Observations Analyzing Treasury Bond Interest Rate History since 1900

Post on: 25 Июль, 2015 No Comment

Tuesday, November 30, 2010

Analyzing Treasury Bond Interest Rate History since 1900

The chart below of bond interest rate history has negative implications not just for some bonds, but potentially for stocks & housing as well. This post complements 100 Years of Treasury Note Interest Rate History. the previous post which graphed the month-by-month rates.

Together, the two posts make it clear that we are currently experiencing historically low yields. That suggests a future of rising interest rates. Rising rates have negative implications not only for many bond investors, but potentially for the stock market and housing market as well.

Treasury Bond Interest Rate History: Yearly Frequency Histogram

The above histogram/frequency distribution of treasury yields is based on the same data as the chart in the previous post (click on image to expand). From 1953 onward, the source data is 10-year U.S. Treasury Note interest rates; prior to that they are Robert Shiller’s rates (see notes at end of post). However, to summarize, this time I’ve used only year-end data. The period covered is from 1900 through 2009.

The vertical blue bars in the histogram show the number of years ending with yields in a given interest rate interval. The scale for the bars is the vertical axis on the left labeled frequency. For example, the first blue bar on the left shows that from 1900 through 2009 there has only been 1 year where the interest rate was less than or equal to 2%. The next bar shows there were 22 years greater than 2% but less than or equal to 3%. The last bar on the right shows that there were 6 years that ended with interest rates above 10%.

The red line graph shows the cumulative percentage of years ending at or below a given interest rate level; the percentage is read on the right vertical axis. Thus, we see that about 21% of the years ended with rates of 3% or less, and 75% ended with rates of 6% or less. Since yields were recently around 2.5%, you might also be interested to know that rates were at or below that level only about 10% of the time. Finally, the median is 4.1%, so half of the years had higher rates and half had lower rates. This is significantly less than the average of 4.9%, reflecting the fact that the rates have a long tail on the right side. Combined, the bar chart and line graph, I think, reinforce the message from the previous time-series graph that we are experiencing historically low interest rates.

Rising Rates and Impact on Bond Markets

If you start with historically low interest rates, rates have nowhere to go but up — though they won’t necessarily rise anytime soon. As discussed in the previous post, because of the relationship between interest rates and bond prices, when the rates rise bond prices will fall (see Yield to Maturity & Interest Rate Risk ). For example, if the yield on the 10-year Treasury Note were to immediately increase from 2.5% to the 100-year average rate of 4.9%; holders of new 10-year notes would see a price decrease of almost 20%. An increase to the more recent average of 6.7% would translate into a price decrease of closer to 30%.

Rising Rates and Potential Impact on Housing & Stock Markets

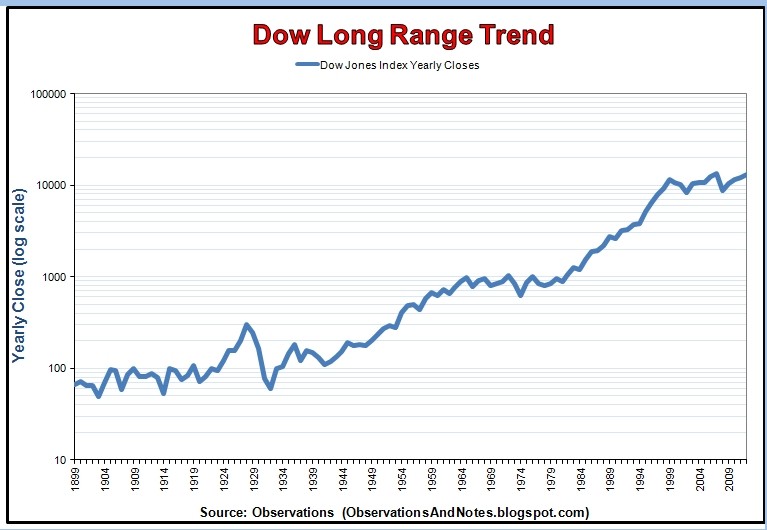

As we saw in Fundamentals of Investment Valuation. interest rates affect the value of all income-generating investments. The impact on valuation is similar whether the income stream comes from interest (bonds), dividends/free cash flow (stocks), or rental income (housing).

As a result, my concern goes beyond the bond market. While it is admittedly unrealistic to expect such an increase in rates overnight. I think the above numbers highlight the headwinds we could potentially be facing at some point in all these markets. In fact, to the extent that the duration of stock and housing investments is longer than that of a 10 year note, the impact on these markets could be even more pronounced. (See The Importance of Duration .) Granted all stock investors do not use this method of valuation, but some do. I expect their valuations will exert downward pressure on the stock market at some point.

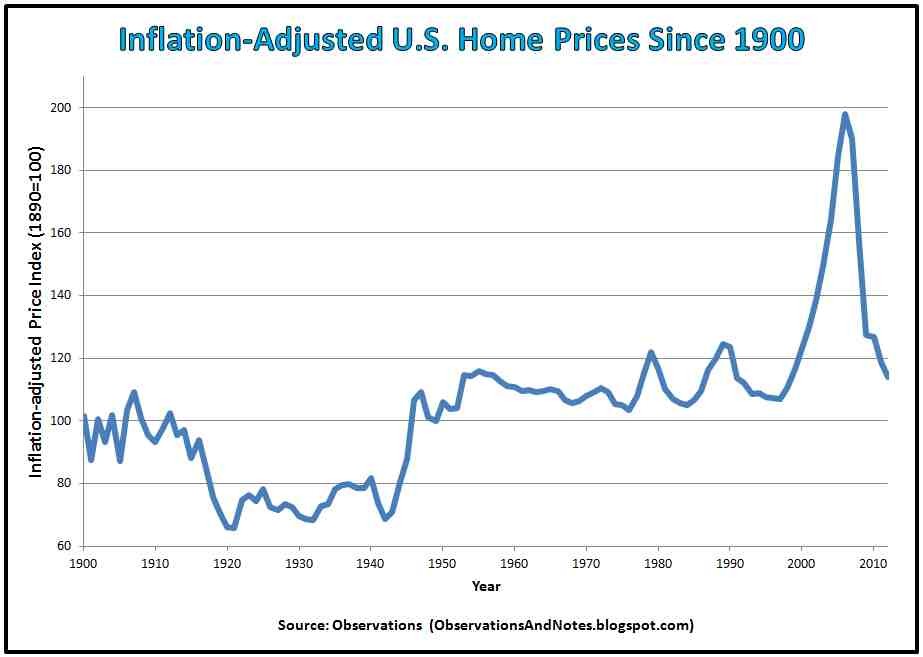

Granted also that in the residential real estate market this method of valuation is used primarily by investors — not owner-occupants. However, interest rates have an equally dramatic impact on housing affordability. A family that can afford to pay $1,000/month for principal and interest can afford a $197,000 30-year mortgage at 4.5%. If (when?) rates rise to 6.5%, they can only afford a $158,000 mortgage — a 20% decrease. I expect that this will exert downward pressure on the residential housing market when rates begin rising.

Past Performance is not a Guarantee of Future Returns

Interest rates are not the only factor affecting investors, but they do matter. The past 30 years may have given a whole generation of investors unrealistic expectations; it appears that virtually all investments are facing a future that may be dramatically different from their experience.

Related Posts

Yield to Maturity & Interest Rate Risk re the impact of interest rates on bond prices