M Lien They Laughed When I Went To Buy Tax Liens But When Those Checks Started Rolling In

Post on: 8 Июнь, 2015 No Comment

They Laughed When I Went To Buy Tax Liens, But When Those Checks Started Rolling In.

Yes. Investing in tax lien certificates can be exciting.

Buying my first few liens was a frightening experience. I left my first sale, giving the Larimer County, Colorado, treasurer a check for $2,708.95. All I had to show for it was a receipt saying I had paid for 7 tax lien certificates. I had no rights to even walk onto these properties!

As I drove home my hands visibly shook on the steering wheel. I wondered what I had got myself into. Things got interesting. though, when I would go out to my mailbox. Every once in a while there would be a check; sometimes small; sometimes big. And, always larger than whatever I paid for the tax lien. All of those seven original tax liens have now been paid back. Since that first sale I have purchased over one thousand tax lien certificates. And at times, those checks were arriving every day! I used to dread going to the mailbox and finding bills. Can you imagine what it is like to get money for the effort of walking to your mailbox? A while back I received a check for $10,343.81!

What are Tax Lien Certificates?

I’m sure you think that sounds great, but what are Tax Lien Certificates? Tax Lien Certificates (TLCs) are financial notes that you can purchase from counties in several states across the country. These TLCs are actually in lieu of unpaid taxes by those who own properties in these counties. When property owners don’t pay their taxes, the counties do not have the money to fund their yearly budgets. So many states have enacted laws that allow the counties to collect their funds another way. That other way is by selling TLCs to investors.

The counties sell the unpaid taxes to investors who are willing to pay the taxes for (1) a lien against the owner’s property, and (2) the rights to get high interest rates if the property owner eventually pays the money back. If the property owner doesn’t pay their taxes, plus interest, by the state defined time limit the lien gives the TLC owner the right to the property. In these cases the TLC purchaser can file paperwork to take possession of the property.

The rates of interest you can expect range from 8% all the way up to 50%, depending on the state. For example Iowa allows for 2% each full or partial month, or 24% a year! And, on an annual basis you can actually exceed these rates in some cases. This is possible because some states have a set penalty or fee for redemption regardless of when the tax lien is redeemed. For example, in Wyoming there is a 3% penalty in addition to a 15% per annum interest rate. So, your best rate of return is actually when the property owner pays the very next day. That would give you a rate of return of 3% x 365 or 1095% on an annual basis. As good as that is, you won’t be able to repeat the feat for the other 364 days of the year. You will usually prefer to let them take a little longer to pay.

The state set redemption time limits (when you can file for possession of the property) can range from less than a year to several years. And once that point has been reached you have another state defined time limit by which you must file on the property or lose the lien altogether. So, if you want to give the owner some more time, and you some more interest, you can wait. Or, if you want to see if you can get the rights to the property you can file right away.

What are Tax Lien Sales Like?

There are as many formats to tax lien sales as there are counties! The following is a rendition of one of the many variations on sale methods.

The day starts early as you drive to the sale site a few counties away. You time your traveling so that you arrive at the sale at 8 a.m. This is one hour before the sale starts and is the time this particular county starts accepting registrations for the sale.

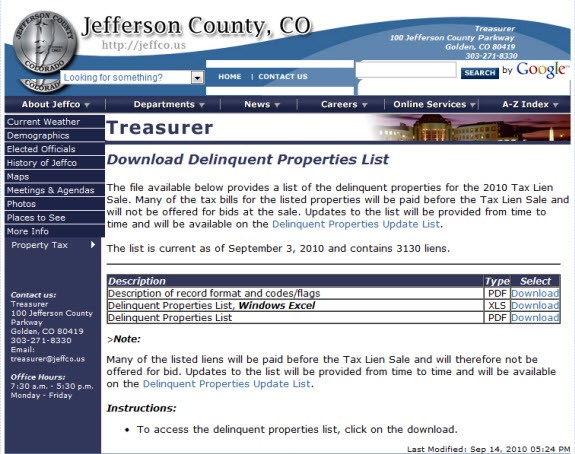

The people at the county treasurer’s office are there at tables taking registration information. They request a filled out w-9 for each investor, as they will be reporting investor earnings to the IRS. They take your name, address, and phone number. T hey assign you a bidding number for the sale. The treasurer’s office also provides you with a sheet with instructions for the sale and a packet with the listing of the tax liens for sale this day.

