Mortgagecases Subprime Mortgage Crisis A Retrospect

Post on: 31 Май, 2015 No Comment

Subprime Mortgage Crisis- A Retrospect

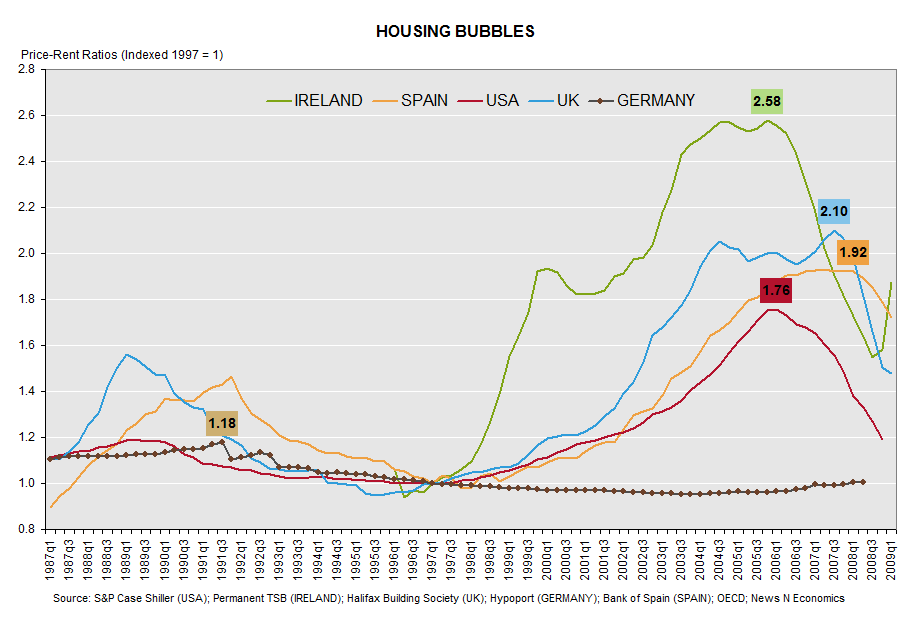

Subprime mortgage crisis resulted due to increase in subprime lending and foreclosures. The subprime mortgage crisis which originated in United States sent ripples around the globe. All the major economies felt the ripple effect of the subprime mortgage crisis.

You cannot blame a single individual for triggering the crisis. The creditors, central banks, credit bureaus, underwriters, investors as well as homeowners are to be blamed jointly for creating the mess.

Reports suggests that it was anticipated that the loss caused due to the subprime mortgage crisis would impact only a fraction of the US economy but it was more than just that. It resulted in a recession. As of July, 2007 it was estimated that subprime loan value was USD$1.4 trillion. Out of this, it was anticipated that about 1/3rd of the outstanding loans had chances of defaulting. However, this was not a cause of concern because in the event of a default, a lender could take away the borrower’s home. Taking into consideration the probability of foreclosures, it was estimated that the subprime loans should not be exceeding USD$150 billion.

As of 2006, USD$13 trillion was produced in GDP or gross domestic product by the US economy. As per statistical data furnished by World Federation of Exchanges (2007), the total stock value of stocks, the world over was USD$50 trillion. So, it was not expected that the subprime mortgage crisis could inflict severe financial injury to the economy.

But the worst was in store. More than the subprime mortgage crisis it self, what was being feared is the impact it will have on the different sects of the economy and a probable recession in the process.

Effect of subprime mortgage crisis on-

With the ongoing recession, more and more people are finding it difficult to buy a house. This in turn is impacting the real estate market and the housing costs. The main reason being there is a deficiency of buyers. As a result, the demand for houses subsides and this impacts the housing costs.

Due to the subprime mortgage crisis, creditors are not willing to lend money to the people. Since subprime lending has almost ceased, it is affecting the subprime buyers the most. The investor sentiments have also been affected to a great extent.

Consumer spending has been greatly affected. The main reason is that the housing market makes up a major portion of the economic activity of the country. With credit risks associated with the subprime market, consumer spending has been greatly affected.