Mergers and acquisitions failures are project management failures

Post on: 16 Март, 2015 No Comment

Projects are how organizations realize their strategies. To remain competitive organizations rely on successful project delivery.

This new project is a merger of equals

Using a project management hat to review mergers and acquisitions (M&A) offers a new frame as the project effort distills to deliver on budget. within a certain time. and on expected synergy (scope).

Yes, synergy is an awful platitude of the M&A world. So, lets peel that off our skin and get comfortable with scope in place of synergy.

So, mergers and acquisitions failures are really business strategy project management failures and part of overall project failure rate.

The goal of a merger or an acquisition might include one, or a combination of, the following business goals:

- New technology

- New market

- Increase customers

- Foreign direct investment

- Improve tax position

The objective of a merger or acquisition might include one, or a combination of, the following business goals:

- Increase shareholder value

- Create firm value

- Cost reduction

- Increased productivity

- Revenue growth

- Strategic benefit

- Market gain

- Complementary resources

- Vertical integration

- Reduce cost of capital

Build, Buy, or Outsource

Any of the above goals or objectives comes down to a build versus buy strategic rationale.

No matter the motive for mergers and acquisitions (M&A) the real work comes with integration.

Similar to a project scope statement that identifies the success criteria for a project, the only way to identify success or failure is within the scope of the M&A goals.

Subsequently, the risk in mergers and acquisitions comes down to the ability of a team to deliver within budget, by a certain time, and up to project expectation (scope ) and project failure rates for M&A deals are strikingly high:

- In a survey of more than 400 U.S. and European corporate executives published by Accenture. 55% of executives said that their most recent deals did not achieve expected cost-saving synergies.

- A McKinsey study found that in 70% of the deals studied the buyer failed to achieve the expected levels of revenue synergies.

- A McKinsey 61% of all acquisition programs were failure s because the acquisition strategies did not earn a sufficient return on the funds invested.

- 1997 research conducted by Carleton indicate between 55% to 70% of mergers and acquisitions fail to meet their anticipated purpose.

- Magnet (1984) and Gilkey (1991) found that between 60% and 67% of mergers and acquisitions fail to meet expectations.

- 2007 study by the Hay Group and the Sorbonne found that more than 97% of mergers by UK companies fail to achieve original strategic objectives.

- 2007 study by the Hay Group and the Sorbonne found 91% of European business leaders thought their deal did not fully achieved its original objectives .

- US sources place merger failure rates as high as 80% and evidence indicates that around half of mergers fail to meet financial expectations.

- “If the definition of a successful merger is driving up shareholder value, then their failure rate is far north of 50% ,” says Lawrence Chia, a managing director of Deloitte & Touche in Beijing, China.

- Ellis and Pekar (1978) and Marks (1988) suggest that in the long term between 50% and 80% of all mergers and takeovers are considered financially unsuccessful .

- General Electric states 95% of its acquisitions over the past decade yielded “disappointing results” .

- A Department of Trade and Industry study published by the British Institute of Management (1988) and another by Hunt (1988) determined the success rates post-acquisition to be around 50% .

- John Kotter. author of iconic Leading Change. believes 70% of all major change efforts in organizations fail .

Synergy as Fantasy

Above shows failure rates to achieve synergy or expected gains. As Ive stated before, organizations rely on projects to remain competitive. Projects are the way organizations deliver and realize their executive strategies.

The ability to deliver a project is the ability to compete. Merger or acquisition integration failure does not just put that project at risk, but destroys firm value beyond the synergy integration at hand:

- A study of 150 major deals led Business Week to conclude that out of 150 deals valued at $500 million or more about half actually destroyed shareholder value” (Feldman and Pratt 1999).

- 2004 study by Bain & Company found that 70% of mergers failed to increase shareholder value.

- KPMG survey estimated that 83% of all mergers fail to create value and half may actually destroy value.

- A 1999 study by KPMG (publishing in PR Newswire, 1999) found that between 75% and 83% of mergers and acquisitions failed, where failure meant lowered productivity, labour unrest, higher absenteeism, and loss of shareholder value, or even a dissolution of the companies involved.

