Measuring And Managing Investment Risk

Post on: 21 Июнь, 2015 No Comment

We tend to think of risk in predominantly negative terms, as something to be avoided or a threat that we hope won’t materialize. In the investment world, however, risk is inseparable from performance and, rather than being desirable or undesirable, is simply necessary. Understanding risk is one of the most important parts of a financial education. This article will examine ways that we measure and manage risk in making investment decisions.

Risk — Good, Bad and Necessary

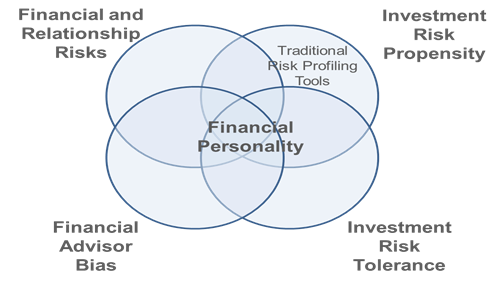

A common definition for investment risk is deviation from an expected outcome. We can express this in absolute terms or relative to something else like a market benchmark. That deviation can be positive or negative, and relates to the idea of no pain, no gain — to achieve higher returns in the long run you have to accept more short-term volatility. How much volatility depends on your risk tolerance — an expression of the capacity to assume volatility based on specific financial circumstances and the propensity to do so, taking into account your psychological comfort with uncertainty and the possibility of incurring large short-term losses.

Absolute Measures of Risk

One of the most commonly used absolute risk metrics is standard deviation. a statistical measure of dispersion around a central tendency. For example, during a 15-year period from August 1, 1992, to July 31, 2007, the average annualized total return of the S&P 500 Stock Index was 10.7%. This number tells you what happened for the whole period, but it doesn’t say what happened along the way.

The average standard deviation of the S&P 500 for that same period was 13.5%. Statistical theory tells us that in normal distributions (the familiar bell-shaped curve) any given outcome should fall within one standard deviation of the mean about 67% of the time and within two standard deviations about 95% of the time. Thus, an S&P 500 investor could expect the return at any given point during this time to be 10.7% +/- 13.5% just under 70% of the time and +/- 27.0% 95% of the time.

Risk and Psychology

While that information may be helpful, it does not fully address an investor’s risk concerns. The field of behavioral finance has contributed an important element to the risk equation, demonstrating asymmetry between how people view gains and losses. In the language of prospect theory. an area of behavioral finance introduced by Amos Tversky and Daniel Kahneman in 1979, investors exhibit loss aversion — they put more weight on the pain associated with a loss than the good feeling associated with a gain.

Thus, what investors really want to know is not just how much an asset deviates from its expected outcome, but how bad things look way down on the left-hand tail of the distribution curve. Value at risk (VAR) attempts to provide an answer to this question. The idea behind VAR is to quantify how bad a loss on an investment could be with a given level of confidence over a defined period of time. For example, the following statement would be an example of VAR: With about a 95% level of confidence, the most you stand to lose on this $1,000 investment over a two-year time horizon is $200. The confidence level is a probability statement based on the statistical characteristics of the investment and the shape of its distribution curve.

Of course, even a measure like VAR doesn’t guarantee that things won’t be worse. Spectacular debacles like hedge fund Long Term Capital Management in 1998 remind us that so-called outlier events may occur. After all, 95% confidence allows that 5% of the time results may be much worse than what VAR calculates. In the case of LTCM, the outlier event was the Russian government’s default on its outstanding sovereign debt obligations, an event that caused the hedge fund’s performance to be much worse than its expected value at risk.

Risk: The Passive and the Active

In addition to wanting to know, for example, whether a mutual fund beat the S&P 500 we also want to know how comparatively risky it was. One measure for this is beta. based on the statistical property of covariance and also called market risk, systematic risk , or non-diversifiable risk. A beta greater than 1 indicates more risk than the market and vice versa.

