Optimal capital structure

Post on: 4 Август, 2015 No Comment

Substantial parts of the literature concerning capital structure have dealt with issues regarding the leverage ratios. These leverage ratios have been analyzed in all kinds of ways, where most studies have explained observed patterns. Our research will also deal with leverage ratios but in an entirely new way. Our problem concerns the practical matter of deciding an appropriate capital structure and the possibility of improvements, which are formulated below. · How do the case companies decide their capital structure? · Are their current capital structures optimal or is there room for improvements? We have studied three companies within the real estate industry due to comparable issues. Our result reveals that the companies do not use any mathematical model when deciding their capital structure but they do consider many important factors. The business and financial risk have the largest impact on the decision even though there are individual variations. Tradition is another factor that seem to influence the management a lot. Our improvement investigation of the three case companies reveals three different scenarios.

1.1 BACKGROUND

2.1 SCIENTIFIC APPROACH

2.1.1 Choice of scientific approach

2.2 STRATEGIC APPROACH

2.2.1 Choice of strategic approach

2.3 RESEARCH DESIGN

2.3.1 Choice of research design

2.3.2 Case study design

2.3.2.1 Choice of case study design

2.3.3 Traditional prejudices against the case study strategy

2.4 THE QUALITY OF OUR RESEARCH DESIGN

2.4.1 Construct validity

2.4.1.1 The constructed validity of this thesis

2.4.2 Internal validity

2.7 RELEVANCE

2.7.1 Practical relevance

2.7.2 Theoretical relevance

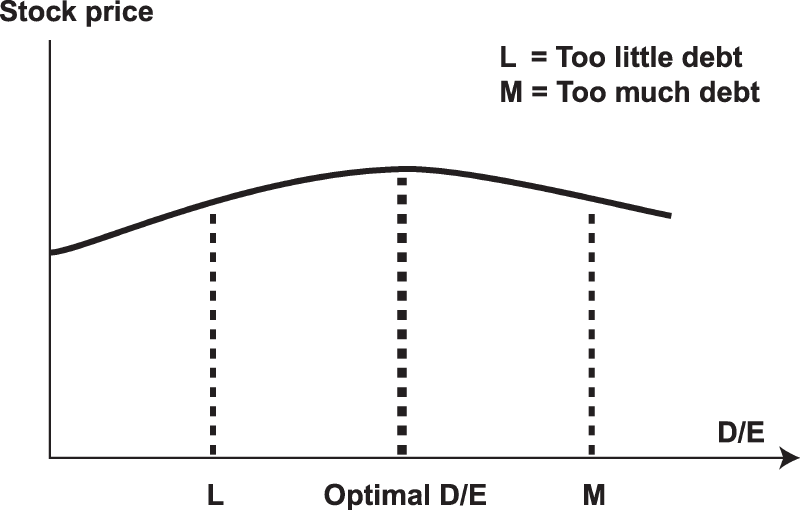

3. THEORETICAL FRAMEWORK

3.1 MODIGLIANI AND MILLER’S PROPOSITIONS

3.1.1 M&M proposition I with no taxes

3.1.2 M&M proposition II with no taxes

3.1.3 M&M proposition I with taxes

3.1.4 M&M proposition II with taxes

3.5.3.2 Growth rate

3.5.3.3 Asset structure

3.5.3.4 Factors that cause stability or variance in future earnings

3.5.4 Financial risk

4.6.3.1 Leverage level

4.6.3.2 Equity ratio

4.6.3.3 Debt coverage ratio

4.6.3.4 Interest rate sensitivity

4.6.3.5 Financial beta

4.7 BUSINESS AND FINANCIAL RISK

5.3 CAPITAL STRUCTURE IN THE FUTURE

6.2 WALLENSTAM’S CAPITAL STRUCTURE

6.3 CAPITAL STRUCTURE IN THE FUTURE

6.4 STRATEGY REGARDING CAPITAL STRUCTURE

6.7.3.1 Industry average