More borrowers opt for defeasance

Post on: 24 Апрель, 2015 No Comment

Appreciated values, sale and refinance opportunities outweigh considerable defeasance costs in many cases.

CRUNCHING THE NUMBERS

defeasewithease.com/) offer Web visitors the ability to plug in property and loan particulars and quickly get ballpark estimates of relevant premiums and fees.

Defeasance would require the purchase of approximately $943,000 worth of bonds to cover the roughly $6,800 in monthly debt service, for a “defeasance premium” of about $38,000. For a borrower working with Commercial Defeasance on a deal of this size, transaction costs would likely total about $62,000: a $10,000 servicer processing fee, a like-sized custodian fee, a $15,000 servicer legal fee, a $4,000 accounting fee and an $8,000 successor borrower fee in addition to Commercial Defeasance’s $15,000 fee.

As interest rates and operating expenses rise, more apartment owners are using defeasance of their securitized mortgages to tap trapped equity and refinance before rates get too high.

Though most loan transactions are unique, and each defeasance includes considerable moving parts, higher values are generally the fundamental defeasance deal driver. As recent transactions illustrate, sale opportunities in some cases can make defeasance pencil out only two or three years into a loan term.

With more-seasoned loans taken out when rates were substantially higher, defeasing can help some borrowers knock about 200 basis points off their debt rates while also converting built-up equity into cash.

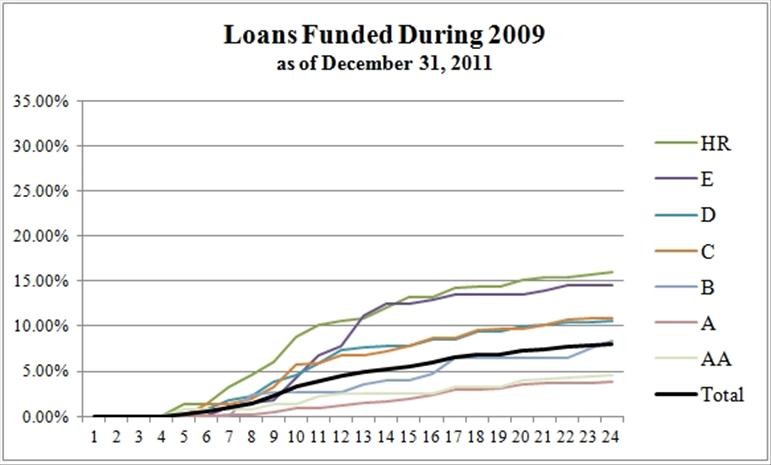

Last year, borrowers did more than 800 defeasance transactions covering more than $6 billion in multifamily property debt, according to Moody’s Investors Service, a credit ratings agency. In fact, U.S. borrowers defeased two-and-a-half times as much securitized real estate debt last year ($21.2 billion) as they had in all previous years combined.

As defeasance is becoming a viable and attractive option for an increasing number of borrowers, more specialists are establishing platforms to help guide investors through the process. Niche pioneer Commercial Defeasance, LLC, now sees competitors ranging from affiliates of giants such as GMAC Commercial Mortgage (which was recently purchased by an investors group) and Wachovia Corp. to upstart boutiques such as Waterstone Capital Advisors.

It’s become standard practice to include defeasance cost and fee calculators on adviser Web sites, allowing would-be customers to simply plug in loan particulars to get ballpark estimates (see sidebar). The emerging competition, fast-growing transaction volume and increased familiarity with the process are reducing costs and speeding up defeasance deals.

Why it works

The first time Houlihan-Parnes/iCap Realty Advisors defeased a conduit loan a few years ago, the overall cost was in the vicinity of $250,000, recalled controller Larry Kolodny. With the firm’s latest $84 million, eight-loan mega-deal overseen by Commercial Defeasance, costs averaged between $40,000 and $45,000 per mortgage in fees, not including the firm’s own legal bill, said Kolodny.

Though advisers now boast of completing defeasance transactions in 30 days, Commercial Defeasance went one step farther and helped ANYI Management Co. close its latest $7.3 million deal in just 14 days, according to ANYI Chief Financial Officer Larry Vering. The deal amount includes the defeasance premium and most of the deal fees. In aiming to reduce its debt rate nearly 250 basis points by refinancing its 302-unit Anderson Villas Apartment in Ypsilanti, Mich. the ANYI group had tentatively locked in its new rate of 5.7% and was willing to pay a $15,000 premium for the quick close, said Vering.