You find yourself a good seat and spend the extra time you have reviewing the tax lien listing. You are looking for words and indications of properties you wouldn’t want if they were offered to you. It might be just too high or too low of a price. Or, it might be that there are a significant number of previous tax years tacked on to the sale item. Or, it might be that the wording indicates the property is common property and would be difficult to redeem. Or it might be improvements only, like a farm silo, and you are not interested in farm silos.

In any case, you mark up your listing so that you know not to accept your no tax liens. If a particular property is borderline and you haven’t decided yet, you place a question mark next to it so you can decide later depending on how your investment day is going.

The sale starts promptly at nine. The county treasurer gives a little information on how the sale will be run; that the sale is “buyer beware”; that the investor has no direct rights to the property they receive (i.e. you are not allowed on the property as that would be trespassing), and asks if there are any questions before they start.

The sale starts.

At this particular sale, they use bingo balls to pick the investor. As each ball comes out the investor number is called out. If the investor wants the tax lien they say “yes”. If they do not they say “no”. A “no” answer means that the treasurer takes out another ball and calls on another investor. Eventually someone accepts the tax lien and all the balls are put back into the bingo machine. Then the next property on the list is read out and a new ball is picked.

Each of the properties is gone through one by one until they have all been taken by investors.

At the end of the sale the treasurer’s office needs time to tally up the totals for each investor. You are asked to come back at 2 p.m. to pay for your purchases. This sale was over by 11:30 a.m.

You head off for some lunch. In the meantime you also add up your purchases to see if they agree with the county’s total. When you arrive at 2:00, and the total agrees, you write out your check. The county gives you copies of your tax lien certificates. You head back home, confident that you will be making good interest on your money.

You will Like Investing In Tax Lien Certificates

You will really like investing in Tax Lien Certificates (TLCs). You may have had your money in the stock market, like I did, and subject to the up and down whims of the market. Even if the market is going up, you may find that your investments in Tax Lien Certificates are better and/or more steady than the stock market.

The reason you will like TLCs are:

Higher, fixed rate returns. Tax Lien Certificates pay much higher rates of returns than Certificates of Deposits and other fixed rate return investments. Investments in Colorado, Wyoming and Iowa have paid interest in the range of 10% to 24% on an annual basis. Other states have a range from 8% to 50%. You will typically receive 7% to 20% more on your money than the typical bank savings rates.

In some years you might get a higher rate of return in the stock market. Yet, I don’t think you can get a consistently higher return in the stock market. And, with the stock market there is the opportunity to go down. A savvy investor could combine a couple of investment methods: when a check arrives from a TLC payoff, one could be investing in the stock market until it they were able to reinvest in tax liens again.

The excitement of going to the mailbox each day. You just can’t wait for the mail to come each day. At times you can have several checks a day from the various counties you have invested in. Sometimes they are less than $100. And sometimes they are some eye-popping amounts like the one I received in January for $10,343.81. It is a great feeling to get paid just to walk to your mailbox. You will want to head right down to credit union and deposit the funds and have them ready for the next tax lien sale!

Backed by real estate. You can be reassured by the fact that the investment is backed by excellent collateral. Although you invest mainly for the high returns, you know that if the property owner doesn’t pay that you will get some real estate for pennies on the dollar. You usually figure that the property tax rate is between 1% and 3% of the real estate value for each year of taxes. So, even when you have had to pay taxes for several years on a property, you usually have only paid 5-15% on the value of the real estate. Even when you figure in the cost of the filing for possession of the property, you can see that you am getting the property for 6 to 20 cents on the dollar!

That makes you more than happy to sell the property you get for only 50 cents on the dollar (of actual value) to get your investment money back quicker. Selling the property at 50% of its appraised value would still give you around 300% return on your money.

The ability to up the investment from home. To make the initial investment in tax liens, one needs to travel to the county sale. After that you have earned the right to pay the taxes for the parcels you purchased from your home. So, if the taxes are again not paid on the parcels you bought, you can send a check to the county for the next year of taxes. And you can keep doing that up until the owner pays off on the parcel or you file for the deed. So, even if you figure the cost of travel expenses against your profit the first year, there only the cost of stamps to consider in the following years.

The fun of spending money that gives you something back. This is more my wife’s than mine. Almost all of us like spending money. My wife likes telling people at the sales — This is the only place my husband lets me spend as much as I want. And she is right. Anytime one can buy something that will pay you back (and more) for buying it is MUCH better than buying trinkets that are go down in value rapidly after you buy them.

