MarketRiders ETF Portfolio Up % in Worst Year Since the 30s; Rebalancing Adds Over 2% to Returns

Post on: 17 Апрель, 2015 No Comment

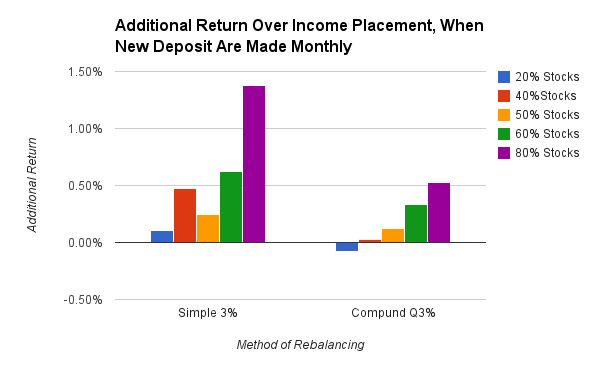

MarketRiders, Inc. today demonstrated how investing for retirement can be simple and more profitable by owning and rebalancing an all ETF portfolio. Over the 12 months ending September 30, 2009, disciplined rebalancing four times over the year yielded an additional 2.62% to the MarketRiders Income Focused 70 portfolios performance. MarketRiders online technology stimulates rebalancing alerts whenever market conditions move the portfolio from its target allocations.

With ETFs, investors aren’t paying managers to beat the market — rather they simply capture the exact returns of multiple markets which is proven to generate greater returns with less risk

Danville, CA (PRWEB) October 16, 2009

MarketRiders, Inc. today demonstrated how investing for retirement can be simple and more profitable by owning and rebalancing an all ETF portfolio. Over the 12 months ending September 30, 2009, disciplined rebalancing four times over the year yielded an additional 2.62% to the MarketRiders Income Focused 70 portfolios performance. MarketRiders online technology stimulates rebalancing alerts whenever market conditions move the portfolio from its target allocations.

Sophisticated investors focus on asset allocation. not stock picking and market timing, and periodically rebalance their portfolios, forcing a buy low and sell high discipline, explains Mitch Tuchman, CEO MarketRiders. Income Focused 70 returned a total of 5.05% instead of only 2.37% because when an asset class drifted from its target, we rebalanced the portfolio — we were forced to buy low and sell high.

With 70% allocated to fixed income and 30% to equity, the Income Focused 70 portfolio is perfect for someone who is early into retirement and needs protection against inflation, but doesnt have the risk tolerance to emotionally withstand big ups and downs. During one of the worst 12 months in financial market history, this portfolio was actually down 15% in March 2009 on its worst day.

The Income Focused 70 includes 10 ETFs from Vanguard, iShares and State Street Bank including: TIP, BIL, BSV BIV BLV and LQD (fixed income), VEU (foreign emerging and developed countries), RWR (real estate) and IJR and SPY (small and large cap US stocks).

Through these ETFs, an investor owns thousands of US, foreign market and real estate stocks and can save nearly 90% over mutual fund fees. ETF fees for $100,000 invested in a typical MarketRiders portfolio are only $170 instead of about $1500 in fees for a comparable mutual fund portfolio.

With ETFs, investors arent paying managers to beat the market — rather they simply capture the exact returns of multiple markets which is proven to generate greater returns with less risk, said Steve Beck, co-founder.

www.marketriders.com ), provides an easy-to use online portfolio manager that allows anyone to invest using strategies previously only available to elite investors and large endowments. In 2 hours a year, anyone can now build and manage their own portfolio, lower their risk, and save on the onerous investment fees which typically siphon away 33% of a portfolio over 15 years. MarketRiders software watches the portfolio 24×7 and tells investors when its time to rebalance.

# # #

PDF Print