Looking for income but don t want to be a landlord Try REITs 101

Post on: 9 Июнь, 2015 No Comment

Posted by Mark on January 21, 2014

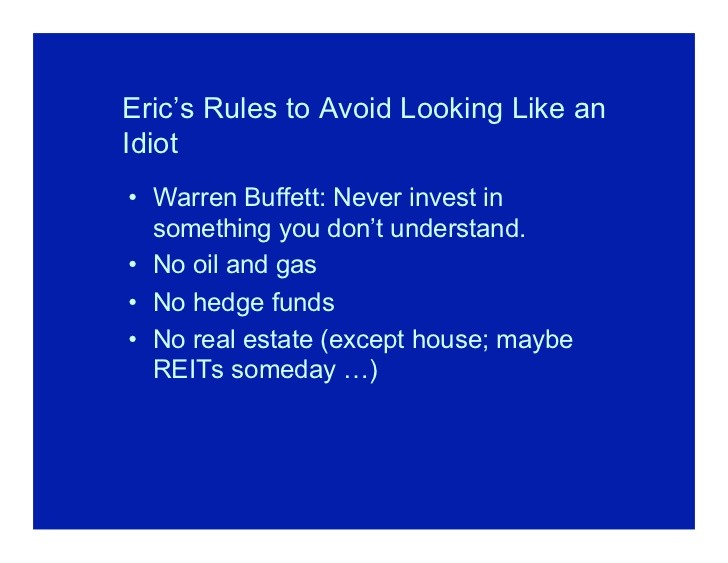

Up until a few years ago I didn’t know very much about Real Estate Investment Trusts (REITs) but after my experience of being a landlord for a couple of years, I wouldn’t invest in real estate any other way.

REITs 101

A Real Estate Investment Trust (REIT) is best understood as a professionally managed trust that buys and holds real estate properties. They offer investors (like me) a way to participate in real estate, including the potential rise in property values, without the headaches of being a landlord. REITs are an attractive asset class to me since these companies provide regular distributions, often monthly distributions. For investors that want to hold real estate as part of their portfolio but don’t want to deal with phone calls from cranky tenants, REITs can be an excellent alternative.

Types of REITs

Listed on the TSX and TSX Venture exchanges REITs trade like stock. For a list of just some of the REITs available to investors, here are the constituents of the S&P/TSX Capped REIT Index courtesy of TMX Money:

REITs come in different shapes and sizes. Some REITs focus on commercial real estate; examples include H&R REIT (HR.UN) and Canadian REIT (REF.UN). Others focus on retail properties; examples include RioCan (REI.UN) and Calloway (CWT.UN). Others still may hold office or residential or industrial properties or even a mixture of these. There are different flavours for every investor. I wrote about my favourite REITs some time ago here, a post I intend to update later this year.

REITs pros and cons

I’ve been a fan of Real Estate Investment Trusts (REITs) ever since my wife and I sold our condo a few years ago. We decided to get out of the rental business after we had a major incident with our condo unit in downtown Ottawa. A slow water leak went unreported by our property manager and our tenants for almost a year that ruined our cork flooring throughout the condo unit. After the new flooring was installed and all repairs to the unit below us were completed, we immediately decided to exit the rental business for the foreseeable future.

Along with avoiding a slow water leak in any other rental unit, I think there are other benefits to owning REITs:

- Returns have been solid – An investor holding ZRE (BMO Equal Weight REITs Index ETF) would have seen returns over 11% since the ETF inception date close to 4 years ago. As noted above, you can also buy the REITs individually on the stock exchange (using the stock symbols above).

- The company’s problem, not yours The company that bought the real estate property is responsible for managing it (not you) and taking care of expenses such as insurance, taxes, and the mortgage. The trust will then take a certain percentage of the rental charge from tenants and you’ll get some of that income as a distribution.

- Regular passive income, with some precautions REITs are not generally required to pay Canadian income tax if they distribute all of their net income for tax purposes on an annual basis, so that tax is passed on to you and me, the investor. For this reason, I suggest owning REITs in registered accounts such as RRSPs, RRIFs, RESPs, and TFSAs.

- With modest yield comes modest risk – REIT income is generally paid out monthly but that depends on the trust. For example, an investor owning 500 shares of one of Canada’s largest REITs, RioCan would see about $60 per month in income at RioCan’s current distribution rate. You can see how RioCan’s distribution history here . The yield for REI.UN is approaching 6%, which is solid, but you need to be mindful of how much a trust is paying out compared to the cash it’s producing (known as FFO ratios). You can read some more technical stuff on FFO payout ratios here thanks to this Globe and Mail article . Just like our personal finances, REITs that payout more than they make is not a sustainable model.

With our Bank of Canada in no rush to raise interest rates in the short-term, I believe REITs can offer steady income today and some portfolio growth over time. If anything, REIT prices now represent a decent buying opportunity. REITs can provide some spice to an investment portfolio. When considering REITs be mindful however how much real estate you already own (including equity in your own home) and as always, be sure this investment choice aligns nicely with your investment plan.

What’s your take on REITs? Own some? Want to own some? Do you prefer being a landlord instead?