Oil prices is the tail wagging the dog Calgary Beacon

Post on: 16 Март, 2015 No Comment

Wall Street speculators or a Chinese thirst for fuel, which carries more of the blame (or credit) for driving the price of crude higher? While the role China has had in driving demand is fairly clear cut, the financial industry’s impact on the commodities markets is less obvious.

Historically, producers and end-users would use the exchanges to mitigate risk, selling or buying contracts to lock in a future price. The contract was never really intended to be settled by delivery, however. In the future, a local commodity broker would contract with the local producer (or end user) to sell (or purchase) the physical commodity in question and the funds received from the local broker would be used to settle the account at the exchange.

Still an element of speculation

There was always an element of speculation, as you never really knew what the price would be from the local broker down the road, but the vast majority of players had a physical connection to the commodity. That began to change a little over a decade ago when American regulators permitted large institutional investors to play a far greater role on commodity exchanges. This change coincided with very strong movements in commodity prices, which raised a number of eyebrows.

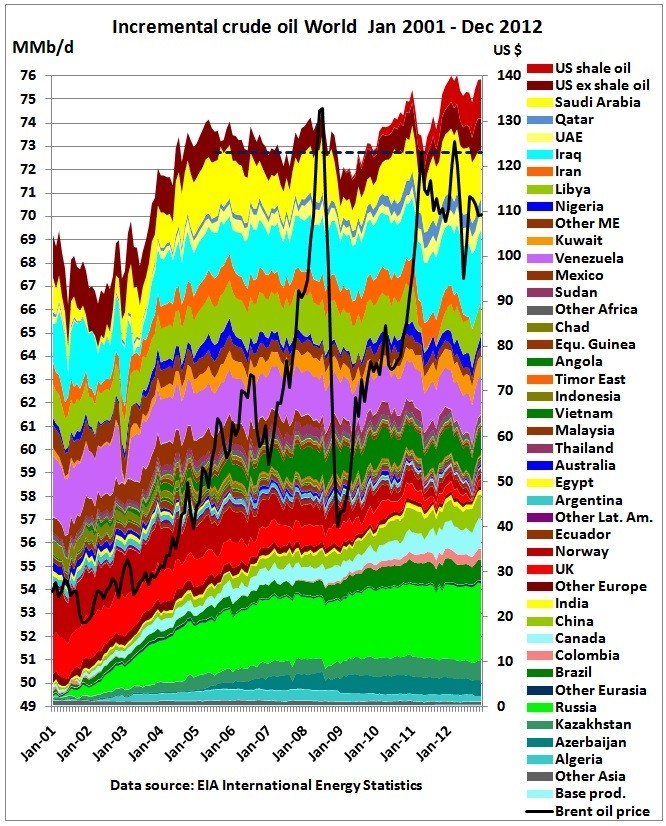

So has the entry of this new class of participants played anything more than just a passive role in commodity markets? The answer is no, according to a recent report by economists Ron Alquist and Olivier Gervais of the Bank of Canada. After looking at a variety of arguments, they concluded that the ultimate culprit has been Asian demand coupled with supply restraints.

It has been claimed that speculative pressure on oil prices comes from the fact that the daily number of crude oil energy contracts traded is up to 15 times higher than daily consumption of crude. Alquist and Gervais highlight that the two variables aren’t directly comparable, with one being measured only at a point in time (a stock variable) and the other measured as a unit of time (a flow variable). Ultimately, the two might be correlated, but it’s only coincidental.

The researchers also looked at whether or not investor positions were greatly in excess of those taken by traditional commercial firms and whether or not the positions taken by financial institutions could be used to predict future price movements. Regarding the former they found that commercial hedging demand rose in tandem with the entry of financial speculative demand and no statistical evidence was found to support the latter.

Lastly, the researchers looked at whether or not the physical quantities of crude oil were being impacted. If the entry of financial firms into the market increased expectations of future higher prices, then there would be an incentive to simply store more crude. Alquist and Gervais show that inventories during the run-up in prices were actually declining and there was no real evidence of producers consciously leaving supply untapped.

It’s unlikely that this is the end of the story, however. Professor James D. Hamilton of the University of California has also written extensively on the topic. Prices are being determined on the commodity exchange and traders pay no attention to whether or not the client placing the order is a speculator or a hedger, but ultimately the price has to equate physical supply with demand. Dr. Hamilton highlights that if the physical demand of crude is not very responsive to price changes, then one can argue either that speculators or that fundamentals are driving prices – it’s all about perception.

Less sensitivity to price changes

In a paper published by the Brookings Institute in 2009, Dr. Hamilton shows that Americans had become increasingly less sensitive to oil price changes. As incomes grew the percentage spent on fuelling ones vehicle declined, meaning the price increases observed earlier in the last decade weren’t really impacting their habits. At a certain point, this changes, naturally. Nevertheless, Dr. Hamilton also concluded that emerging market demand and lower supplies were the principle drivers – even if the price did overshoot in 2008, aided possibly by speculators.

The real question then becomes whether or not investors are reacting differently than commodity users to market information, increasing volatility. Put another way, is the tail wagging the dog?

Will Van’t Veld is an economist with ATB Financial.