Neural Network Analysis Methods for the Stock Market

Post on: 16 Март, 2015 No Comment

Contemporary hurricane forecasting uses similar neural network analysis methods.

Joe Raedle/Getty Images News/Getty Images

More Articles

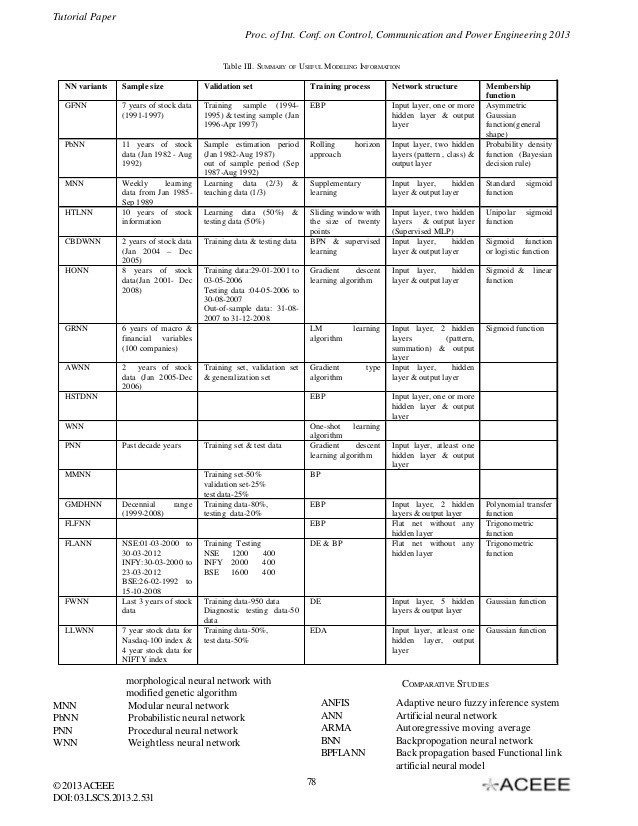

A artificial neural network is an information-processing system loosely modeled on neural activity in the human brain. It necessitates simultaneous analysis of a very large number of interconnections and therefore requires extensive parallel-processing power and large databases. It’s a proven technique for identifying stock market opportunities. It may also improve stock market forecasting.

Interest in Neural Network Analysis

Following the publication of Edward Gately’s seminal Neural Networks for Financial Forecasting, scholarly books and academic papers began exploring the subject of using artificial neural networks in the stock market. Since then, several dozen books and nearly a hundred academic papers on the subject have been published. Neural network analysis underlies many of the techniques used profitably by high-speed traders.

Essence of Neural Network Analysis

Despite the name, neural network analysis is not a literal attempt to mimic the behavior of the human brain. Instead, it employs stratagems that typify brain behavior and distinguish neural network analysis from earlier computer programs: reliance on a large amount of data, including data with no immediately discernible relation to the specific problem being investigated; simultaneous exploration of many different data paths; and acceptance of probabilistic results. The analysis is less linear than earlier forecasting techniques, and it attempts to discover patterns in nonlinear and chaotic systems. Analysis velocity is important and sometimes critically important.

Efficient Market Theory

Efficient market theory, or EMT, came into vogue in the 1970s and is still influential. According to EMT, you really can’t beat the market because at any given moment an efficient market has already incorporated all the available information into its present state, which includes each and every stock price. Neural network analysis acknowledges the validity of EMT’s assertion that everything known about the market is already incorporated in current stock prices, but it qualifies the theory by assuming that not everything is known. Analysis of a very large data set that includes chaotic data eventually reveals unknown information that provides traders with a profitable advantage.