Low Income Housing Tax Credits 101

Post on: 22 Апрель, 2015 No Comment

About the Low-Income Housing Program

The Low-Income Housing Tax Credit (LIHTC) program has provided critical financing for more than 2 million rental homes. According to the Affordable Housing Tax Credit Coalition :

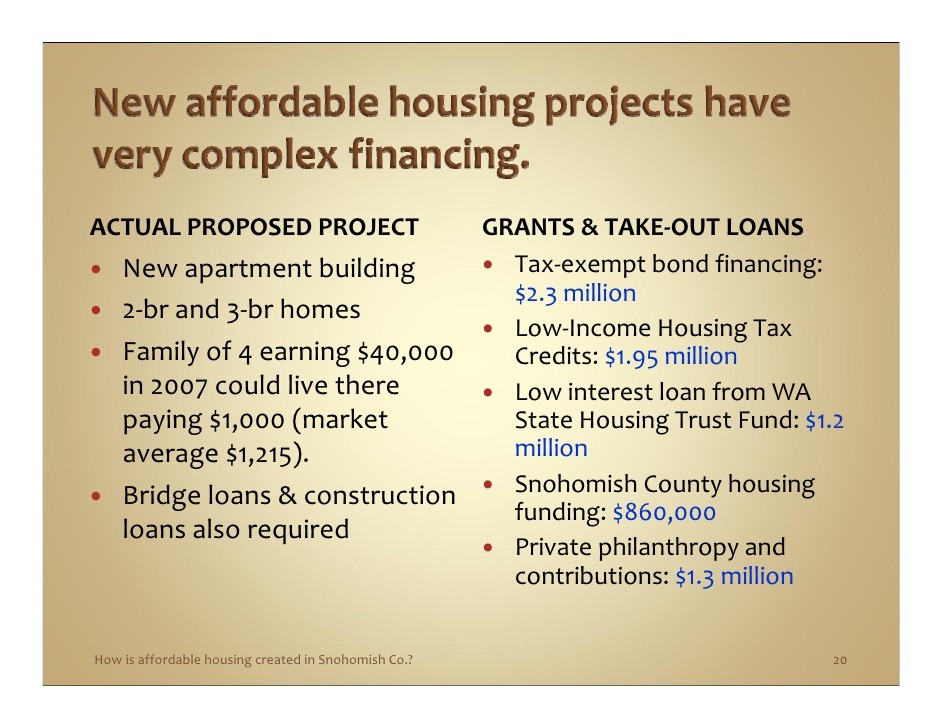

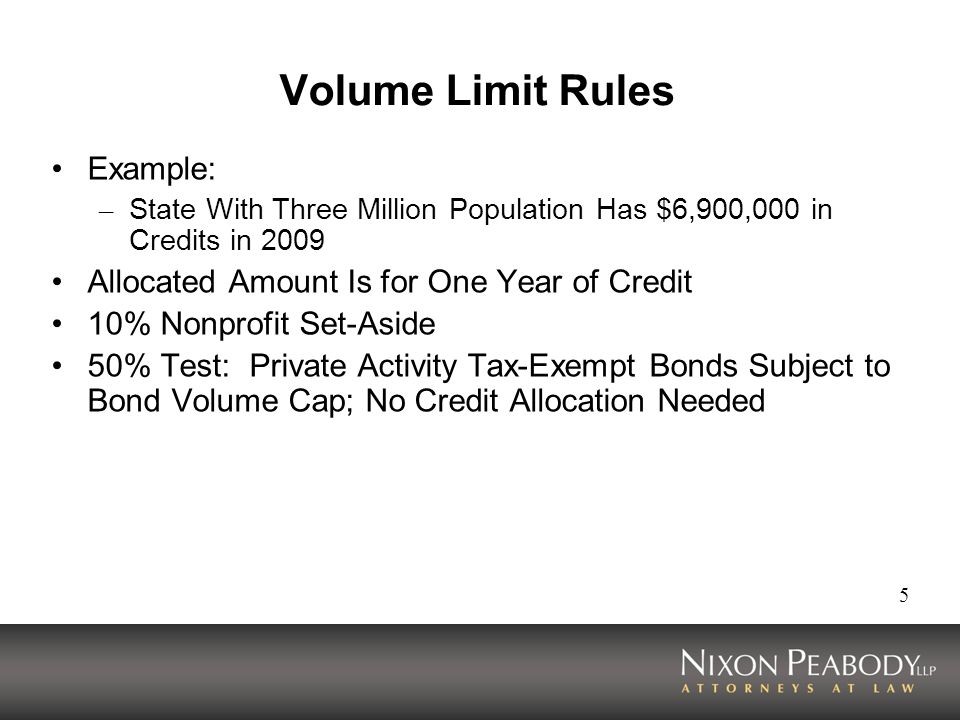

The LIHTC program effectively uses tax policy to help develop affordable rental housing for low and very low-income families. Originally part of the Tax Reform Act of 1986, the LIHTC program leverages private capital and investor equity to support the development of new and rehabilitated affordable rental housing. The credits are competitively priced. In general, state governments can adapt the LIHTC program to meet their housing needs under broad federal guidelines. In addition, the private sector carries all development and marketing risk and enforces strong oversight and accountability.

The program addresses the continued need for affordable housing with a low foreclosure risk. Working-class families, seniors, the homeless, and underserved urban and rural communities benefit from housing developed with the LIHTC program. LIHTC properties have an average vacancy rate of 4.2 percent, compared to 10.6 percent in the overall rental market. Foreclosures have occurred in less than 1 percent of all LIHTC properties since 1986, better than all other classes of real estate.

The LIHTC program uses a pay-for-performance policy with ongoing risk to the investors. Investors only get to claim and keep the tax credits if their units are built, leased and maintained as affordable housing throughout a 15-year compliance period. Many states enforce a 15 year extended-use period to require that properties stay affordable beyond the first 15 years. Developers provide guaranties throughout the 15-year compliance period, including operating deficit and tax credit guaranties. States use a competitive process to award developers with credits.

The program creates jobs for small businesses. When developing affordable rental with support from the LIHTC program, architects, plumbers, electricians, carpentersand other building specialists benefit. Property managers, maintenance workers, service providers and others benefit when the housing is occupied.

Advocacy & Urgency

The 2007-2009 recession and financial crisis sharply reduced investment in the program. To maintain the LIHTC investment market and project pipeline, congress needs to enact legislation to increase private investment interest and broaden the investor base.

To advocate for LIHTC legislative proposals, Enterprise helped to establish and lead the Affordable Rental Housing A.C.T.I.O.N. (A Call to Invest in Our Neighborhoods) Campaign. a national grassroots coalition.