Know Your Indicators DMI

Post on: 16 Март, 2015 No Comment

Know Your Indicators DMI/ADX

Wednesday, November 14th, 2007 @ 11:56 pm by Sunil Mangwani

Most strategies or techniques in technical analysis involve the use of indicators .

But more often than not, most traders use indicators for all kinds of situations which tend to render them quite ineffective .

Just as a carpenter’s toolbox has different instruments which are used for different purposes, each indicator in the tool box of a trader has to be used for a particular situation.

In our Live Trading Room we teach, among many other things, a series of lessons we call “Know your Indicators”. which introduce specific indicators, and go over the characteristics and drawbacks of the same.

First and foremost, there is one point that a trader needs to keep in mind all indicators are lagging. and it is ultimately price which is the only leading indicator.

Indicators should be used just as they are described – as “indications” for price movements and not as confirmations. While this does not diminish the importance of the indicators, one must remember that a change in price will cause a change in the indicator not the other way round.

Indicators, nevertheless, play an important part in the building of strategies and techniques but only if one applies them correctly .

The DMI/ADX is one of the most effective and yet underused indicators. If used with the correct parameters, it can be a very effective trading system on its own.

It consists of two components:

- The Directional Movement Indicator (DMI) is a trend-following system developed by Welles Wilder.

- The Average Directional Movement Index (ADX), is part of the DMI and determines the market trend.

When used with the up and down Directional Indicator (DI) values: Plus DI and Minus DI the Directional Movement Indicator is considered a trading system.

The rules for using the Directional Movement Indicator are:

- You establish a long position whenever the Plus DI crosses above the Minus DI.

- You establish a short position, when the Minus DI crosses above the Plus DI.

A simple DI+/DI- crossover is an entry and exit system. However, used that way it produces frequent whipsaws.

Hence we combine this with the ADX to reduce these whipsaws.

The ADX is the integral part of this system, as it gives a warning for a market about to change direction. It gives precise interpretations of the price action as follows:

- It tells you if there is a trend present or not.

- It also informs you if it is early or late in a trend.

- It informs of a de-trending, of a reversal and renewal.

- If the ADX line is trading above 20, then the market is in a trend.

- If the ADX line is below 20, it means the trend is not a strong one.

- As long as the ADX line is above 20, you should still consider a trend to be in effect.

The ADX however does not indicate the direction of the trend. only the strength of the trend.

Once we have these basics clear, let us add some filters to these indicators, which will enhance the characteristics.

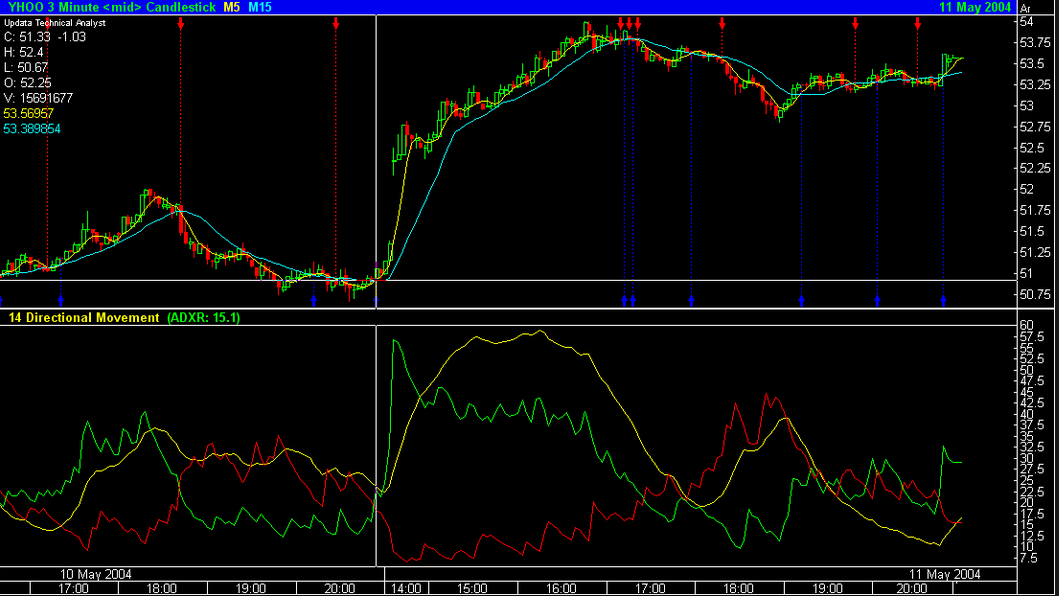

Now in our chart here, we have the red line as the minus DI, the blue line as the plus DI, and the green line is the ADX. I have drawn a line at the 20 level for the ADX, since the rise of the ADX above 20 signifies an emerging of a trend.

Overall, if we observe only the two DMI lines (the blue and the red) it does give a correct picture of the trend, and keeps us in the correct side of the market.

Simply put, at the area marked with the red line, the –DMI line, is above the +DMI line, signifying a downtrend .

And at the area marked with the blue line, the +DMI line is above the –DMI line, signifying an uptrend .

But what about the areas, where the DMI lines have frequent crossings?

This is the kind of situation which will whipsaw out any position and this where the ADX is used in tandem. For these kinds of situations we define certain parameters, which will help us make a correct decision.

For the effective use of this indicator, the rules for a trade should be:

- The ADX must have 3 consecutive higher readings above 20 to confirm that we are entering into a trend.

- The ADX should be pointed up at all times when entry is being considered

- If at this time, the plus DMI (the blue line) is above the minus DMI (the red line), which indicates an uptrend, then the ADX should have also crossed the minus DMI (the red line). This is a very important confirming factor .

On this ADX/DI crossover, the trend is very frequently confirmed and is a good place to add a position. Or if you failed to take the original DMI crossover entry signal, then this is a good position to enter.

- We place our stops at the low of the bar, where the DMI lines have the crossover.

- We look to exit the trade only when the ADX line starts to fall down.

This use of the ADX for the exits is called the turning-point concept.

- First, the ADX must be above both DI lines.

- When the ADX turns lower, the market often reverses the current trend.

- The turning points in markets are often heralded by turns in the DI+/DI- at upper and lower extremes shortly followed by a down turn in the ADX which is above both DI lines.

This sign is near coincident with major turning points. So the reversal of the ADX at these high levels is a good place to take profits and STAND ASIDE .

These rules will help keep us out of a whipsaw trade, give us a safe stop point, and a proper exit to protect our profits.

If we apply our rules to our example here:

We will consider an entry only at this point marked ‘A’. when the ADX has had 3 higher readings.

At this point the ADX has already crossed the minus DMI line, so we have an added confirmation to the trade.

We have our stop level clearly defined, and we place it beneath the low of the bar where the DMI lines have crossed.

We consider exiting the trade, only when the plus DMI has reached an extreme level, and the ADX is turning down at this point.

This keeps us in the trade till the end of the trend.

If you notice at the area marked with red dot, the price had a retracement to the downside. But since the ADX was still rising, the -DMI had not crossed above the +DMI line, and the +DMI had not yet reached the overbought level, we could decide to stay with the trend.

And as we can see, price found support at the 21 EMA and resumed its uptrend.

I hope you found this discussion of the DMI/ADX helpful. If you have any questions, please do not hesitate to get in touch with us!