Monte Carlo Simulations for Better Real Estate Decisions Leading Landlord Blog

Post on: 16 Апрель, 2015 No Comment

Heres some breaking news. You have the power to predict the future with more accuracy. And as a real estate investor, you should be extremely happy about that.

Heres how to do it. Simply start using Monte Carlo Simulations.

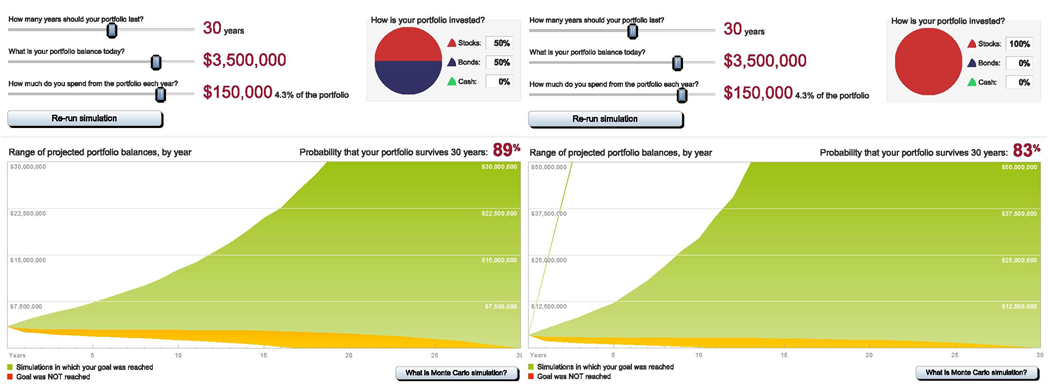

Whats that right? It’s a technique that helps you calculate a large number of possible outcomes for your investment and allows you to statistically estimate which set of outcomes will most likely occur. So, even if Murphy shows up, you’re ready.

This used to be something that only atomic scientists could do, but now you can do it with ease. If you already know some spreadsheet basics, and youre willing to learn a few new tricks, then the computing power is yours.

When Should You Use a Monte Carlo Simulation?

You should run a Monte Carlo analysis before any significant investment for the same reasons you check a ladder before climbing it. You want to make sure its sturdy; you want to understand and reduce your risks. Make sense?

As a real estate investor, you make informed predictions (educated guesses) all day long. Without thinking about it, you account for fluctuating market demands, uncertain project completion dates, and all kinds of variables.

Basically, if youre investment has timing and financial issues, which all of them do, you need to use the Monte Carlo Method to understand your risks.

Why isn’t your current estimating method adequate?

If you had t bet $100 that your calculations would match your actual investment outcome, wouldnt you rather bet on landing within a range of values instead of hitting one target? Sure you would.

Instinctively we know we should be working with a ranges. We just dont know how.

Even if its your practice is to calculate the best and worse case scenarios, you know youre exaggerate the projections. Your variables will never all be ideal or worse-case at the same time.

Working with Monte Carlo simulations helps you make realistic predictions. Not only does the method lead you to find the most likely outcome, it also helps you find the odds of being correct.

A FREE 5-Day eCourse for Busy People

I know youre busy. So I broke up the lessons in to five coffee-break-sized modules that step you through a basic example. Afterwards, youll be able to apply the method to your everyday work.

When you sign up, Ill send you the following lessons: