Mistakes Must Serve a Purpose

Post on: 7 Апрель, 2015 No Comment

Experience is that marvelous thing that enables you to recognize a mistakewhen you make it again. Franklin P. Jones

It is not that easy to talk about ones mistakes. In the early days of Tocqueville Asset Management, I suggested that the senior partners jointly write a report about their most memorable investment mistakes and what they had learned from them. At the time, several of my partners thought this could result in unnecessary negative publicity. Now, nearly 20 years later, I sense the same uneasiness at the prospect of my writing about my own mistakes. Nevertheless, I was comforted in my project by a Financial Times editorial of February 4, 2015, in which Seth Klarman, one of todays most successful investment managers, celebrates the 50th birthday of Warren Buffets leadership at Berkshire Hathaway by recalling, What Ive Learned from Warren Buffet. Among those lessons:

7. You can make some investment mistakes and still thrive.

10. Candour is essential. Its important to acknowledge mistakes, act decisively, and learn from them.

With these points in mind, I recall the slip-up that involved me and a few of my partners perhaps the only time when a majority of us stumbled together.

Even We Are a Crowd

In a review of the firms 1999 investment performance, I explained:

I have fought long and hard to avoid investment by consensus at Tocqueville. Consensus decisions amount to management by committee, which is an unfailing recipe for mediocrity. Instead, I have purposely assembled a high-level team of strong-minded individuals who share and debate their best investment ideas. There is a great deal of intellectual exchange, both formal and informal, among managers, and most wind up buying some of the others stocks but they do so of their own free will.

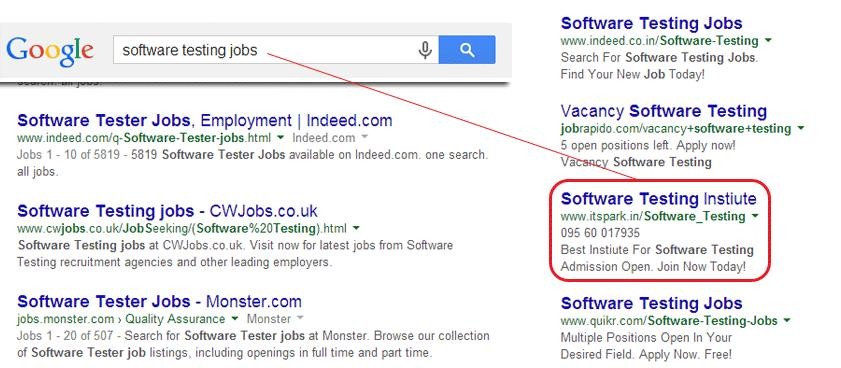

As it happened, though, prior to that, in 1996, several of Tocquevilles strong-minded early musketeers had purchased shares of Integrated Health Services (IHS), one of the largest and, we thought, strongest healthcare organizations in the country.

Our confidence was enhanced by the fact that a government audit prior to their acquisition of a troubled competitor had given IHS a clean bill of health, according to its supervisory agencies a comforting factor in an industry often plagued with irregularities. While its balance sheet carried a substantial amount of debt, most of it was related to real estate underlying their healthcare facilities, so we felt that it was largely secured. Finally, there was a possibility that IHS would soon float a fast-growing and valuable subsidiary on the market, releasing ample funds to reduce the debt burden.

But in 1998-1999, everything went wrong. We had underestimated the impact on margins of government-mandated changes in Medicare and Medicaid reimbursement procedures, and the zeal with which bureaucrats would go about implementing these changes. Even as things deteriorated, we felt that the pressure on margins would soon be relieved, because these trends equally affected the rest of the industry; and, we believed, the government could not afford to let a whole segment of the nations healthcare complex collapse.

However, with a balance sheet heavy with debt, reduced earnings soon complicated debt service, making the value of the underlying real estate irrelevant. To make matters worse, the company could not reach agreement with its debt holders on the modalities of a possible IPO of the valuable subsidiary, on which we had pinned our last hopes. As a result of all this, IHS was now struggling for survival, with little or no likelihood that there would be any money left for shareholders once the debt was restructured. The result can be seen on the graph below.

