Mortgage reits Income Investing

Post on: 29 Март, 2015 No Comment

2:10 PM ET

Credit Suisse Turns Bearish on 3 Mortgage REITs

By Johanna Bennett

The year gotten off to a difficult start for mortgage real estate investment trusts with a compression in the yield curve as well as widening of agency mortgage-backed securities spreads. Credit Suisse analyst Douglas Harter and his team still see attractive opportunities within the sector given the 12.9% discount to book value and juicy dividend yields.

PennyMac Mortgage Investment Trust (PMT ), Two Harbors Investment Corp. (TWO ), and New Residential Investment (NRZ ) remain among their top picks.

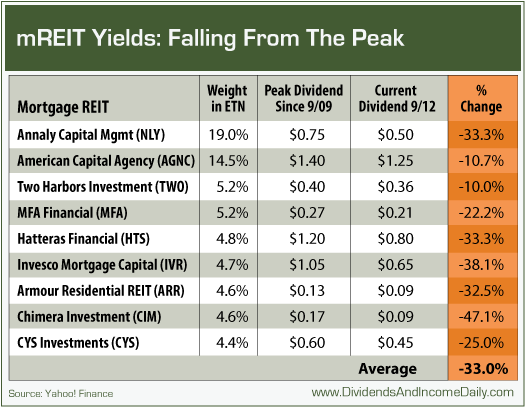

But everything isn’t rosy. In the face of this challenging new investment environment, Harter, et al have taken a hammer to a trio of mortgage REITS, downgrading Armour Residential REIT (ARR ), CYS Investments (CYS ) and NY Mortgage Trust (NYMT ) to underperform.

The downgrade took a bite out of stock prices. Armour, previously rated outperform, fell 5.4% in recent trading, while CYS and NY Mortgage Trust, both previously rated at neutral, fell 2.7% and 1.8% respectively.

Why the downgrades? Here’s how Harter and friends explained it in their note, published earlier today:

ARR – Downgrade to Underperform (from Outperform): The combination of a negative duration and relatively long dated hedges lead to book value underperformance in a flat curve environment. This combined with a below average historical risk-adjusted return profile lead us to a lower valuation.

CYS – Downgrade to Underperform (from Neutral): With above average economic return volatility we expect CYS to continue to have one of the lower price to book multiples among the Agency-only REITs leading us to believe the total return will underperform peers.

NYMT – Downgrade to Underperform (from Neutral): The continuation of a tight credit spread and low yield environment will make it challenging for NYMT to meaningfully expand core EPS in order to cover the dividend without relying on gains. This coupled with the highest price to book in our residential mREIT coverage cause us to see relative underperformance.

Feb 2, 2015

11:18 AM ET

Annaly Capital Management: Bring the Noise

By Johanna Bennett

It’s complicated. That’s how J.P. Morgan analysts Richard Shane and Amrita Ganguly describe the fourth-quarter earnings outlook for mortgage REITS like Annaly Capital Management (NLY ), American Capital Agency (AGNC ), and Apollo Residential Mortgage (AMTG ).

The pair see a “straightforward” quarter for commercial mortgage REITS. but expect “a noisy quarter for the Resi MREITS, with results influenced by asset mix and hedge tactics.” In short, Shane and Ganguly believe asset prices for non-agency mortgage-backed securities rose roughly 0.75% to 2.50% with riskier assets outperforming, and expect a 1% gain by agency mortgage-backed securities. An intra-quarter flattening of the yield curve may lead to divergent results based upon hedge positions as companies with more conservative hedge positions experienced more significant write-downs on their swap positions.

As Shane and Ganguly write:

Residential MREITs: Book Value Marks May Diverge. Based on our estimates, we believe 4Q14 BV marks will range from 0.0% to +4.5% across our Resi REIT coverage universe. In general, we believe companies with exposure to Non-Agency MBS fared the best (Apollo Residential Mortgage—OW, MFA Financial (MFA )—Neutral) as credit assets outperformed and require less rate hedging. In contrast, we believe that companies positioned for higher rates through swaps (Annaly Capital Management—N, Western Asset Mortgage Capital (WMC )—N) may see limited BV gains. While the 4Q rally in rates likely drove BVs higher than we previously assumed, in our view it only forestalls the drag from rising rates on future book value.

