Mortgage Rates Dip to 2014 Lows Market Update

Post on: 29 Июнь, 2015 No Comment

Mortgage Rates

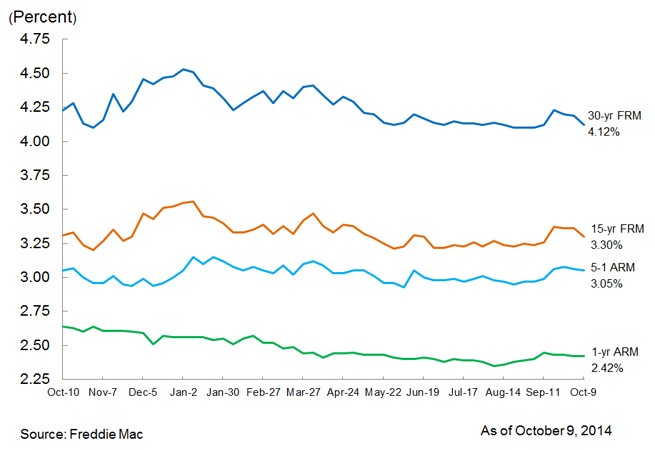

According to the Primary Mortgage Market Survey released by Freddie Mac, average fixed-rate mortgage rates dropped to some of their lowest levels in 2014.

30-year fixed-rate mortgages (FRMs) averaged 4.10% with an average 0.5 point for the week ending August 21, 2014, down from last week when they averaged 4.12%. A year ago at this time, 30-year FRMs averaged 4.58%.

15-year FRMs this week averaged 3.23% with an average 0.6 point, down from last week when they averaged 3.24%. A year ago at this time, 15-year FRMs averaged 3.60%.

5-year Treasury-indexed hybrid adjustable-rate mortgages (ARMs) averaged 2.95% this week with an average 0.5 point, down from last week when they averaged 2.97%. A year ago, 5-year ARMs averaged 3.21%.

1-year Treasury-indexed ARMs averaged 2.38% this week with an average 0.5 point, up from last week when they averaged 2.36%. At this time last year, 1-year ARMs averaged 2.67%.

Equity Market

The Dow Jones Industrial Average gained nearly 0.4% to close at 17,039.49, while the S&P 500 jumped 0.3% and ended the week at 1,992.37. The NASDAQ gained 0.1% and closed at 4,532.10.

The Week Ahead

Monday, August 25

New Home Sales (10:00 a.m. ET) – New home sales measure the number of newly constructed homes with a committed sale during the month.

Tuesday, August 26

FHFA House Price Index (9:00 a.m. ET) – The Federal Housing Finance Agency (FHFA) House Price Index (HPI) covers single-family housing, using data provided by Fannie Mae and Freddie Mac. The House Price Index is derived from transactions involving conforming conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac.

S&P Case-Shiller HPI – The S&P Case-Shiller home pricing index tracks monthly changes in the value of residential real estate in 20 metropolitan regions across the U.S.

Wednesday, August 27

MBA Purchase Applications (7:00 a.m. ET) – The purchase applications index measures applications at mortgage lenders. This is a leading indicator for single-family home sales and housing construction.

Thursday, August 28

Jobless Claims (8:30 a.m. ET) – New unemployment claims are compiled weekly to show the number of individuals who filed for unemployment insurance for the first time.

Pending Home Sales Index (10:00 a.m. ET) – The National Association of REALTORS developed the pending home sales index as a leading indicator of housing activity. Specifically, it is a leading indicator of existing home sales, not new home sales.

Visit the Quicken Loans Zing Blog for updated information on important economic releases that affect your wallet.