Laddering a wise plan on bonds

Post on: 16 Апрель, 2015 No Comment

Your Money

September 11, 2005 | By Andrew Leckey

Setting a personal investment strategy in bonds and certificates of deposit is a demanding task in 2005.

The odds of Fed Chairman Alan Greenspan raising short-term rates another quarter-percent when policymakers meet Sept. 20, considered a sure thing before Hurricane Katrina devastated the Gulf Coast, are now more of a 50-50 proposition.

Katrina is a human crisis first and foremost, but the economic fallout is powerful. Americans are learning the interconnected nature of our economy. Many did not know that the New Orleans area played an economic role other than tourism, certainly not that it was a critical juncture in our oil supply.

Greenspan must weigh opposing considerations:

On the one hand, consumer spending will be pinched in the third quarter because of higher gasoline prices and general economic disruption. So he shouldn’t raise interest rates, or at least not until later this year.

On the other hand, the economy should get a boost from higher construction spending as the historic rebuilding process begins. So he should go ahead and raise rates now, as he said he would. Stay the course, because financial markets expect it.

Greenspan must decide one way or another this month, even though full data on Katrina’s effects won’t be in until next month. He is known for sticking to a plan, but is being heavily pressured to leave rates alone.

Whatever he decides, don’t expect interest rates to veer out of control this year. It should be steady going.

Because the economy is resilient, the Federal Reserve will likely continue to increase rates, said Mario DeRose, chief fixed-income strategist for Edward Jones in St. Louis. Longer term, the hurricane’s effects could be somewhat of a drag on economic growth and keep bond prices up and interest rates lower than they otherwise would be.

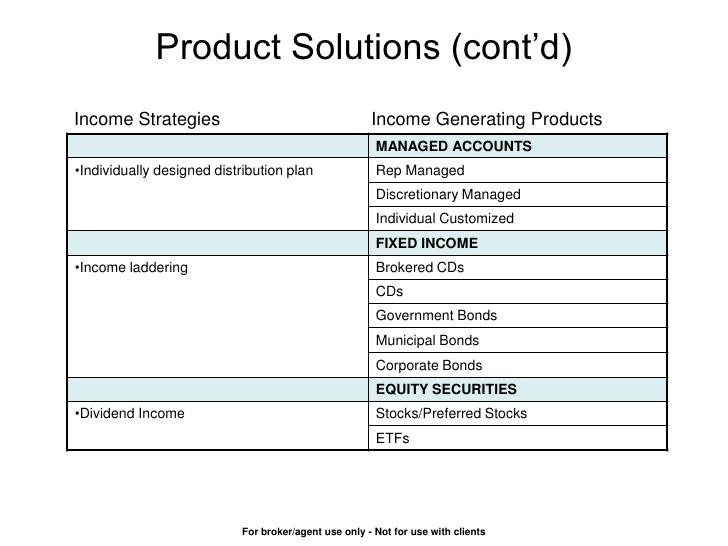

The logical fixed-income strategy for average investors, DeRose is convinced, is to cover all their bases.

He suggests laddering a number of bonds, bond funds or CDs of different maturities and yields to avoid being tied to any one interest-rate scenario. This philosophy also is practiced by large institutional investors who don’t want to go out on a limb.

With bonds, you worry about rising rates, but people have been predicting rising rates for years, and they’re still not that high, said Greg Habeeb, lead portfolio manager for Calvert Short Duration Income Fund in Bethesda, with a 3.93 percent return during the past 12 months. However, stay away from long-maturity bonds, because it is just a matter of time before they are hit pretty substantially as long-term rates go up.

Habeeb urged investors to avoid high-yield bonds that aren’t compensating you enough for risk. Diversify fixed-rate holdings and know each one well.

Scudder Limited-Duration Plus A (PPIAX); $791 million; 2.75 percent load (sales charge); $500 minimum initial investment; no three-year return yet; 5.31 percent over 12 months.

Security Capital Preservation A (SIPAX); $271 million; 3.5 percent load; $100 minimum; 4.2 percent annualized three-year return; 5.22 percent.

Metropolitan West Strategic Income M (MWSTX); $213 million in assets; no load; $5,000 minimum; no three-year return yet; 4.67 percent.

Calvert Short Duration Income A (CSDAX); $236 million; 2.75 percent load; $2,000 minimum; 5.90 percent annualized three-year return; 3.93 percent.

Phoenix Multi-Sector Short-Term Bond C (PSTCX); $1.26 billion; no load; $500 minimum; 6.18 percent annualized three-year return; 3.68 percent.

As oil prices go higher and Greenspan raises rates, the economy will slow down, and he won’t have to raise them anymore, said Clark Stamper, manager for Evergreen Strategic Municipal Bond Fund, Santa Cruz, Calif. with a 3.45 percent return the past 12 months. I expect short-term rates to increase probably another 75 basis points from here, or at least 50 basis points.

Stamper doesn’t consider the economy strong, seeing bubbles in real estate and elsewhere. He thinks high-yield junk bonds will be in real trouble.

Longer-term rates will eventually catch up to what we’ve seen in shorter maturities, said Anne Briglia, senior fixed-income strategist for UBS Financial Services in New York. Bond prices fall as rates rise, but the average investor tends to buy and hold.

In the top tax brackets, tax-exempt municipal bonds almost always make more sense than taxable choices, Briglia said. Because half of them are insured, it’s a quality market.

Top short-term municipal bond funds in total return the past 12 months included:

Evergreen Strategic Municipal Bond A (VMPAX); $769 million; 4.75 percent load; $1,000 minimum initial investment; 3.06 percent annualized three-year return; 3.45 percent.

Wells Fargo Advantage Short-Term Municipal Bond (STSMX); $671 million; no load; $2,500 minimum; 3.38 percent annualized three-year return; 3.09 percent.

BlackRock Ultra Short Municipal (BRMSX); $44 million; no load; $5,000 minimum; no three-year return yet; 2.74 percent.

Andrew Leckey is a Tribune Media Services columnist.