NonProfit Organization Investment Policies

Post on: 26 Июнь, 2015 No Comment

Revising Policies and Practices to Recognize and Control New Market Risks

Recording of a 100-minute webinar with Q&A

Conducted on Thursday, July 23, 2009

Recorded event now available

This seminar will outline steps for non-profit advisors to craft a general strategy for working with investment committees and trustees to scrutinize and revise investment policies.

Description

A well-conceived investment policy is fundamental to a non-profit organization’s success and even survival. As far back as 2007, a survey found that 70% of NPOs are exposed to illiquid real estate or private equity investments. Now, many NPOs find their policies did not anticipate today’s market turmoil.

Suitably safe investment opportunities are scarce, and profitable ones are rare. NPOs’ investment committees and trustees must rely on sound written investment policies and on their professional advisors to help ensure those policies are updated and sufficiently exacting.

NPOs must revisit policies now to ensure consistency on acceptable risks and investments and on expectations of outside money managers, and the flexibility to react to current conditions. Conditions require diligent scrutiny of current financial positions, trust and brokerage accounts, etc.

Listen as our panel of veteran accounting advisors offers best practices for non-profit organizations to reevaluate and reshape their investment policies. The panel will discuss ongoing financial oversight to keep pace with today’s rocky equity markets.

Outline

- The state of investment markets for non-profit organizations and foundations

- Severely declining returns and liquidity

- Pressures to find acceptable returns to sustain the NPOs mission and staffing levels

Benefits

The panel will address these and other critical topics:

- Fundamentals for investment policy and financial position reviews: First priorities, striking a proper balance between prohibited investments and flexibility, getting actionable performance reports from money managers.

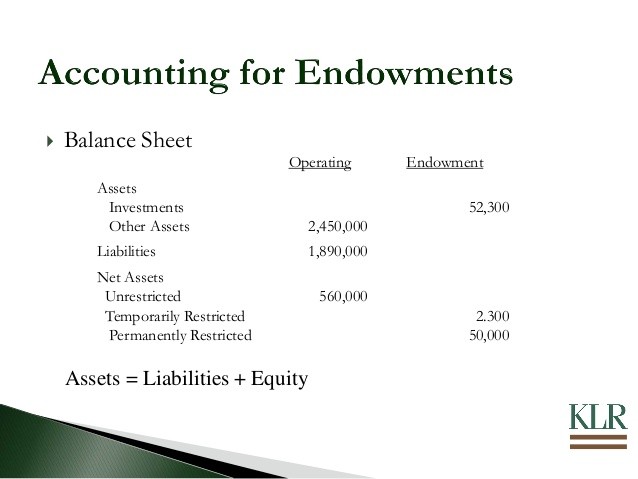

- Donor-restricted endowment funds: Changing investment policies for states that adopt UPMIFA laws.

- Policing and reporting foreign investments: Jeopardizing investments after the Madoff scandal, exotic investments like hedge funds, the IRS emphasis on disclosure rules.

Faculty

Robert Venezia. Founder and Chief Investment Officer

Key Investment Team, Encino, Calif.

He has worked in investment management for non-profit and individual clients, as well as investment advisory and asset management work with for-profit clients, since 1982. He recently conducted a seminar on creating a non-profit investment policy statement.

Nasi Raissian. Senior Manager, Non-Profit Organizations Practice

Ireland San Filippo, San Jose, Calif.

She has 20 years of experience and has been with the firm since May 2008 after spending 11 years with the Caporicci & Larson accounting firm, where she was a partner. She also served as Finance Manager for the city of Sunnyvale, Calif. from 2002 to 2004.