Motif Investing Lets You Build Your Own ETF

Post on: 22 Июнь, 2015 No Comment

When Hardeep Walia launched Motif Investing in June of 2012, his goal was to make it easy for investors to compile a portfolio of stocks based on inspiring ideas.

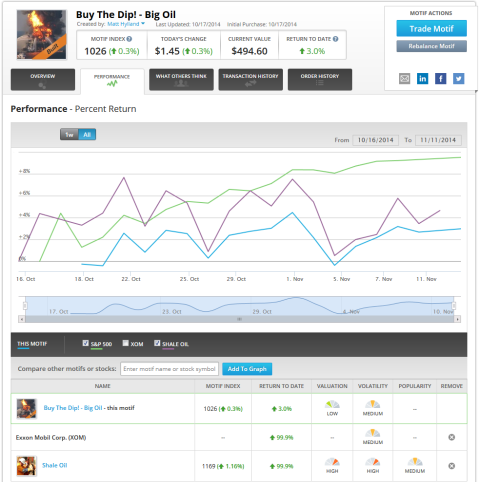

Motif Investing, at its website motifinvesting.com. is a trading platform where baskets of up to 30 stocks or ETFs that reflect an idea or theme can be traded. For example, the Home Improvement motif contains Lowe’s (NYSE:LOW ), Home Depot (NYSE:HD ) and Lumber Liquidators (NYSE:LL ) in the portfolio. Motif Investing themes include sports, energy and utilities, health care, technology and real estate.

While Motif portfolios can resemble ETFs, there are differences. Like ETF or mutual-fund investors, Motif investors can buy into a ready-made basket of stocks. But when a user buys a motif, he owns the underlying shares of each security. And unlike ETF or mutual-fund investors, Motif users can adjust and trade the stocks within the portfolio however and whenever they like.

Motif is also different from an ETF in that users can create their own stock portfolios. That’s what a sixth-grade class did with notable success in a competition between the school’s math classes.

The two sixth-grade math classes at Oak Grove Lutheran School in Fargo, N.D. were encouraged to select stocks they knew and liked. They designed their own stock portfolios using the Motif platform.

Ross Almlie, investment adviser at Jamieson Capital Advisors and a Motif Investing user, shared some basics on investing and Motif with the students.

Of all platforms that let you play in the sandbox, test out and invent a portfolio, Motif was the best available for this project, Almlie told IBD. It was straightforward to the kids, with a small learning curve to how the site worked.

Motif Investing set it up so students could use the platform without having to invest real money. The winning class had a 21.6% gain from Sept. 16, 2013, to Feb. 28, 2014. They also beat the S&P 500 by more than two times in that period. The portfolio included Facebook (NASDAQ:FB ), Amazon (NASDAQ:AMZN ), Netflix (NASDAQ:NFLX ), Starbucks (NASDAQ:SBUX ), Under Armour (NYSE:UA ), Google (NASDAQ:GOOGL ) and Priceline (NASDAQ:PCLN ).

The class won bigger bragging rights when their portfolio outdid nine top collegiate investing clubs in a separate competition that Motif Investing sponsored. In that contest, which ran from Nov. 1, 2013, to Feb. 28, 2014, the winning team McIntire Investment Institute at the University of Virginia had a gain of 18.5%. It underperformed the sixth graders at Oak Grove by 14%. The class also outperformed investment clubs from Berkeley and Cornell University.