Local traders slow to embrace ETFs

Post on: 2 Апрель, 2015 No Comment

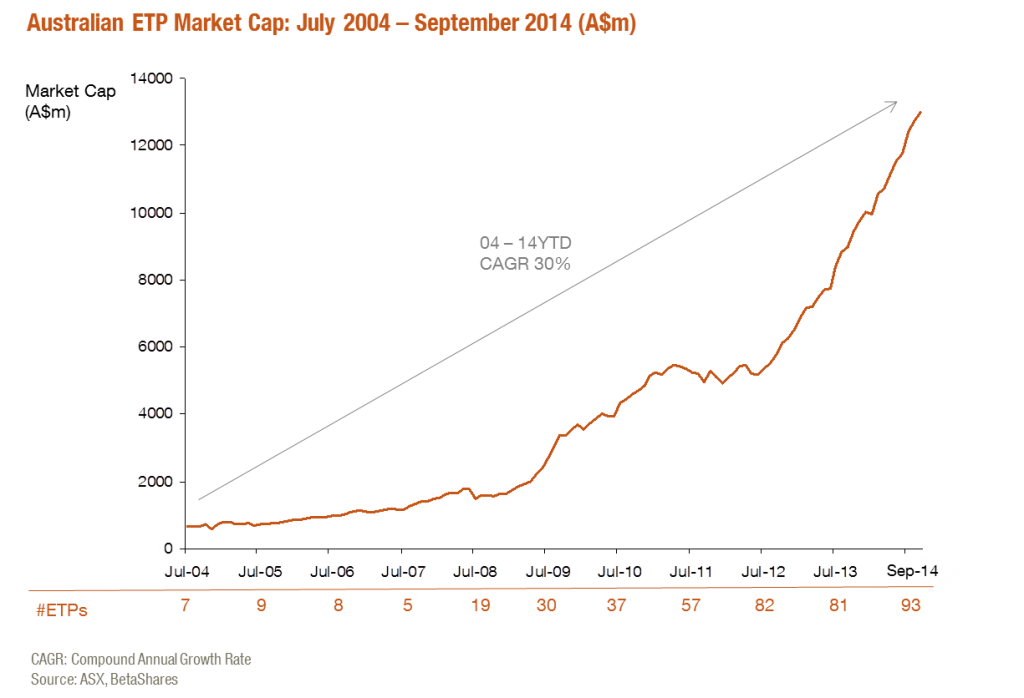

Despite the ever-widening range of offerings in areas such as fixed interest, currencies and commodities, Australias $5.4billion exchange-traded funds sector is taking its time gaining the sort of support these investments enjoy in other world markets.

The reasons behind this reluctance go beyond investors steering clear of risk assets and preferring the capital stability offered by cash and term deposits, say analysts and market watchers, although this is a valid consideration given todays volatile market environment.

Holding ETFs back in Australia are other factors such as more sophisticated investors, who might make greater use of them, regarding the local offerings as generally more expensive and unpredictable than they should be.

Another major factor is a lack of direct investment knowledge among the investors and financial advisers these products are aimed at.

ETF analyst Tim Murphy, co-head of fund research at Morningstar, reckons there is still only one Australia ETF, the $2.1billion SPDR S&P/ASX200 fund, that displays the sort of efficiency investors should expect from these financial products. This fund is promoted by State Street Global Advisors.

Not only does it trade close to net asset value on most days but the all-important average bid-ask spread is very competitive. At a skinny five basis points or 0.05 of one per cent it is as good as any ETF product you can find, says Murphy, although investors must still take care they follow smart trading rules that apply to ETF trading.

There are golden rules you should always remember when trading or investing in ETFs, he says. You should always place limit orders that specify the price you are prepared to pay or want from an ETF trade.

Another essential rule is to avoid trading or investing when markets can be at their most unpredictable, like shortly after the market opens, and avoiding the closing half-hour.

We say people should only trade ETFs between 10.30am and 3.30pm and always use limit orders, Murphy says.

