Piercing the Corporate Veil

Post on: 16 Март, 2015 No Comment

August, 2004; Last Reviewed Dec. 2010.

Contents

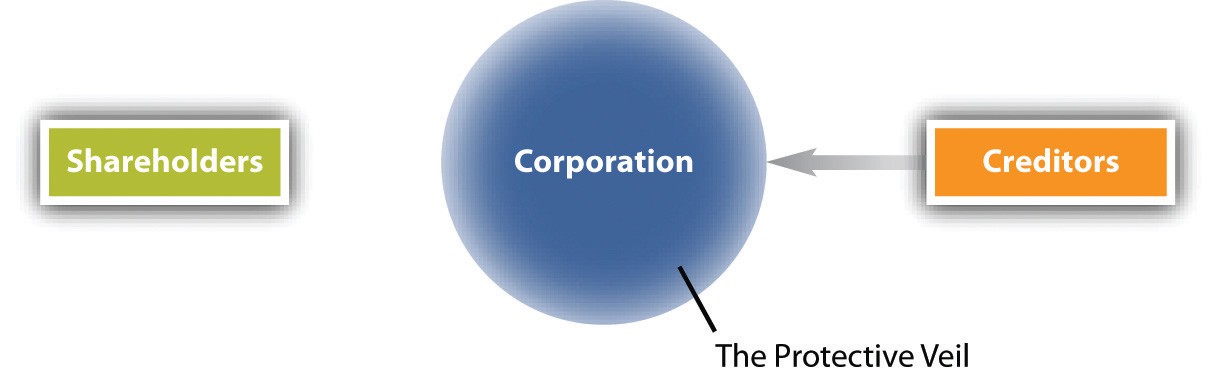

One of the biggest advantages to incorporating a business is that the principals of the corporation enjoy broad protection from being held personally responsible for the debts and liabilities of the corporation. That is, creditors can reach the corporation’s assets, but once those assets are exhausted they cannot ordinarily also reach the personal assets of the owners or shareholders of the corporation. Under some circumstances, those to whom the corporation is liable will attempt to pierce the corporate veil, the legal term used to describe an action to have the corporation set aside for purposes of the litigation such that personal liability attaches, and personal assets can be reached.

An action to pierce the corporate veil normally arises in civil litigation when the corporation is believed to have inadequate assets to cover its liabilities, and the plaintiff alleges that the corporation is actually a sham — that is, the corporation is not really a distinct individual, but is merely an extension or alter ego of its shareholders, being used to advance their private interests or to perpetrate a fraud.

As the precise facts and circumstances which can result in a piercing of the corporate veil will vary depending upon state law, and as this is a fact-dependent inquiry, it is important to consult with a qualified lawyer when evaluating whether the corporate veil may be pierced in any specific case. A corporation offers strong protection to its shareholders, and most efforts to pierce the corporate veil are rejected by the courts.

Factors Considered

Generally, when evaluating if a corporation is in fact legitimate, or if the corporate veil should be pierced, courts look at the following factors:

Corporate Formalities — Did the corporation follow proper procedure, for example in its formation and appointment of directors, issuance of stock, the holding of its annual meetings, the filing of annual reports with the state, and the maintenance of its own property, and financial books and accounts? Or were the procedures not followed, was the corporation dependent on property or assets of a shareholder which it did not technically own or control, or were the corporate finances commingled with those of its shareholders?

Individual Control — What amount of financial interest, ownership and control did the principals maintain over the corporation?

Personal Use — Did the principals use the corporation to advance personal purposes?

If the court examines those factors and concludes that there is such unity of interest between the corporation and its shareholders that they are inseparable, and it would be unjust to permit the corporate form to stand, a court will typically pierce the corporate veil.

Fraud

A court may also pierce the corporate veil to prevent a fraud, where the corporation is found to be a sham meant to facilitate fraud against third parties. If the corporation was set up, for example, to shield its owners from liability over a fraudulent real estate deal, and the owners siphon out the corporate assets such that the corporation is unable to compensate the victims of the fraud, a court is likely to set aside the corporation and allow the victims to recover from the personal assets of the owners.