Paying Taxes on ETF Dividends

Post on: 26 Июнь, 2015 No Comment

What You Need to Realize About Taxes on ETF Dividends

You can opt-out at any time.

Please refer to our privacy policy for contact information.

As you know, one of the main benefits of ETFs is the tax advantage it holds over mutual funds. However, when it comes to paying taxes on ETF dividends, the story is a little different.

Qualified ETF Dividends

There are two kinds of dividends that the stocks in an ETF may issue. Qualified dividends and unqualified dividends. In order for an ETF dividend to be taxed as qualified, the equity in the fund paying the dividend must be owned by the investor for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. Also, it cannot be on the unqualified dividend list and it must be paid by a U.S. or qualified foreign corporation.

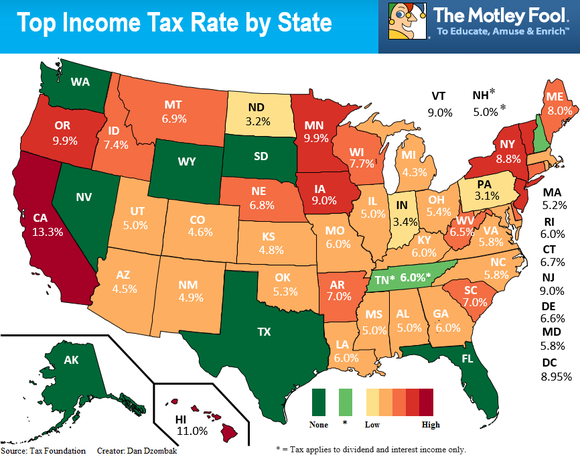

The tax rate on qualified dividends is anywhere from 5% to 15%, depending on your income tax rate. If you have an income tax rate of 25% or higher, then your qualified dividend is taxed at 15%. If your income tax rate is less than 25%, then your qualified dividends are taxed at 5% So far, so good.

Unqualified ETF Dividends

Unqualified dividends are those payouts that do not meet the qualifications discussed above. In other words, they are dividends that the government does not consider true dividends. Some examples include dividends on money market accounts. dividends on short term mutual fund capital gains. interest from your credit union, dividends in your IRA, and dividends from REITs (real estate investment trusts ). In the case of unqualified dividends, these payouts are taxed at your normal income tax rate. So if you have unqualified dividends from the ETFs in your portfolio, then they will have a heavier tax burden than the normal qualified dividends from these securities.

Keeping track of your Dividends

Knowing the difference between qualified and unqualified dividends is very important in regard to ETFs. After you understand the concept, you will need to put that knowledge to use as you track the dividend payouts for all the stocks in your dividend ETFs (a spreadsheet may be helpful). Once you have it all figured out, you can fill out your tax forms correctly and file your return. Or you can do what most investors do and hire a good tax accountant. Hopefully your gains will cover his fee.

And if you want to see some dividend ETFs in action, look no further than my List of Dividend ETFs