Travel that you can write off. Our family likes to travel and visit new places. Over the last several years we have had the privilege to visit places all over Colorado, Wyoming, and Iowa that we just wouldn’t have gone to otherwise. We have been able to take trips to see Yellowstone, Jackson Hole, Breckenridge, Dinosaur National Monument and a whole bunch of other fun places. Although the trips certainly offset the profits you would make, the fact that the trips are able to be written off as a business expense make it worth it.

It helped me quit my day job. I had been working toward financial independence for some time before I learned about tax liens. I was trying to accumulate enough money to be able to live off the interest at 5%. I just didn’t seem to be getting close enough. Well when I found out how to make around 15% on my money, the amount I needed to accumulate was cut to one third the size! I was able to invest most of my money in tax lien certificates and quit my day job. It wasn’t enough to be totally comfortable all year long, but I was able to take long spells of time off and fill in with occasional contracting jobs. I have been able to spend more time with my family, work on an advanced degree, and to work on the projects that I would like to work on. Being able to wake up without an alarm clock has been priceless.

Ultimately, you will like fixed rate returns that you can count on. And you will like getting around 15% rather than 2-5% for your fixed rate returns. You may find the roller coaster effects of other investment approaches don’t fit in with your new investment style.

What are the Risks with Tax Lien Certificates?

Tax Lien Certificates (TLCs) are not risk free. Nor are they necessarily high risk, when you think of high risk being linked high returns. There are also a few factors that make tax lien certificates less than a perfect investment for most. Those factors are not risks, just detractors.

Now, although there are a number of risks, they are not prevalent. And, there are ways to minimize the risks.

Unusable land. Every once in a while a tax lien that comes up for sale is actually unusable land. If you have raw land that is not buildable, then it is next to useless. You might be able to camp on it, but that is not what you were investing for. Examples of unusable land are (1) landlocked access, (2) common property, (3) swamp land, (4) deeded private parks, and (5) roads.

Landlocked access would be when a parcel of land has parcels surrounding it that are owned by other owners. There is no road / public access at any point to the property. Without permission from one of the adjacent owners, there is nothing you can really do with the land. You would be trespassing over their property to get to yours. That would be true whether walking to it, driving to it, or having building machinery / materials brought to it. You can look up and find these properties in the plat maps at the county. Worst case, if you were to end up with one of these might be to buy one of the adjacent properties so you can have legal access to the property.

I have one friend who ended up purchasing a tax lien on a strip along a limited access highway that was 10 yards wide and 1/2 mile long. Since it was a limited access highway there was no way to get to the property. That was compounded by the fact that it just wasn’t wide enough to do anything with it. I purchased a landlocked parcel by accident once; the owner paid off anyhow.

Common property is when there is some association of property owners involved. This typically happens with condos or townhouses. There is a common, shared space that is usually a green, park-like area. It could be anything, though. Many times the common property has its own county tax identifier and therefore separate taxes. These taxes are supposed to be paid by the association. Unfortunately, many of these associations have found that it is possible to get away with NOT paying their taxes. This can happen because the association has written up bylaws and deed restrictions to all of the land (owned by property owners [e.g. townhouses] and the common areas). Therefore, even if someone takes the deed to the common space, the new owner must lawfully abide by the deed restrictions that are in place. The new owner receives common space that can have nothing done to it! I have even heard about one association who, after the property was filed on, started billing the new owner for some of the association fees!

Swamp land is my term for anything of a general category of naturally unbuildable land. This could be a swamp, a desert, or anything that is so undesirable that no reasonable person would build on it.

Deeded private parks is similar to open space, but it is not connected with an association necessarily.

Roads as a category includes alleys and parts of roads that seem to make it occasionally into the tax rolls. I have heard of examples of counties ending up with a new road (i.e. one that was deeded as part of a development) and hadn’t changed its tax status to non-taxable. These show up and are sold as normal liens.

Property not worth the cost of filing. There are properties that, after you have paid all the taxes and are ready to file for deed, are not worth the amount you will have paid plus the costs to file. The cases I can think of are: (1) several years of back taxes, (2) small parcels, (3) property had a structure that changed, (4) EPA site, and (5) special assessments.