20financial.png /%

My 1999 review concluded:

The main lesson from this sorry episode, I believe, is that our basic principles (such as insisting on a firms financial strength) should be unbendable, no matter how attractive a companys investment story sounds.

I could now add another lesson: In assessing a companys financial strength, liquidity (the ability to face current payments through the ups and downs of the business and financial cycles) is at least as important as solvability (the accounting surplus of assets over liabilities).

Finally, the IHS episode also reminded us that consensuses are typically shaped by what Charles MacKay called the madness of crowds, while a committee tends to work as a group of men who keep minutes and waste hours (Milton Berle).

It is to avoid situations like this that we have since assembled a team of our analysts (The Skeptics), whose duty it is to question and argue against all new ideas presented at our research meetings.

Looking back, Integrated Health Services turned out to be our poorest-performing investment in 1999. In the accounts that I personally managed, for example, I estimated that the IHS collapse had cost about four percentage points of performance. Fortunately, in spite of this, 1999 still was a fairly good year for our managers and our clients.

Besides buttressing my bias against consensus investing, this episode reinforced my conviction that even good investment managers will make some mistakes, and that what counts, besides adequate diversification, is to make fewer of them than the investing crowd as a whole.

Today we are a much bigger and more diversified firm; and, in spite of the high level of consultation and cooperation among our various teams, few of our investment errors are firm-wide. So, I feel freer to reflect on some of my own mistakes, and to wonder what Ive learned from them. The ones mentioned below took place in the 1970s, at Tucker Anthony, when I clearly was learning a lot of lessons fast. My memory of the details has become a bit fuzzy, but the lessons have not.

Can You Do It Again?

It must have been in 1971 that I purchased some shares of AVCO Corporation. The company, originally a military contractor, had since become one of the most diversified conglomerates in America. This complexity should have alerted me. However, at the time I had more brains than common sense, and I was receptive to the arguments of leading Wall Street analysts, who promised marvels from the conglomerate craze in the form of economies of scale and growth synergies. Unfortunately, besides the accounting liberties allowed by conglomeration (which I will explain later), it was difficult to figure what a companys recurring profits were, when they originated in a multitude of disparate subsidiaries.

As a case in point, in 1967 AVCO had purchased Embassy Pictures, whose film The Graduate became the top-grossing movie of 1968 (and remains one of the best-grossing movies of all time), considerably boosting AVCOs profits. Earnings per share, helped by the pooled record of the Embassy acquisition, had nearly tripled between 1965 and 1967. In 1968 and 1969, the success of The Graduate helped cushion already deteriorating profits elsewhere in the company. But by 1969 and 1970, reality and the first post-Vietnam-War recession caught up with AVCO, and earnings collapsed.

20chart.png /%

So, if my memory serves me well, I did purchase the shares after their 1970 price collapse, which was consistent with my contrarian investment approach. Unfortunately, I never questioned the published record prior to that decline, or the fact that the level of earnings reached in 1967, artificially inflated by the pooling of Embassy Pictures and the success of The Graduate, had not reflected AVCOs recurring earning power and might not be reached again for quite a while. In fact, by the time the 1974-1976 global recession resulted in losses for the company, the conglomerate bubble had been deflated and all this had become academic.

The Fake Magic of Pooling of Interest

I cant recall the exact dates of my investment in Chromalloy American, but judging by the chart below, it must have started somewhere around late 1972 or early 1973.

20graph.png /%

At the time I was playing an innocent but very educational game with one of my mentors a superb analyst who had gone from messenger-boy on Wall Street in the 1920s to partner of a small but prestigious firm before retiring comfortably in 1968. I would do substantial research on a company and then provide him with five years of annual and 10K reports, pretending that I was only planning to look at it. He would then inform me of his preliminary opinion and suggest a list of questions to ask that companys management.

Chromalloy had a seemingly good record, some solid businesses (particularly in sophisticated aerospace coatings), and a number of newer but highly promising ventures. However, my mentor returned the reports with only a very atypical remark on the ethnic origins of the companys management, which I found totally out of line. So, in protest, I purchased the stock of Chromalloy American without his moral support.

