New Home Purchases Rise Due to Low Mortgage Rates Job Gains

Post on: 16 Март, 2015 No Comment

Find out how much you can afford to borrow:

Low mortgage rates and a stronger employment sector have led to an increase in loan applications for new homes in the U.S. These and other signals bode well for home builders and lenders.

Yes, mortgage rates rose this week. And yes, experts are predicting they will rise further through the end of 2015. But theyre still hovering near historic lows. Consumers are paying attention to these trends, and more of them are entering the new home market as a result.

According to a recent report from the Mortgage Bankers Association (MBA), loan applications for new home purchases rose by 12% from January to February 2015. This is based on MBAs Builder Application Survey, or BAS, which monitors loan application volume from builders across the United States.

Mortgage applications for new home purchases in January and February were also higher on a year-over-year basis. These are good signs for builders, suggesting that the remainder of 2015 could be a strong period for sales.

2015: A Good Year for New Home Purchases

New home purchases appear to be on the rise in 2015, and theres little wonder why. The economy is doing well, more people are gainfully employed, and mortgage rates are still hovering below 4%.

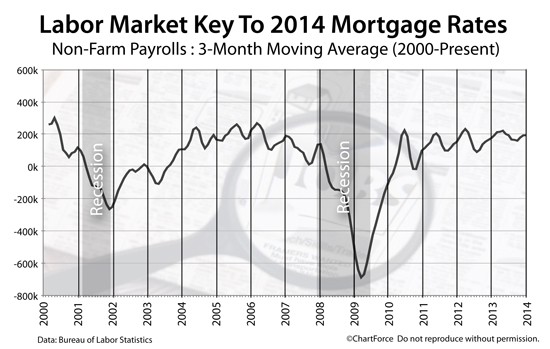

On the jobs front, the U.S. unemployment rate has dropped steadily over the last couple of years. The nations jobless rate fell to 5.5% in February 2015, according to the Bureau of Labor Statistics. This is down from a recession peak of 10% in 2009. If this current downward trend continues, the unemployment rate could fall below 5% sometime this year for the first time since before the recession.

Job gains put more people in a position to buy a home. This is partly why mortgage application volume for new home purchases rose in January and February, relative to last year (and from one month to the next). But its not the only reason. Low mortgage rates are also bringing more buyers into the new home market in 2015.

Low Mortgage Rates Still Attracting Buyers

According to Freddie Mac, 30-year mortgage rates rose by 11 basis points (0.11%) this week, to land at 3.86%. Gasp! But theres no need to panic, if you step back and look at the bigger picture.

At the end of last year, the average rate for a 30-year fixed mortgage was 3.87%, one basis point higher than this weeks average. On this day last year (March 13, 2014), the 30-year rate average rate was at 4.37%.

Home buyers who opt for the 5/1 ARM are currently locking in rates as low as 3.0%, according to Freddie Mac. So its still a great time to get a mortgage loan for a new home purchase, as far as interest rates go.

In addition to low borrowing costs, we are also seeing some easing in the area of mortgage requirements. Ive written about this several times over the past year. In short, lenders today are allowing smaller down payments and are more flexible in other areas such as borrower credit scores.

Home Builders Offering Incentives and Freebies

New home builders have been offering incentives to buyers since the dawn of construction. Its one of their most powerful sales tactics, and its alive and well in 2015.

We conducted an informal survey of 25 home builders across the U.S. and nearly all of them said they were offering some kind of incentive to buyers.

Incentives and freebies are more common in slower real estate markets, where builders are more desperate to bring in new business. They are less common in hot markets, where buyers are lining up to compete for limited inventory. Common incentives for new home purchases include cash discounts, free upgrades such as granite counters or a finished basement, and the builder paying all or part of the home buyers closing costs.

All in all, the rest of 2015 could be a good time for home builders as well as buyers in the market for new construction. This is one area where most economists agree.

Stephanie Karol, an economist at IHS Global Insight, recently told the New York Times. We expect housing will improve later this year due to the improvement in the labor market and credit conditions.