Overdiversification does not help in improving returns

Post on: 22 Июль, 2015 No Comment

Diversification of investments is a strategy adopted by most investors. Essentially, it means spreading your investments across more than one investment avenue, so that if one of your investments falters, another will balance it out. Diversification of investments can be choosing multiple asset classes and/or diversification within the same asset class.

Diversification of investment is a must to mitigate risk. However, more often than not we have a dilemma of how much to diversify. Either too much or too less diversification may not provide the desired results. You should have a right balance in your diversification strategy.

Why should you diversify your portfolio

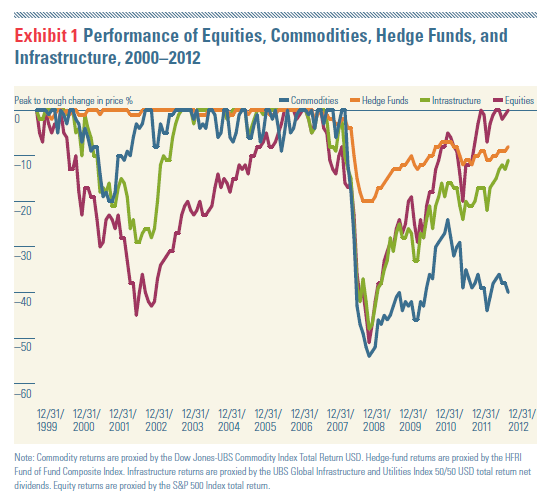

The returns from different asset classes have different returns at different points of time. Suppose return from one asset class is depressed we gain by the extra return from another asset class. For instance, gold as an asset class has provided a superlative return for many years, till 2012. However, in this calendar year it has provided negative returns. On the other hand, the returns from equity were subdued for the last few years. However, the market is seeing some buoyancy in the last few months.

Investments in different asset categories will help in the following ways

* Stocks help your portfolio grow

* Mutual funds provide stable returns as compared to stocks

* Bonds bring in fixed income

* Real estate and gold provide a hedge against inflation. They have a low correlation to stocks

* Liquid investment such Bank FDs and liquid funds gives your portfolio security and stability

Advantages of diversification of portfolio

* Since money is spread across several asset classes, risk is diversified

* It helps to increase returns

* It helps in maintaining adequate liquidity in your portfolio

* Many a times, if you invest in a single or less diversified portfolio, you may run the risk of making low or no returns

Diversification in equities

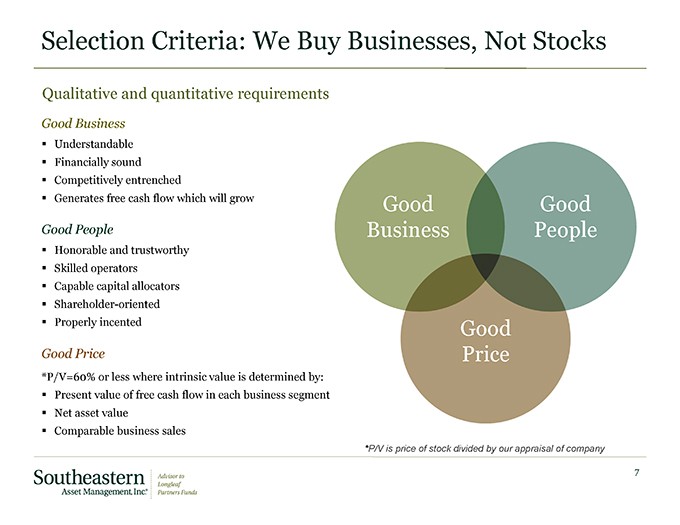

Diversification in stocks can be achieved by buying different stocks, in different sectors or by investing in an equity mutual fund. You should choose the sectors such that they are not related. While this may not save you from a stock market crash, a fall in one sector doesnt usually hurt another.

For example, an Information Technology stock and FMCG stock does not have a direct correlation. Similarly, a banking stock does not have a direct correlation with pharma, but has a correlation with, say, infrastructure or power sector stock (interest rate sensitivity). Here, it is important not to diversify too much. For example, if your exposure to equity is, say Rs 10 lakh, then you should not invest in more than 20 to 25 stocks. Over diversification can make it difficult to track the stocks.

If you are investing in an equity mutual fund, then you must remember that an equity mutual fund, by definition is a diversified investment. Each mutual fund invests in a basket of stocks that the fund manager chooses. Yet, many investors buy multiple mutual funds from different or same fund-houses, assuming that they should not concentrate their bets on one fund. While having five to six funds might make sense for this purpose, it serves no useful purpose to have, say 15 or 20 different equity mutual funds in your portfolio. You would just spend more time and energy in analysing and tracking their performance without any consequent benefits.

Many mutual fund holders also suffer from being over-diversified. Some funds, especially the larger ones, have so many assets (that is, cash to invest) that they have to hold literally hundreds of stocks and consequently, so do you. In some cases this makes it nearly impossible for the fund to outperform indexes — the whole reason you invested in the fund and are paying the fund manager a management fee.

Risks of diversification

* It is also important to note that even a diversified portfolio has some inherent risks attached to it. For instance, stocks could be volatile in the short term.

* Under certain conditions investors can make a loss even though they have a well diversified portfolio. Some of these are global financial crisis, commodities meltdown, and so on. In such circumstances, even the most prudent diversification can lead to losses as stock prices keep on falling.

* Diversification is a must for those who do not have the time or skill to handle investing decisions themselves.

Do not over diversify

By having too many stocks in a portfolio, your more profitable investments may not create a significant value for you. As your capital is spread out thinly among the different investments, the impact of an upside in one investment could be marginal. So, by over-diversifying, you are depriving yourself off the gains from profitable investments.

It is cumbersome to maintain a huge portfolio and keep track of various investments. If you cannot monitor your investments regularly and find that it takes up too much time, then it is a clear indication that you may have spread out thinly. In such a scenario, you may fail to notice a shift in the fundamentals of one or more of your investments. You may realise this too late, by which time the asset value could have eroded substantially.

Too much diversification in the portfolio will lead to increase in transaction costs such as brokerage, DP charges, bank charges and so on, due to churning of the portfolio.

Too less diversification

If you do not diversify there may be the risk of losing out on the gains which a particular asset class may provide.

Diversification of portfolio helps the investors to reduce the risks and increase the returns. However, one should not do over diversification as it would be difficult to track.

The objective of diversification is to diversify risks, achieve the goals and invest for a specific period of time and get higher returns. There is no ideal portfolio. It depends on the risk appetite of the investor, the goals to be achieved, and period of investment.

The writer is a freelancer