At the time, conglomerates increasingly acquired other companies by pooling of interest, an accounting method that involved an exchange of shares (instead of cash payment) and allowed the acquiring company to restate its past earnings as if it and the acquired company had always been merged.

In the case of Chromalloy, for example, earnings showed little progress while I owned the shares. Yet each new annual report showed a historical record of impressive growth because the company kept restating past earnings downward to reflect the fact that newly acquired companies had grown rapidly from low past levels of profitability. In addition, each year, management would tout a new high-tech venture or acquisition with great promise for the future, but earnings showed no progress.

I finally lost patience and sold the stock poorer but wiser. It is always useful to look at the earnings as they were originally reported, together with the stories that were then told.

A Dangerous Promise and a Flash Scare

In 1972 my boss at Tucker Anthony departed for a fairly long trip and left me in charge of his clients portfolios. He particularly asked that I take good care of a personal friend who did not have a large fortune but who needed a lot of hand-holding. On a long conversation with the friend, she informed me that she could not afford any loss but still needed to make some money in the stock market! Naively, I accepted this mission, which any responsible manager would decline: In the stock market, volatility is inherent and nothing is earned when nothing is ventured. One can only strive to limit, not eliminate, risks through hard work and thorough analysis.

But I felt quite sure of myself. I had studied extensively a smallish manufacturer of gasoline pumps and meters called Tokheim. They were leaders in their business; both the earnings record and the financials were clean; and despite a recent advance, the shares remained reasonably priced.

Exact dates elude me again, but I remember vividly that no sooner had I purchased the stock, its price started melting down day after day, in an agonizing slide. To make things worse, repeated calls to Tokheims management to double-check my original assumptions remained unanswered. Probably the only reason I did not sell and take our loss was that this was my first and only recommendation to that new client, and I felt more or less condemned to stand stubbornly behind my decision.

Then, a miracle saved me: In early April 1972, a first-page article in the Wall Street Journal announced, Major Oil Companies Join Rush To Set Up Self-Service Stations. Tokheim was the only gasoline-pump manufacturer mentioned in the article. (It also turned out that, despite the companys suspicious silence, no bad news was forthcoming.)

20graph.png /%

The impact of a sudden burst of media publicity on the supply and demand for the shares of a relatively small company can be viewed on the graph above. Not only were the early losses quickly erased, but large gains also resulted.

Still, the cold sweat of this brief episode made me swear never again to make unsupportable promises.

Snobbery Is Not Discernment

I have long had an intellectual preference for people who make or invent things, as opposed to those who merely sell them. Perhaps for that reason, I have often been attracted to companies having instruments in their name, although I cannot truly say that they have always helped my investment performance.

In December of 1978, my colleague Jean-Pierre Conreur convinced me to invest in a company called Veeco Instruments. It had been founded after WWII by two former scientists of the Manhattan Project, and had become one of the early competitors in the semiconductor equipment business.

Some time later, Jean-Pierre suggested that we visit the company in nearby Long Island. Conducting the tour, the then-CEO introduced us to Veecos newest machines, but could not stop speaking about the companys catalogue. I was dejected by this base fascination with a mere sales brochure, and soon after (in January 1979) decided to sell out of Veeco at around our purchase price. Still, to satisfy a nagging doubt, we spoke with a number of engineers and scientists at other companies. It turned out that, at the time, Veeco was best known forits eponymous catalogue!

Instruments and testing equipment are expensive machines and can be used intensely. If they stop working even for a short time because a small part fails or wears out, for example the lost time can cost a lot of money. Veecos catalogue carried thousands of these parts and components, which could be ordered and delivered almost instantly. As a result, most engineers in the business carried the Veeco catalogue under their arms, ready for use at all times.

The gains I forfeited by selling without understanding the companys real business are shown on the graph below. In the two years following my sale, the stock soared from under $20 to over $50.

Of course, I have made more mistakes since these early days, but not many with lessons that marked me as much. As time passes, however, perhaps those other missteps will gain greater importance among my memories; as this happens, I will make sure to write about them as well.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.