Marketviews Top Performing Sectors of the JSE

Post on: 21 Июль, 2015 No Comment

Top Performing Sectors of the JSE

Natalie Mayer

2 April 2013

One of the mantras of investing must be diversify, diversify, diversify. The logic is simple: if all your eggs are in one basket, you will lose everything if that basket falls. Diversifying or spreading your investment amongst many baskets thus helps to protect you from specific economic shocks.

In practice, we tend to apply this diversification quite narrowly. We invest in ten to twenty different shares rather than one or two. This is a good start, but there are other layers of diversification to consider that will further reduce your risk, such as diversifying by type of asset (e.g. spreading your investment across shares, property, and cash in the bank) and diversifying share investments by sector. In this article we will look at how you can diversify by sector on the JSE, make your investments more resilient to shocks, and enjoy improved portfolio performance.

Why diversify by sector, rather than just by share or asset?

When you spread your investments across different sectors that have a low correlation to each other, you help to reduce volatility in price. The reason for this is that different sectors dont often rally or fall at the same time, or at the same pace. For example, if the basic materials sector (specifically mining) suffers labour unrest and sector prices fall, this trend may spread to several mining companies. Even if you had diversified your investment across different mining shares, your portfolio is likely to decrease in value due to the sector trend. However, if you had split your investment to include shares in the consumer goods sector (which is not strongly linked to the basic materials sector and not suffering from labour issues), you could have cushioned your losses.

In summary, if your portfolio includes shares from different sectors, you are less likely to suffer major losses because not all the sectors will be losing at the same time. Like diversifying across shares, diversifying by sector helps your portfolio to enjoy a more consistent performance.

So, which sectors are available to the local investor?

Main sectors of the JSE

Excluding the specialist securities (e.g. the ALTX) and indices (e.g. the Indi 25), there are nine main sectors listed on the JSE. These are:

Oil & Gas

Basic Materials (e.g. companies involved in gold, diamonds, metals and minerals, paper, etc)

Industrials (e.g. building and construction, electronic equipment, shipping and ports)

Consumer Goods (e.g. beverages, clothing, household appliances)

Health Care (e.g. hospitals, pharmaceuticals)

Consumer Services (e.g. airlines, hotels, restaurants, media agencies)

Telecommunications (e.g. fixed or wireless telecommunications)

Financials (e.g. banks, real estate, insurance companies)

Technology (e.g. computer hardware and software)

Out of the 378 companies listed on the JSE, most belong to either the financial, basic materials or industrial sectors. The pie chart below shows the full breakdown of the JSE in terms of each sectors value contribution, or using proper terminology, its market capitalisation:

Source: Sharenet. Data as at 4 February 2013.

The pie chart shows that about 26% of the total value of all JSE-listed companies is contributed by the basic materials sector, equivalent to approximately R2 trillion. It makes sense that the basic materials sector is the largest component of the JSE, given South Africas wealth of natural resources. The second largest component (perhaps surprisingly) is the consumer services sector, worth about R1.6 trillion. The financial sector comes close behind in third place, contributing about R1.5 trillion, with both consumer services and financial sectors each making up around 20% of the total value of JSE-listed companies.

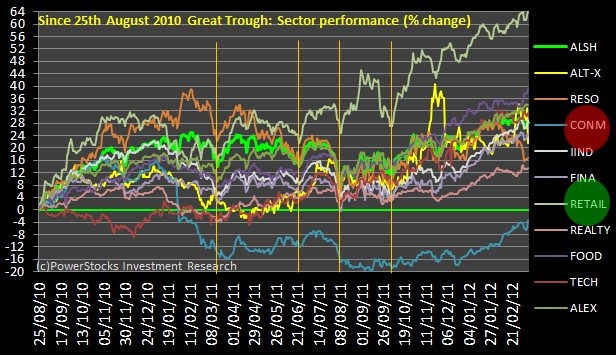

Sector performance over the last 5 years

Source: Sharenet. Data as at 5 February 2013.

The size of the sector is not necessarily linked to its rate of return. Despite being the largest sector, basic materials only saw a 4.8% growth rate since January 2008. Over the last five years, the health care sector has seen the highest growth rate in terms of increased market capitalisation, more than tripling its value in Rands. Second place goes to the consumer goods sector which saw a 177% increase, and third to the technology sector which enjoyed a 109% gain.

Top performing shares per sector

In the list below are the top three companies in each sector whose market capitalisation growth significantly outperformed their sectors market cap growth over the past 5 years, and whose increase in share price was also notable. (Companies that were listed after 23 January 2008 were excluded to obtain a complete 5-years worth of data. Where only one or two companies are mentioned, it means that the other companies in the sector who were listed on 23 January 2008 did not outperform their sectors market capitalisation growth.)

Hopefully you now have a better understanding of the sectors of the JSE, and know which sectors and companies have historically showed good growth and are worth further research for possible inclusion in your share portfolio. By diversifying across these sectors, you should be able to build a more resilient and higher value portfolio in the medium to long term.

Our workshop dates for 2013 are now out! To find out more about the seminars and to book your seats, click here .