Beta helps us to understand the concepts of passive and active risk. The graph below shows a time series of returns (each data point labeled +) for a particular portfolio R(p) versus the market return R(m). The returns are cash-adjusted, so the point at which the x and y axes intersect is the cash-equivalent return. Drawing a line of best fit through the data points allows us to quantify the passive, or beta, risk and the active risk, which we refer to as alpha.

The gradient of the line is its beta. For example, a gradient of 1.0 indicates that for every unit increase of market return, the portfolio return also increases by one unit. A manager employing a passive management strategy can attempt to increase the portfolio return by taking on more market risk (i.e. a beta greater than 1) or alternatively decrease portfolio risk (and return) by reducing the portfolio beta below 1.

Influence of Other Factors

If the level of market or systematic risk were the only influencing factor, then a portfolio’s return would always be equal to the beta-adjusted market return. Of course, this is not the case — returns vary as a result of a number of factors unrelated to market risk. Investment managers who follow an active strategy take on other risks to achieve excess returns over the market’s performance. Active strategies include stock, sector or country selection, fundamental analysis and charting.

Active managers are on the hunt for alpha — the measure of excess return. In our diagram example above, alpha is the amount of portfolio return not explained by beta, represented as the distance between the intersection of the x and y axes and the y axis intercept, which can be positive or negative. In their quest for excess returns, active managers expose investors to alpha risk — the risk that their bets will prove negative rather than positive. For example, a manager may think that the energy sector will outperform the S&P 500 and increase her portfolio’s weighting in this sector. If unexpected economic developments cause energy stocks to sharply decline, the manager will likely underperform the benchmark — an example of alpha risk.

A note of caution is in order when analyzing the significance of alpha and beta. There must be some evidence of a linear pattern between the portfolio returns and those of the market, or a reasonably inclusive line of best fit. If the data points are randomly dispersed, then the line of best fit will have little predictive ability and the results for alpha and beta will be statistically insignificant. A general rule is that an r-squared of 0.70 or higher (1.0 being perfect correlation ) between the portfolio and the market reasonably validates the significance of alpha, beta and other relative measures.

The Price of Risk

There are economic consequences to the decision between passive and active risk. In general, the more active the investment strategy (the more alpha a fund manager seeks to generate) the more an investor will need to pay for exposure to that strategy. It helps to think in terms of a spectrum from a purely passive approach. For example, a buy and hold investment into a proxy for the S&P 500 — all the way to a highly active approach such as a hedge fund employing complex trading strategies involving high capital commitments and transaction costs. For a purely passive vehicle like an index fund or an exchange trade fund ETF) you might pay 15-20 basis points in annual management fees, while for a high-octane hedge fund you would need to shell out 200 basis points in annual fees plus give 20% of the profits back to the manager. In between these two extremes lie alternative approaches combining active and passive risk management.

The difference in pricing between passive and active strategies (or beta risk and alpha risk respectively) encourages many investors to try and separate these risks: i.e. to pay lower fees for the beta risk assumed and concentrate their more expensive exposures to specifically defined alpha opportunities. This is popularly known as portable alpha. the idea that the alpha component of a total return is separate from the beta component.

For example a fund manager may claim to have an active sector rotation strategy for beating the S&P 500 and show as evidence a track record of beating the index by 1.5% on an average annualized basis. To the investor, that 1.5% of excess return is the manager’s value — the alpha — and the investor is willing to pay higher fees to obtain it. The rest of the total return, what the S&P 500 itself earned, arguably has nothing to do with the manager’s unique ability, so why pay the same fee? Portable alpha strategies use derivatives and other tools to refine the means by which they obtain and pay for the alpha and beta components of their exposure.

Conclusions

Risk is inseparable from return. Every investment involves some degree of risk, which can be very close to zero in the case of a U.S. Treasury security or very high for something such as concentrated exposure to Sri Lankan equities or real estate in Argentina. Risk is quantifiable both in absolute and in relative terms. A solid understanding of risk in its different forms can help investors to better understand the opportunities, trade-offs and costs involved with different investment approaches.