- Of 277 big M&A deals in America between 1986 and 2000, 64% destroyed valued for the acquirers shareholders.

- McKinsey study presents evidence that most organizations would have received a better return on their investment by banking their money and not buying another company.

- The Art of M&A Integration (Lajoux, 1998) 15 studies done between 1965 and 1997 of over seven thousand mergers and acquisitions: 55% and 77% of all mergers fail to deliver on the financial promise announced when the merger was initiated and 77% of acquisitions do not earn back their capital.

Before you identify success or failure you need to create time-bound, quantifiable M&A goals. Firms who successfully integrate are market leaders.

Those that fail have difficulty even remaining competitive or surviving. The cost for M&A project failure is quite quantifiable*:

- According to Fortune magazine 30 years of M&A activity have resulted in an average 3% loss of equity .

- The average acquirer lost almost 4% of its value in the medium term as a result of the merger (Andrade, Mitchell, & Safford, 2001).

- In deals financed by the issuance of equity, acquiring firms lost over 6% of their value over the medium term as a result of the announced merger (Andrade, Mitchell, & Safford, 2001).

- Approximately 60% of mergers result in lowered profitability for as long as 7 years post-merger (Schenk, 2000).

- Industrial acquiring plants show longer term productivity losses (McGlickin and Nquyen, 1995) while 2 other studies show net productivity gains for mergers average zero (AMS, 2001 and Schoar, 2002).

- Firms whose acquisitions result in divestitures and who subsequently become targets lose about 7% on average at initial announced merger (Mitchell and Lane, 1990).

- About 40% of firms whose acquisitions result in divestitures become acquisition targets (Mitchell and Lane, 1990).

- About 50% of the executives in firms involved in a merger or acquisition leave within three years (Galpin, 2000).

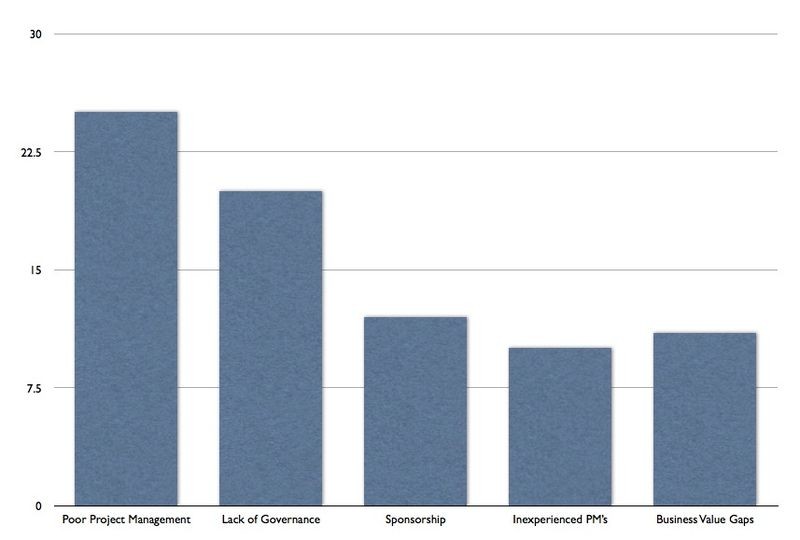

And what of the people component? The human capital risk. Project succeed through people, we innately know that. Human Resources (HR) offers 5 major roadblocks to M&A success around people**:

- Inability to sustain financial performance (64% )

- Loss of productivity (62% )

- Incompatible cultures (56% )

- Loss of key talent (53% )

- Clash of management styles (53% )

HR folks are renowned for their ability to ruin a good party, but HR does have a role in deal-making .

M&A as a Project

Do you have project managers as part of your M&A team? Are your project managers focused solely on IT integration. The decision to invest comes down to a decision to invest in a team to deliver a project. People and firms can qualify and quantify human capital risk before investments and manage and mitigate human capital along the entire life cycle.

Those that do can better realize the M&A return using a human capital portfolio perspective.

Since project management skills really boil down to talent management skills I would be derelict by not reiterating my common theme: the real risk to capital is a human capital risk to manage a project.

M&A deals are not only financial capital deals, but also human capital deals .

M&A Project Management Sources: