are getting more services in the form of extended warranty periods.

- Pepsi and Coca Cola are competing by increasing their advertising and offering new beverages in the market.

We discussed about the offline business, when it comes to online business on the Internet, the competition is more fierce, consumer get more control over its purchasing by sitting at home on computer and comparing the similar and substitute products on bases of features and prices.

Amazon.com is the best online book selling site, offering a huge library containing millions of books on a variety of subjects. People visit to amazon because they enjoy user friendly design, products, books and search capability of the site but when it come to purchase the product customer move to other site such as buy.com for purchase on discounts. Buy.com CEO says, The Internet is going to shrink retailers margins to the point where they will not survive.

- Dell.com offers computers and laptops of high quality at low prices as compared to its competitors.

- EBay.com is a site where people like to go to purchase products online at low price.

The rivalry among competing firms increases as the number of competitors increases, as competitors grow more equal in size and capability, as demand for the company products decline, products are undifferentiated, product prices decline, consumer brand switching cost is less, number of supplier available for raw material, low price substitute products are available and entry into market is easy due to less constraints. As rivalry among competing firms intensifies, industry profits decline, in some cases to the point where an industry becomes inherently unattractive.

Potential Entry of New Competitors

Potential entry for new competitors is also the factor to intense the competition in the industry. A larger pool of new entrants results in more changes of intense competition. Barriers to entry, however can restrict the firms from entering the market, more number of entry barriers will make it difficult for the new entrants to exploit the opportunity of new market.

Barrier to entry, however, can include the need to gain economies of scale quickly, strong customer loyalty, strong brand preferences, large capital requirements, lack of adequate distribution channels, government regulatory policies, tariffs, lack of access to raw material, possession of patents, undesirable locations, counterattack by entrenched firms and potential saturation of the market.

If existing firms are producing at economies of scale then the new entrants must ensure to make its entry into the market with a large production scale capability to lower its fixed and variable cost per unit in order to compete with the competitors product, otherwise new entrants will face exceeding cost problems. Government policy creates hurdles for new entrants by heavy taxes and interest rates. New firms must get to know the Government regulations and policies before making a entry decision into the country.

Despite the numerous barriers to entry, new firms sometimes enter industries with higher-quality products, lower prices and substantial marketing resources. The strategists job, therefore, is to identify potential new firms entering the market, to monitor the new rival firms strategies to counterattack as per need and to capitalize on existing strengths and opportunities.

Potential Development of Substitute Products

Firms mostly monitoring the trends within the industry to track the strategies but competition not only arise within the similar industry but also in different industry. Companies in other industry offer products with similar features and functionality or even better act as substitute for the products. For Instance, the producers of spectacles and contact lenses are facing mounting competitive pressures from growing consumer interest in laser surgery. Newspaper firms are feeling competitive force of the general public turning to cable news channels for late-breaking news and using Internet sources to get information about sports results, stock quotes, and job opportunities.

A firm faces intense competition from substitute product producing firms, when the customer cost of switching is lower, substitute products are better in quality and functionality. end users grow more comfortable when using the substitutes. The competitive strength can be determined by market share, sales pattern, producers adding capacity for more production, and rise in profits.

Bargaining Power of Suppliers

Supplier and producer relation always matters specially in manufacturing industries. Suppliers play an important role in the production of goods and services, making the raw material better and till the final product is made. Bargaining power of suppliers affect the intensity of competition especially if there are huge number of suppliers, less availability of raw material and the cost of switching between suppliers or raw material is high. These attributes in the industry give power to the supplier to enforce terms and conditions on manufacturers and charge high cost on raw materials.

For Examples,

The bargaining power of Microsoft and Intel in more because they are the huge suppliers of software and hardware. Microsoft enforce computer manufacturers to load Windows in their computers and place their logo on laptops, desktops and server machines. Intel on the other hand also demands computer manufacturers to place their logo on machines using Intel processor. Intel and Microsoft enforcing their terms and conditions also charging high cost from the computer manufacturing companies.

Manufacturer needs to build relationship with the supplier in order to improve the quality and reduce the prices of the product by working together for improvement in processes and reduce time to market by implementing just-in-time inventory.

Dell computer known for low cost and best quality computer, laptop and server manufacturer in the industry. The key behind dells success is maintaining good relationship and collaboration with the supplier of computer hardware and software.

To gain control or ownership over its suppler, backward integration strategy is adopted by most of the companies. This strategy will help both suppliers and companies to work together for improvement in product quality, reduce cost, reduce time to market and earn good reputation in the industry.

Bargaining Power of Consumers

Consumers are the final users of the product; performance of the companies totally depend upon the consumers. Bargaining power of consumers is more especially when they are huge in number and consumers purchase in large quantity. Rival firms offer discounts, warranty and services to switch the consumer from one brand to another in the same industry.

The bargaining power of consumers is also more when products are undifferentiated and widely available. In this case consumer can ask for more discounts, extended warranty and services. As the satisfaction level of consumer goes up more the intensity level of competition increases. Firms should monitor the competitors strategies and also take care of the consumers likes and dislikes by maintaining good relationship with the consumer by implementing CRM processes in the company.

P & G has an online portal to ask the customer about their views, opinions and new ideas about the products of their desire.

Criticism on Porter Five Forces Model

In the previous few years, other forces like globalization, technology and deregulation are introduced; these factors have a deep impact on the organization as well. The strategists should consider all the internal and external environmental variables into consideration in order to formulate fine-tuned strategies.