Looking to Make a Profit on Lawsuits Firms Invest in Them

Post on: 18 Июнь, 2015 No Comment

By William Alden April 30, 2012 6:07 pm April 30, 2012 6:07 pm

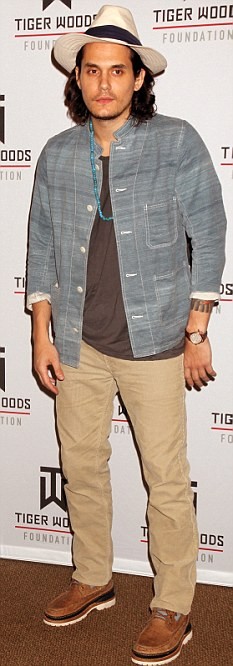

Fred R. Conrad/The New York Times Jonathan T. Molot, left, chief investment officer of Burford Capital, a litigation investment firm, and Christopher P. Bogart, the firms chief executive.

When it comes to legal spats, companies often loathe having to spend millions of dollars on legal fees while waiting months for a case to drag through courts. But to Wall Street, lengthy litigation is a growing investment opportunity.

Once considered taboo in the legal profession, the practice of litigation finance is enticing more corporate lawyers to become investors, bankrolling lawsuits in exchange for a piece of the potential winnings.

Two litigation investment firms run by former lawyers, BlackRobe Capital and Fulbrook Management, both started last year. In January, the litigation finance team at Credit Suisse left the bank to form Parabellum Capital, after a former colleague’s move to start a similar firm, Bentham Capital, a few months earlier.

Related Links

They are lured by the possibility of double-digit payoffs. The nearly three-year-old Burford Capital, the largest player in the industry, is set to make $32 million on nine cases that were resolved last year, a return of 91 percent, according to the firm.

“Increasingly, companies involved in business disputes are beginning to look to financing as a prudent way to manage the costs of those disputes,” said Jonathan T. Molot, Burford’s chief investment officer and a Georgetown law professor. “This is very much like a venture capital or private equity process, with the subject matter being different.”

The growing industry faces criticism. The United States Chamber of Commerce. for example, has said that these investment firms, bent on making a profit, can inappropriately influence cases.

But the practice is increasingly gaining backing from some of the country’s top law firms, which had previously viewed the business with caution. Partners at Simpson Thacher & Bartlett, Latham & Watkins, Fulbright & Jaworski and Patton Boggs have all fought cases backed by litigation finance firms.

“We have been deluged with investment opportunities from my former colleagues,” said John P. Coffey, a co-founder of BlackRobe and previously a partner at Bernstein Litowitz, where he pursued shareholder lawsuits against companies like WorldCom. “The typical call is from a top-25 law firm.”

Firms have to be selective about the cases they pick, combining a lawyer’s legal sense with an investor’s knowledge of risk. Deals are customized for each case, after a due diligence process that often includes analysis of a case’s facts, witnesses, opposing counsel and potential recoveries. Firms typically put several million dollars on the line.

In one recent case, Burford backed a real estate developer in Arizona that claimed that a rival had tried to block one of its residential projects. The developer, the Gray Development Group, had hired Barry R. Ostrager, a prominent partner at Simpson Thacher. When the real estate collapse left Gray facing a cash shortage, Mr. Ostrager introduced his client to Burford.

A $6 million infusion from Burford helped Gray pursue a case that resulted in a $110 million award from a jury, according to Bruce Gray, the company’s chairman. With the potential for appeal, the two parties later settled, and Burford stands to get an $18 million payday, Mr. Gray said.

For companies that invest in Burford — institutions like Fidelity and Invesco — such returns have been lucrative at a time when hedge funds and private equity firms have been posting disappointing results. Juridica Capital Management, which has about $200 million under management, reported that 2011 profit increased nearly sevenfold from the year earlier. Burford, with about $300 million under management, posted a tenfold rise in profit in 2011, its second full year of existence.

“These are alternative assets with very low correlation to the rest of the market,” said Richard W. Fields, a former corporate plaintiffs’ lawyer who is the chairman and chief executive of Juridica.

But some business leaders have questioned the value of the litigation financing industry, said Lisa A. Rickard, president of the Institute for Legal Reform at the United States Chamber of Commerce. A third-party investor, she said, can affect a company’s legal strategy, potentially to its detriment. The American Bar Association recently issued a report that outlined the risks of litigation financing but did not condemn the practice.

John H. Beisner, a partner at the law firm Skadden, Arps, Slate, Meagher & Flom, who has been retained by the United States Chamber of Commerce, testified last year before the House of Representatives that litigation financing could encourage frivolous lawsuits.

“The whole theory is to take the legal system and turn it into a stock market,” Mr. Beisner said in an interview.

Those in the industry counter that argument by saying that their incentives are aligned with the interests of the companies they finance, and they insist they only invest in cases that they believe have merit. Christopher P. Bogart, the chief executive of Burford, who was once a general counsel at Time Warner. said his firm was a passive investor, providing capital without seeking to influence the court proceedings.

“This really is just corporate finance,” he said. “It just happens that the underlying asset is a litigation claim instead of an airplane or a photocopier.”