Mortgage Rates

Post on: 8 Май, 2015 No Comment

How Are Mortgage Rates Determined?

Numerous factors determine mortgage rate, making them increase or decrease. For most consumers one of the most important aspects to getting a mortgage is obtaining the best rate possible. Many homeowners rely on their bank or mortgage broker to secure their interest rate, often without investigating the lenders loan rates or inquiring about how the rates move.

Regardless of whether you?re interested in rates, it?s always wise to better understand how interest rates move and why. With just a slight change in rate of .125 to .25 percent can mean thousands of dollars per year, in loss or savings.

Although there are many contributors that will affect interest on mortgage rate. the one believed to be the best indicator by most mortgage experts is the 10 year Treasury bond. Why? Most mortgages are offered as 30 year programs. Averages have shown the mortgage industry that the majority of these loans are paid off or refinanced within 10 years, making the 10 year bond a good resource to gauge interest rate change.

These 10 year treasury bonds are also known as intermediate term bonds and long term fixed rate mortgages, they are packaged into mortgage backed securities (MBS) and compete for the same investors due to being very similar financial instruments. Treasuries are 100% guaranteed to be paid back, unlike mortgage backed securities which are not due to payment default and early prepayment; since these carry more risk they are priced higher.

Other variables affecting mortgage rate is supply and demand. When loan applications take a major jump in volume, the supply of mortgage backed securities will rise above the demand; prices will need to decrease so they are more attractive to buyers. Timing is also an issue; bond prices may take a dive in the morning and then rise back up in the afternoon, leaving mortgage rate unchanged. This is because sometimes the bond movement doesn?t always make it down to the wholesale markets, meaning it takes more time to do so.

Mortgage rate has a greater susceptibility to economic impact than treasuries; this is due to the possibility of consumer or homeowner losing their jobs and therefore unable to make their home loan payments. For this reason, job reports; consumer price index; gross domestic product, consumer confidence; home sales and other significant data on the economic grid can drastically move interest rates.

And let?s not forget about the Fed?s. When the ?Fed Minutes? are released or they change the Federal Funds Rate, interest rates can swing up or down, depending on what their report indicates about the economy. This can change the norm of how the economy usually will impact rates. Prior to this economic crisis our country is currently experiencing, you could use inflation as a gauge; the rule of thumb was, if fears of inflation are strong interest rates would rise; when the risk of inflation was minimal mortgage rate would likely fall.

Determining mortgage rate is very complex in nature and we cannot cover everything that is applied to how they are calculated. But by gaining some basic knowledge of knowing some of the elements to look for, you can better prepare yourself when buying or refinancing your home so you get the best mortgage rate possible.

Will Mortgage Rates Stay Low?

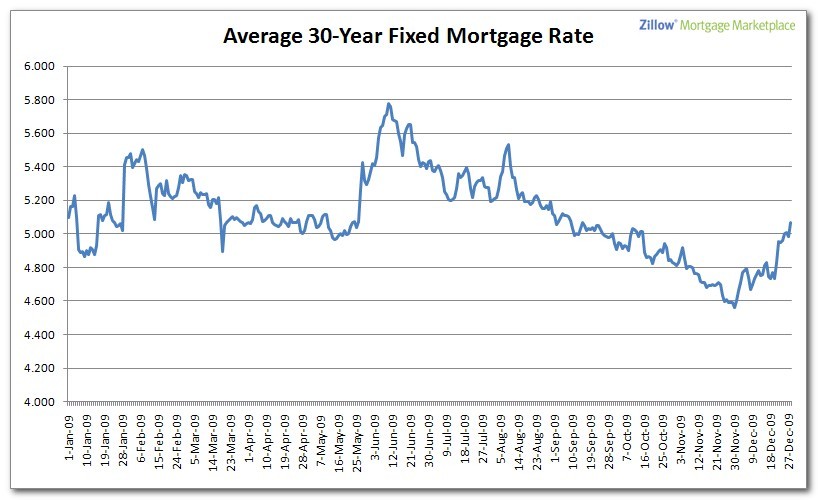

Forecasting mortgages rates can be a challenge, there are many variables involved with how they are determined and calculated. While none of us have an interest rate ?crystal ball? there?s signs pointing to somewhat of stable rate expectancy. Right now rates are still at almost a record low, that?s always a good indicator to move forward with financing if you are looking to purchase or refinance a home.

You could ask 100 different economists to forecast rates for this year, and you will get 100 different answers. There are a few economists who are in a position for giving a fairly accurate prediction; one of them works for Freddie Mac, Frank Nothaft their chief economist. He basically says mortgage rates will remain relatively low during 2011, but some rate increases can be expected between now and then; the average rate for a 30 year fixed mortgage will probably stay below 5% and the 5/1 hybrid ARM will probably stay below 4%. Translation: this year in 2011 in all probability will be a lot like 2010 in regard to mortgages rates .

We know the job market recently has started to gain strength, and there are signs of new construction picking back up. There has also been an increase in mortgage loan applications, in all likelihood due to real estate values starting to rise again. Over all, the country is slowly turning around but it will take a considerable amount. With all of these factors rising and falling in any given month as the economy struggles to move forward in a positive manner, mortgage rates will likely be impacted too (moving up and down.)

If you have a steady income and good credit history, 2011 might be a great time to buy a home.

You will have plenty of buying power in terms of home prices and mortgages rates. Just keep a watchful eye on your local housing market. Start to keep tabs on what home prices are doing in your area, and what the local experts are saying prices are expected to do over the next few years. Buying a home in a market that is steadily declining in value isn?t something any of us would want to do. However, if values are remaining steady, you might want to take advantages of purchasing a home while the rates are still low.

While there are many various considerations that make up the rising and falling of mortgages rates. most economists agree the biggest factor hinges on inflation. The main economic indicator most closely hinged to housing is unemployment. It goes without saying that these are closely tied together; with a bad economy and a slow recovering recession comes inflation; with inflation not only the consumer has to cut back but so do businesses; this contributes to cut back in hours or loss of jobs; that triggers a struggle for the consumer to pay their bills. If borrowers can?t make their mortgage payments, foreclosures start to reveal themselves and recent years it?s been in record numbers. Our economies present condition is probably the most relevant factor as to why mortgages rates have remained low.

The good news is, this country is rebounding and right now mortgages rates are still great. If you?re considering buying or refinancing your home, this could be one of the best opportunities you?ll have.