Mortgage Rate Trend Survey ~ Will Mortgage Rates Rise or Fall

Post on: 22 Июнь, 2015 No Comment

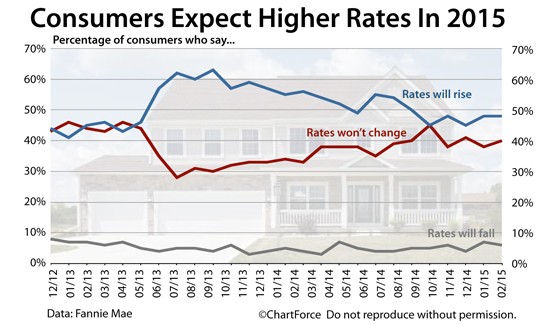

Currently, about 41% of the participating mortgage professionals believe mortgage rates will remain unchanged over the next 30 days and 41% believe mortgage rates will rise slightly over the next 90 days.

Participating Mortgage Companies (a partial list):

- Casta del Sol Real Estate

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will decline significantly.

Comment by Raymond Denton: Interest rates have edged up, but will drop dramatically the end of Spring and early Summer.

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will remain unchanged.

Comment by Joseph Metzler, NMLS #274132: Minneapolis, MN as of 01/27/2015: Rates should hover near these new levels, then slowly rise by next summer. ACT NOW — (651) 552-3681

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will rise slightly.

Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will decline slightly.

Comment by Jeremy Redlinger: The market is still very volitale and the data has suggested a weaker economy since the government shutdown.

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will rise slightly.

Comment by Paul Freitag: With Ben Bernake comment that the FED might stop buying bonds has scared the market somewhat and rates have gone up .500 since then. the should stablize until the next couple of FED meetings

Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will decline slightly.

Comment by Kevin Mace: The stock market is almost at its highest levels ever, we have experienced a steady increase in rates the past 3-5 months and I expect it to rebound slightly over the next few months with the overall trend for higher rates this year.

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will rise slightly.

Comment by Nikitas Kouimanis: I think over the next 30 days rates will remain unchanged. Than over the next 90 days rates will rise slightly. If anyone needs anything feel free to contact me at 212 920 4471. Respectfully Submitted, Nikitas Kouimanis VP of Mortgage Lending.

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will remain unchanged.

Comment by Joel Lobb, NMLS #57916: -I think rates will stay about where they are at now. No great change up or down.

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will remain unchanged.

Comment by Eric Grathwol: I think this spike since end of January is temporary and rates will dip to their prior lows in March, and continue bouncing in this range for the foreseeable future.

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will rise slightly.

Comment by Jason Gonzalez: The increases seen over the past few weeks were, in my opinion, based on emotional trading (is there any other kind?.) I believe rates will teeter around the same levels or possibly rise slightly this month, while pushing higher into the spring. LOCK

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will remain unchanged.

Comment by Cary Cox: Rates are up due to a rising stock market. That market is severely overbought — when the stock market sells off rates should improve.

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will rise slightly.

Comment by Anthony Piccone: It is widely believed that the 10 yr Bond will rise above 2.00 to 2.24 over the course of the next 6 months. In the interime there will be a shift towards higher rates.

Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will rise slightly.

Comment by Cody Velkovich: If the impending sequestration indeed kicks in on March 1st, the markets will react very negatively, which should send interest rate back down in a significant way.

- Inlanta Mortgage Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will remain unchanged.

- Watchtower Mortgage Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will rise significantly.

- Academy Mortgage Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will remain unchanged.

- Cambria Mortgage Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will decline slightly.

- MB Mortgage Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will rise slightly.

- iLoan Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will rise slightly.

- NFM Lending Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will rise slightly.

- MortgageRevolution.com — Chad Banken at MUI Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will decline slightly.

- First Heritage Mortgage, LLC

Vote: () () Over the next 30 days rates will rise slightly; over the next 90 days rates will remain unchanged.

- WVHomeLoans.Com

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will rise slightly.

- Mortgage One, Inc.

Vote: () () Over the next 30 days rates will decline slightly; over the next 90 days rates will remain unchanged.

- www.cbLoans.com

Vote: () () Over the next 30 days rates will remain unchanged; over the next 90 days rates will remain unchanged.

Note: Mortgage-X is not responsible for decisions based on the Mortgage Rate Trend Survey. The reported Survey results are for informational purposes only.