Shane and Ganguly cut price targets for Annaly Capital Management, American Capital Agency, Two Harbors Investments (TWO ), Apollo Residential Mortgage, and Western Asset Mortgage Capital.

Shares of Annaly Capital Management have fallen 1.5% to $10:40 at 12:57 p.m. while American Capital Agency has dropped 1.1% to $21.31, Two Harbors Investments has declined 1% to $10.22, Apollo Residential Mortgage has slipped 1.2% to $15.47, and Western Asset Mortgage Capital is off 0.2% at $13.47.

Among commercial mortgage names, Blackstone Mortgage Trust (BMXT ) remains a top pick for Shane and Ganguly. As they write:

Commercial Mortgage Lenders. Fundamentals for commercial lenders continue to remain very favorable. Commercial cap rate spreads remain wide, and returns available to CRE investors remain attractive. Further, we anticipate over $1 trillion of CRE loans will be due for refinancing from 2015 to 2017, suggesting continued opportunity for robust originations from ACRE, ARI, and BXMT. We maintain PT’s on our CRE names; BXMT remains our top pick.

Jan 30, 2015

1:35 PM ET

Normura: Mortgage REITs in transition

By Johanna Bennett

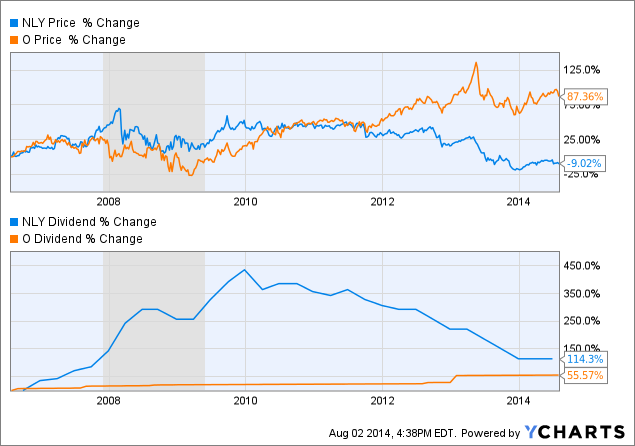

With dividend yields of 11.3% and 12% respectively, Annaly Capital Management (NLY ) and American Capital Agency (AGNC ) would seem like a dream for investors hungry for income.

After all, the yield on the 10-year U.S. Treasury note has fallen below 1.7% today to hit a 20-month low.

But in a note published today, Nomura analyst Brock Vandervliet initiated coverage on eight mortgage real estate investment trusts (REITs), with neutral ratings on all but two, citing a “transition” underway in the key growth and earnings drivers for mortgage REITs. In short, the industry faces the threat of higher interest rates driving up funding costs and a yield curve that continues to flatten, squeezing net interest spreads.

American Capital was initiated at a neutral with a price target of $21. Vandervliet writes:

AGNC faces similar headwinds as its peers, including the threat of higher interest rates driving up funding costs and a yield curve that continues to flatten, squeezing net interest spreads. Despite these factors, AGNC has delivered five years of consistently higher economic returns than peers. The company also has a strong management team with experience at Freddie Mac, and has opportunistically capitalized on “dollar roll,” an off-balance sheet financing structure. Our $21 target price for American Capital Agency Corp. (AGNC) is derived based on applying a 0.91x multiple to our 4Q16 book value per share of $23. F15E EPS estimate at $2.92 vs Consensus at $2.91.

At $21.49, the share fell 0.13% in recent trading.

Annaly Capital was initiated at neutral with a $10 price target. Vandervliet writes:

Dancing Until the Fed Hike. In addition to being the largest Agency REIT, a distinction of NLY is its greater willingness than others to adopt a directional interest rate posture. In both asset selection and in the structure and positioning of hedges, NLY is oriented for the Fed to leave rates unchanged. With lower leverage than the sector and no dollar roll earnings to add further complexity, we believe NLY can prudently assume this incrementally higher risk. However, we believe investors should be aware of this distinction in approach. Our $10 target price for Annaly Capital Management Inc. (NLY) is derived by applying an 0.89x multiple to our 4Q16 book value per share estimate of $11. F15E EPS estimate at $1.13 vs Consensus at $1.22.

At $10.53, the stock fell 0.2% in recent trading.