Several years of back taxes is usually noted very prominently at the tax lien sale. There will either be totals for prior years shown, or at least an indication on the bidders list that there are prior years included. Sometimes, with just a year or two of back taxes involved, it can still be a good investment. What you need to watch out for is so many years accumulated that after you have paid a few years of subtaxes and the fees for filing that you have run up the costs too high relative to the property value.

Small parcels refers to small dollar amount parcels in general. These parcels might be taxed anywhere from less than a dollar to a couple hundred dollars (levels depend on the county). The point is that by the time the tax lien has been listed for sale it has already accumulated some fees. The county usually tacks on an advertising fee. I’ve seen those as high as $40. The county will have already accumulated some interest fees against the owner, too. So, if the property was originally taxed at only $10 a year, the tax lien you are buying might be $60. If this particular county’s taxing rate is about 3% of the value, the parcel is worth about $333. A few years of subtax payments might get you to about $100. Then figure in some filing costs of at least $200 (more in some cases), and you will have spent at least $300 for a property assessed at $333. You might be able to get your money back, but you will not have ended up with the high interest rates you wanted to get in the first place.

Property had a structure that changed is not one that you can do a lot about. Sometimes a parcel that has a building on it has something happen to it. Examples include fire, moving the building (mobile homes and solid building can be moved!), demolition, and cave-ins. What can happen is at the time you purchased the lien there was a viable structure on the property. Then sometime before you file the building has something happen to it. You as tax lien holder will see is a drop in the taxes to pay, significantly.

I have heard about some very strange cases under this category. In one, a property owner had a commercial building on the site. The owner would not pay the taxes and before the deed filing time he had the building moved to another parcel! What is even worse in this story is that the owner did it a second time! In another case, the city condemned a building during the redemption period. The building was torn down. The tax lien holder was never notified (and I am not sure they needed to).

EPA site refers anything that might cause the EPA to need to clean up the site. This could be as ‘simple’ as an old gas station that likely had leaky tanks underground to some major industrial cleanup site. In most cases you will not know if such a site exists. I would stay away from property that is a gas station and probably adjacent to it.

Special assessments are those costs that are tagged onto the taxes. These could be things like road paving, sewers, and other public utility kinds of things. Each owner is usually assessed a portion of the total costs of the project. Many of these assessments are reasonable costs that improve the value of the property. Usually the tax lien listing at the sales event will also indicate that there are special assessments involved with the parcel. Sometime the costs are rolled into the cost of the taxes. Sometimes the special assessments are not due until you file. The latter of these is the more troublesome. You may not know how much the assessments are, yet you will need to pay them before you can take possession of the property. I had a property I needed to file on where the total taxes I had paid were less than $10,000, but the special assessments totaled over $25,000. I knew the land and building were worth more than $100,000, so it was worth filing for the deed. The owner paid up before I could get the deed.

Improvements only are usually noted on the tax lien sales listing. I’ve seen this include mobile homes, farm silos, and other general structures. What is happening here is that the individual structure is being taxed separately from the land. In most cases, I can’t recommend buying the tax liens on these items. Unless you are interested in the structure itself (for example you want a farm silo). I am not sure what you would do with the structure if you ended up getting it! And mobile homes can be very difficult. They can be easily moved in the night, before you can get to them, and you will never find them! So, unless you are a mobile home park manager, who can observe the movements of your tenants, and also have a way of selling the mobile homes you get the title to, I would steer away from improvement only items.

Incorrectly sold means that the county made an error and sold the tax lien to a property that had its taxes paid in full. When the county figures out they sold the taxes in error they need to pay you off. In all the states I have done business with they have a provision in their state code as to what to do. In the case of Colorado it was a lower interest rate (e.g. 9% rather than 14%). In the case of Iowa it was that the county had to pay the tax lien holder the full amount due at the time the error was discovered.

I had one of these in Iowa. Because I was able to quote the correct state statute the county gave me everything that I was due.

You may be saying at this point that there sure are a lot of risks to this type of investing. I am not sure they are any less than any other investment. Stocks can go to zero value. Banks can fold and you can lose your Certificate of Deposit funds, etc. etc. In the case of TLCs I tend to think statistically. There are very few properties that have these problems. With experience and knowledge (most of which will be gained from our home-study course) you can avoid most of the problem parcels. The few that are left you can write them off as losses and still make a good return on your total group of Tax Lien Certificates. I have bought over one thousand TLCs. When I find an undesirable one, I stop paying the subtaxes on it. Many times the owners still pay off. And the the few that don’t, the losses are small.