NonCyclical Sectors Outperforming Cyclical Sectors

Post on: 16 Март, 2015 No Comment

Stay Connected

On April 18 I wrote a piece entitled Where We Stand: A Look at S&P 500 Sectors and Industries which looked at the recent outperformance of more cyclically exposed sectors versus defensive sectors.

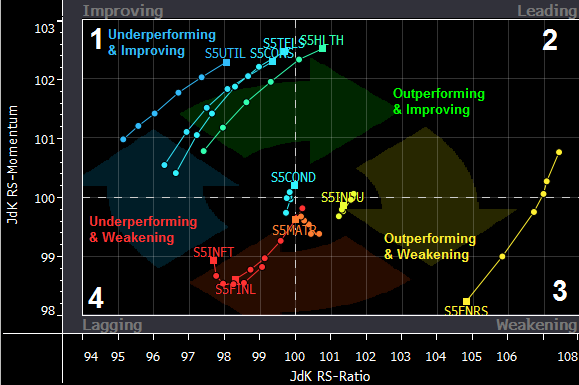

What I had found was that defensive sectors like the utilities (XLU ) and consumer stables (XLP ) had decreasing correlation versus the S&P 500 (SPY ) over the past three years, and the financials (XLF ) and other cyclical sectors had stable to increasing correlations versus the SPY. This decreasing correlation of non-cyclicals has led them to outperform the cyclical sectors and the S&P 500 since February 2011.

Historically seen, when defensive sectors start leading the tape it has tended to be a sign of a cyclical top in the making.

Over the past few weeks we had a number of key economic data points and a further stock market rally followed by last and this week’s commodity collapse. As such I wanted to revisit the previous findings and see what if anything had changed.

For consistency I again used the SPDR sector ETFs to represent the S&P 500 sectors.

Before last week’s high at 137.18 (May 2), the S&P 500 made its previous 2011 high on February 18 at $134.70.

To visually gauge relative strength of the different sectors I drew a horizontal line from each sector’s February 18 high. The simple but clear result is that the cyclical sectors like financials, technology, and consumer discretionary are currently trading below or near the levels they were at the February 18 highs. The non-cyclical sectors like consumer staples, health care, and utilities, however, are well above the levels from February 18. The rotation into defensive sectors has continued.

Cyclical Sector Charts

Financials (XLF)

Technology (XLK )

Consumer Discretionary (XLY )

Non-Cyclical Sector Charts

Consumer Staples (XLP)

Health Care (XLV )

Utilities (XLU)

As a side note, given the sharp rally in utilities, consumer staples, and health care those sectors may arguably be overbought in the near-term.

In the previous article I also pointed out the semiconductors as being early cyclical and given that they were lagging the S&P 500 at the time, may be flashing early warning signs. Since then Intel (INTC ) has staged an impressive rally and as such has taken the ETF (SMH ) up with it. The Semiconductor Index (SOX) however remains well below the February 18 highs.

I had also pointed out the pharmaceuticals (as looked at via the DRG Index ) last time and mentioned that it looked poised to break higher above the $320 area. Pharmaceuticals, of course, are also non-cyclical in nature. And break out they did.

While I still feel the major equity indices may have enough power to reach somewhere between $1380 and $1400 in the case of the S&P 500 in the very short-term, the continued lagging of cyclical sectors versus non-cyclical sectors remains a troubling sign in the medium term.