Mortgage Purchase Applications Index

Post on: 29 Июнь, 2015 No Comment

What’s Ahead For Mortgage Rates This Week – February 16, 2015

February 16, 2015

Fixed Mortgage Rates Still Higher

According to Len Kiefer, deputy chief economist of Freddie Mac, Mortgage rates rose last week following strong economic data. The economy added 257,000 new jobs in January after robust increases of 329,000 in December and 423,000 in November. The unemployment rate edged up to 5.7 percent last month from 5.6 percent in December. Average hourly earnings rose 0.5 percent, following a 0.2 percent decline in December.

Freddie Mac Primary Mortgage Market Surveys results released February 12, 2015:

- 30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending February 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

- 15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.97 percent this week with an average 0.5 point, up from last week when it averaged 2.82 percent. A year ago, the 5-year ARM averaged 3.05 percent.

- 1-year Treasury-indexed ARM averaged 2.42 percent this week with an average 0.4 point, up from last week when it averaged 2.39 percent. At this time last year, the 1-year ARM averaged 2.55 percent.

This Week’s Scheduled Economic News Releases

The key economic report this week is January housing starts on Wednesday. For manufacturing, the January Industrial Production and Capacity Utilization report, and the February NY Fed (Empire State), and Philly Fed surveys, will be released this week. For prices, PPI will be released on Wednesday.

Monday, February 16th

- All US markets are closed in observance of the Presidents Day holiday.

Tuesday, February 17th

- 8:30 AM: NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of 9.0, down from 10.0 last month (above zero is expansion).

- 10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

Wednesday, February 18th

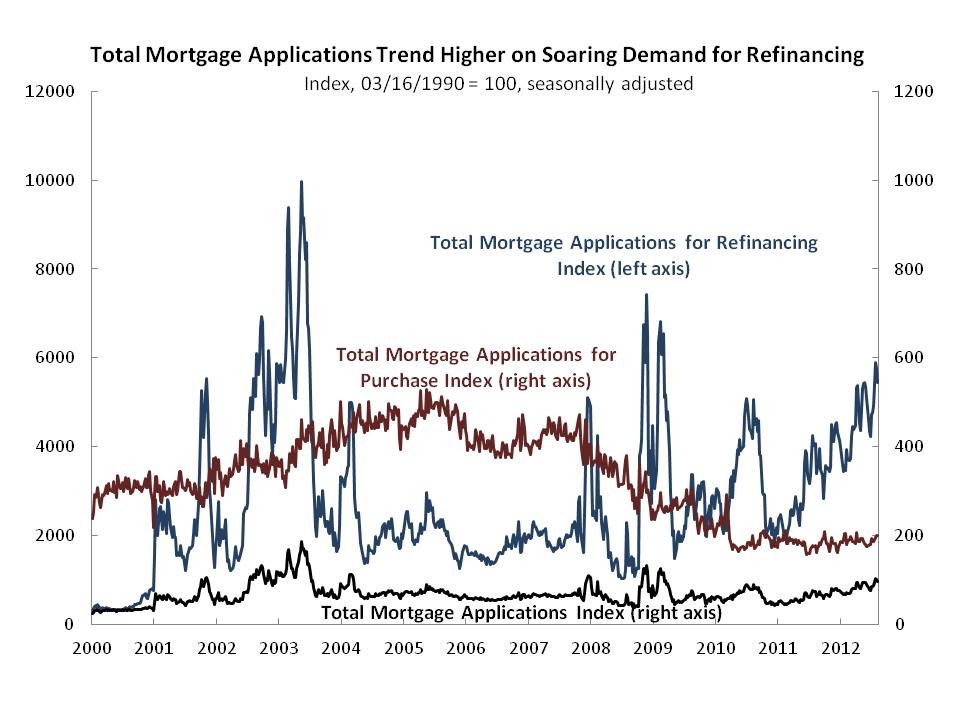

- 7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index .

- 8:30 AM: Housing Starts for January. Total housing starts were at 1.089 million (SAAR) in December. Single family starts were at 679 thousand SAAR in December. The consensus is for total housing starts to decrease to 1.070 million (SAAR) in January.

- 8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

- 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.9%.

- During the day: The AIAs Architecture Billings Index for January (a leading indicator for commercial real estate).

- 2:00 PM: FOMC Minutes for Meeting of January 27-28, 2015

Thursday, February 19th

- 8:30 AM: The initial weekly unemployment claims report will be released.

- 10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 8.5, up from 6.3 last month (above zero indicates expansion).

Friday, February 20th

- No economic releases scheduled.