However, the most important rule is to be on top of bid/ask spreads, which means they must constantly be monitored. With many ETFs, investors could find themselves paying up to 10 times the spread on the SPDR200 fund and even more.

Also worth monitoring is the discount or premium to net asset value that various ETFs trade at.

Tim Bradbury, the principal of ETF Consulting, reckons that while there seem to be many investors who say they wouldnt mind getting into ETFs, either for the first time or more seriously, tother traders are aware the local market suffers from poor spreads and low volumes. So many are waiting for this to change and preferring to stay on the sidelines until this happens.

A study by market researcher Investment Trends, sponsored by ETF promoter BetaShares, claims there were more than 60,000 investors in ETFs at the end of 2011 and this could grow to up to 70,000 by the end of 2012.

Bradbury says what the local ETF market needs is more trading volume which, in turn, should drive average bid and ask spreads closer.

Of the 70 ETFs in the market only three have monthly trading volumes in excess of 1million units. The SPDR S&P/ASX200 is the outstanding leader with more 3million.

The solid support this fund has enjoyed, says Bradbury, shows the potential of ETFs, although why it enjoys this support in not clear.

There could be any number of reasons why investors have bought equity ETFs, which dominate the local market. Nearly 60 per cent of the local ETF market is Australian equity CFDs. Whether it is because investors are blending ETFs with actively managed fund or single stock portfolios or treating them as stand-alone investments in not clear. Each could be valid because a key thing about ETFs, says Bradbury, is that they can serve many strategies.

There have also been ETFs that have attracted special attention, like the $600million Physical Gold ETF, which has revolutionised the way small investors own gold.

One interesting current aspect of this ETF is the way that support for this product has waxed and waned. This suggests investors are taking tactical views on gold that have spread to a smaller extent to other precious metal ETFs such as palladium and platinum.

ETFs being traded for tactical reasons are also suggested by volume shifts in different products, like a $25 million exodus of funds from two Russell equity funds, one of them the $120 million High Dividend Australian Shares fund.

While Australian equity ETFs dominate, about 20 per cent of the market is focused on global equities, products where not only annual management fees can be twice and three times those of local share ETFs but also bid-ask spreads of 50 to 100 basis points can be found.

With ETFs, says Morningstars Murphy, it is important to check what you pay in management fees because paying more in fees can be an expense that will detract from a total return.

An ETF, says Bradbury, is not unduly complicated in that what investors must appreciate is that they seek to deliver the performance of particular market indices.

This means choosing ETFs on performance is really a matter of choosing how different markets and market sectors might perform.

Its not the individual ETFs that deliver but rather the ETFs in a particular sector. For instance, in April, the top performing ETFs were two listed funds that invest in local real estate investment trusts, one promoted by State Street and the other by Vanguard.

The things that can make a difference between products are higher management fees and whether the market, in terms of average spreads, is more efficient.

Of course support for specific ETFs will be influenced by investor and adviser views on different assets. For instance, of the nine income ETFs launched in March, the fund that attracted the most support was the BetaShares Australian High Interest Cash ETF. While it attracted about $2million during April, support surged in May to more than $45million following the reduction in official rates at the start of the month.

This fund has the goal of beating the 30-day bank bill interest rate after fees and expenses, which should see it outperform standard cash investments. The management fees are 18 basis points and the average bid-ask spread is just four points. This fund pays monthly interest and delivered an annualised 4.3per cent during April.

By comparison, funds such as the Russell Australian Semi-Government Bond ETF attracted about $2 million during April and other income funds also had modest inflows. Bradbury reckons it will take time for investors and advisers to warm to fixed interest ETFs.

This is because both investors and advisers will need to understand how fixed interest investments actually work.

Unlike standard managed funds where the professional managers have all the expertise regarding investments and how they behave, with ETFs it is the investor or adviser who needs to understand these intricacies.

While ETF promoters may have hoped that the arrival of fixed income ETFs would be widely welcomed by investors for their diversification, Bradbury believes it will take a while for this to occur.

Although in aggregate the new fixed income ETFs have probably attracted about $90million since their launch, a sizeable proportion of this is probably due to market makers who often build up major interests in the funds they support.