Through defeasance a borrower can have a trust deed reconveyed by paying off a conduit mortgage’s outstanding principal (usually through a refinance or sale), while also purchasing sufficient low-risk bonds (usually Treasuries) to cover the defeased loan’s scheduled debt-service with interest payments. The option, which borrowers can use after an initial pre-payment lock-out period, has been standard practice among Wall Street conduit lenders for nearly a decade. Mortgage-backed bondholders (and corresponding ratings agencies) tend to welcome defeasance: They get the same cash flow but with substantially lower risk from the real estate collateral.

Any difference between the principal balance and the cost of the replacement collateral (the bonds) is known as the “defeasance premium.” And given the difference between Treasury rates (in the 4.8% vicinity at press time) and the rates on many seasoned conduit loans, the premium can be substantial. Therefore, though defeasance is obviously becoming an attractive option for more property owners, borrowers have to weigh the benefits against an array of costs, fees and other detriments.

For the Houlihan-Parnes/CLK group, for example, the partners were willing to pay roughly $6.2 million in defeasance premiums and fees in order to pull out about $20 million in cash (essentially representing their initial equity investments) about three years before the seven-year conduit loans matured. Defeasing and refinancing also reduced their debt rates by nearly 150 basis points.

That was enough to convince CLK Principal Craig L. Koenigsberg and Houlihan-Parnes executives to defease and refinance the seven-year mortgages secured by eight top-performing Southeast properties. The defeasance premium amounted to about $5.9 million, with total additional costs of approximately $300,000, said Kolodny.

The group saved roughly $600,000 on its defeasance premiums because Houlihan-Parnes purchased some higher-yielding Fannie Mae and Freddie Mac securities as replacement collateral, rather than just Treasuries, to defease the mortgages.

The Houlihan-Parnes group was paying 6.99% on slightly more than $84 million worth of acquisition mortgages from Bank of America dating to a 12,550-unit portfolio acquisition in 2001. In refinancing these eight communities, the iCap group secured new 10-year mortgages totaling $113 million from Wachovia Corp. at a 5.57% interest rate, interest-only for five years followed by 30-year amortization.

During the interest-only period, Kolodny expects the Houlihan-Parnes/CLK group to save about $735,000 in debt service, relative to the defeased mortgages, even at the new principal amount that is 35% above the initial acquisition debt. The group considered defeasing some of the portfolio’s 10-year mortgages as well, but that wouldn’t have penciled out as well, given the lengthier debt-service obligations, said Kolodny.

Choosing the best deal

Defeasance in many cases is allowing investors to capitalize on attractive disposition opportunities part-way into a loan term. Such was the case at Merrill Land Co. which opted to sell its 224-unit Crystal Lake Apartments in Pensacola, Fla. for about $12 million less than three years after taking out a seven-year, $8.5 million conduit mortgage.

The deal also allowed the buyers, a family group relocating to Florida from Michigan, to finance their acquisition with a new mortgage amount about 40% larger than the balance of the defeased loan.

The original loan from Prudential Financial carried an attractive rate and was assumable – for a fee, of course – but the buyers preferred to borrow a much higher amount based on the appreciated value, Merrill Land Principal Collier Merrill and in-house counsel Lawrence Schill explained. The Prudential mortgage, funded in mid-2003, carried an interest rate of slightly more than 5%.

As is often the case in a sale-motivated defeasance these days, the buyers agreed to pay what ultimately amounted to a defeasance premium of about $380,000. Related fees added another $61,000, also covered by the buyers, said Merrill and Schill.

In the ANYI group’s case, the difference between interest rates available today and those prevailing when the firm took out the Anderson Villas mortgage six years ago was a primary motivation for defeasing, Vering stressed.

The property had appreciated considerably over that period, so ANYI Management decided to defease the $6.8 million, 10-year mortgage from the JPMorgan (now Morgan Chase) conduit in favor of a new $9.2 million mortgage from Deutsche Bank. Since the deal allowed the owners to lower their interest rate from more than 8% to about 5.7%, monthly payments only went up “a couple thousand” dollars, even though the property is carrying 35% more debt, said Vering.

The defeasance premium amounted to about $840,000, with fees adding up to about another $70,000, he said. Unsolicited offers prompted the partners to consider selling, but they opted instead to pull out some of the trapped equity, reduce the mortgage rate – and hope the appreciation continues, said Vering.