Mainstreaming Impact Investing Blog

Post on: 16 Март, 2015 No Comment

Mainstreaming Impact Investing

04 Oct 2013 Michael Harvey

Recently I attended an event as part of the United Nations Global Compact Leaders ( UNGC ) Summit entitled “Impact Investment in the Post-2015 Development Agenda,” that focussed on the practical steps needed to bring impact investing to scale. Given the size and systematic nature of issues that the current Millennium Development Goals seek to address, both for-profit companies and mainstream investors will need to play a key role in creating solutions. Recent reports by JP Morgan and the Rockefeller Foundation as well as the World Economic Forum ( WEF ) suggest that impact investing may provide the right platform to do so, but that this will require both collaboration and innovation from a range of stakeholders.

Impact investment is distinct from other investment approaches in that investors target environmental and/or social benefits in addition to a financial return. In their 2010 report JP Morgan and the Rockefeller Foundation suggested that the impact investment sector could reach US$ 1 trillion by 2020. However, currently less than US$ 40 billion of capitalout of the tens of trillions in global capitalis committed to impact investments, indicating that much more structural groundwork is required before impact investing lives up to its potential.

Discussion during the UNGC impact investing event underlined several key challenges facing the sector:

1. Defining “impact investing”. Participants noted that “some definitions [of impact investing] are so ‘big’ you could park an aircraft carrier in them,” and that the distinction between “impact financing” and traditional financing may itself be misleading as under some definitions “impact financing IS financing.”

These discussions reflect existing confusion about whether impact investment is best understood as an “asset class” (securities or investments that behave similarly under varying market conditions and that are governed by a similar set of rules and regulations) or rather as an “approach” (a lens through which investment decisions are made). In a timely addition to this debate, the recently published WEF report, From the Margins to the Mainstream. defined impact investing as “an investment approach that intentionally seeks to create both financial return and positive social or environmental impact that is actively measured.” Hopefully this definition will enable stakeholders within the sector to move past this initial source of confusion and align efforts for growth.

2. Building platforms to support growth. Currently a limited amount of market platforms provide a centralised location for people to pitch ideas and receive funding for new businesses. Developing this infrastructure, through efforts such as the Gate Impact Platform. will be pivotal to sector grow.

Moreover, with relatively primitive vetting and due diligence of social enterprises, challenges exist in how the enterprises are sourced, matched to investors, and have their performance measured. Work by organisations such as IRIS. who provide a standardised catalogue of performance metrics used by investors not only to measure social, environmental, and financial success but also to evaluate deals, should help to grow the credibility of the impact investing industry.

3. Addressing market gaps. UNGC Summit panelist Richard Kauffman, New York State Chair for Energy Policy & Finance explained that, “The problem is not liquidity, or returns on investments, or even the need for subsidies; it’s really about filling the market gaps that inhibit money from flowing from where it is needed to where it is wanted.”

Other panellists suggested that innovation is required to address existing financing gaps and the lack of suitable products that meet the needs of social and environmental enterprises. Social and environmental enterprises typically require long-term, patient capital at the start-up phase, and often don’t fit the typical investment criteria (time-frame, rate of return, etc.) meaning that investors may need to rethink their overall approach, identify new ways of structuring investments and be willing to accept limited or very low returns in the initial period.

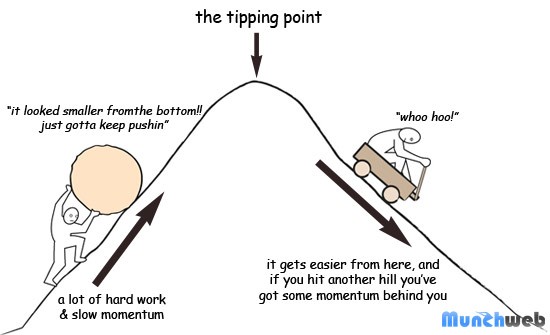

To bring impact investing to scale, these are just some of the challenges amidst many others (such the current state of fragmentation within the impact investing universe and the lack of an established track record of exits for investors in “double bottom line” companies) that might constrain impact investing to remaining a niche investment approach. However, two recently published reports suggest that the development of the sector is at a critical juncture.

According to the previously referenced study from the World Economic Forum, impact investing’s potential to meet social and environmental challenges makes it “too important an opportunity not to pursue,” but before the approach can be practiced, the sector must address several key areas. The report suggests that bringing impact investing to scale will include activity from a range of stakeholders, including:

- Impact investing funds Increased transparency from impact investment funds on the financial returns that are generated;

- Impact enterprises Proactive measurement and reporting on social and environmental impact by enterprises;

- Governments – Provision of tax relief for early-stage investments in which public benefit is created; and

- Philanthropists and foundations – Commitment of investment capital to impact investments in addition to programmatic allocations.

The WEF report provides the groundwork for efforts to address these issues; however, “CEO Study on Sustainability 2013”, a recent survey of leaders from Global Compact signatory companies that was completed by professional services firm Accenture, reveals a worrying level of “sustainability fatigue” in corporate boardrooms. This suggests that carrying out the groundwork required to mainstream impact investing and bringing it to scale will require a reinvigoration of the current efforts, innovative financial solutions, and perhaps most importantly, a collaborative approach which engages governments, civil society, and businesses – particularly mainstream investors.