Patterns and Trends of Foreign Direct Investment into Africa

Post on: 16 Март, 2015 No Comment

Latest available statistics point to a downward trend in FDI inflows into Africa since registering a peak in 2008, the year that saw the onset of the global financial crisis. Although Africa currently represents less than 5% of global Foreign Direct Investment (FDI) which is estimated between 1.4 and 1.6 trillion in 2011 by UNCTAD, the continent nevertheless currently represents $55 billion (2010) or around 9% of total FDI flows to developing countries. Retrospectively it can be noted that FDI was merely 38 billion in 2010 (Figure 1). With global economic recovery ahead, FDI is poised to gather momentum over time. What is propelling FDI in Africa, what are the major sources of such investment and into which countries and sectors are FDI inflows being channelled to will be analysed and discussed below. It might also be interesting to evaluate the impact of FDI on the continent’s unprecedented growth rates. Economic theory recognises that investment plays a crucial role in creating national growth and where domestic savings are insufficient, external capital flows can complement these to boost Gross Domestic Product. FDI definitely holds the potential to improve employment levels, increase production and exports while enabling the transfer of technology and skills.

Source: World Investment Report

FDI Sources

While the old West has traditionally been the predominant source of investment in Africa, this hegemony is being eroded with the larger role being played by the BRICS and especially China and India or even other emerging economies.

The top five investors in terms of projects are USA, France, UK, India and UAE. Among emerging sources of investment, South Africa, China, Kenya, Nigeria, Russia can be noted and they rank in the top 20 sources of investment (E&Y Attractiveness Survey 2012). Among recent examples of investment, the $200m investment by Canada-based Bombardier Aerospace into a manufacturing facility in Morocco can be mentioned. Besides, Switzerland-based Nestlé has set up a new manufacturing plant ($91.9m) in Nigeria (Fdi intelligence 2012).

The most common modes of FDI are Mergers and Acquisitions (M&As) and Greenfield investments. The expansion of Multinational companies (MNCs) accounts for the largest proportion of FDI inflows in Africa. 11,421 cross border M&As have been reported in 2010. There has on the other hand been a 23% increase in the number of greenfield projects on the continent from 2009 to 2010 (World Investment Report).

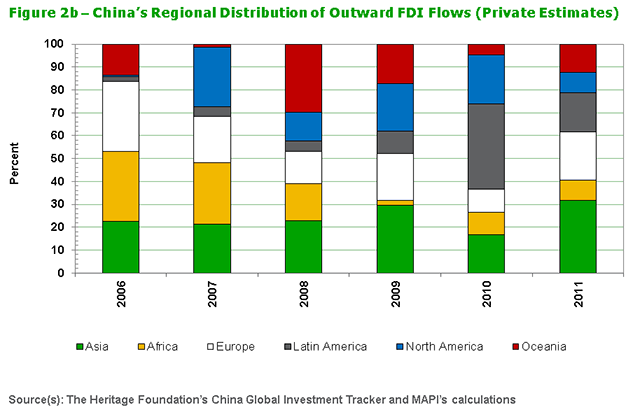

The growing interest of Asia in Africa deserves some comments. Faced with a large population and rising income levels resulting from high rates of growth, China has been seeking more efficient sources of raw materials to further develop its industrial activities. China’s FDI has been particularly significant in Ethiopia, Rwanda, and Zambia from 2003 to 2010 (Ernst & Young. It’s Time for Africa). Chinese companies present in Africa include a number of Chinese state-owned companies such as China Petrochemical Corp. China National Petroleum Corp. and China National Offshore Oil Corp. Chinese investment has been recently preferred to international financial institutions as they provide more flexible terms of repayments but are equally combined with infrastructure development necessary for the eventual successful trade of the products developed. More than 35 African countries have been financing their infrastructure projects with the help of China infrastructure, with a highest number of projects in Nigeria, Angola, Sudan and Ethiopia in fields such as water, transport, electricity and ICT (African Development Bank 2011).

India on the other hand has shown a sharp interest in sectors where it has a strong competitive advantage already. The expanded presence of Bharti Airtel in the telecommunications sector after the acquisition of the giant telco Zain Africa (for $10.7 billion) is one such example. Transfer of technology has been privileged over the exploitation of natural resources while investment into agriculture or oil is not being overlooked. India initially focused its investment in Kenya, Nigeria and Uganda but has lately been expanding its investment flows to over 20 countries in Africa. Companies involved are both from the private sector (e.g. Apollo Group of Hospitals, Fortis Escorts Hospitals, Mahindra and Mahindra Limited, NIIT, Tata Group) and from Government enterprises (e.g. Rail India Technical and Economic Services, Konkan Railways, IRCON International Limited, Oil and Natural Gas Corporations, Videsh Limited (OVL), Bharat Heavy Electricals Limited).

Recent trends also reveal that Chinese and Indian MNEs are diversifying rapidly across several sectors, a pattern that is reflected in overall investment as well and further discussed below.

FDI destinations

The nature and direction of such flows can largely be explained by the presence of natural resources (in particular oil) while other drivers for FDI have also been related to either seeking larger markets or efficiency by targeting countries with larger populations or with relative lower costs (e.g. labour).

Figure 2 provides an overview of regional FDI inflows, pointing to the prime attractiveness of Northern and Southern Africa.

Figure 2: Regional FDI inflows ($ billion), 2010

Source: World Investment Report 2011, p.23