Japan s lost decade has lessons for U S

Post on: 28 Июль, 2015 No Comment

It’s been 20 years since Japan entered its so-called Lost Decade, a long period of sluggish growth that began with the collapse of a real estate bubble, a stock market crash and a near-meltdown of the financial system.

Sound familiar?

As the Lost Decade comes to the end of its second decade, some economists in the U.S. worry that we could be headed down the same path. And UC San Diego economist Takeo Hoshi warns that there are several troubling similarities between the two countries’ approaches to their financial crises.

“Compared to Japan, I feel optimistic about the U.S. economy,” said Hoshi, who was trained at the University of Tokyo before immigrating to the United States in the 1980s. “But there are still a number of things to be worried about, especially how bad commercial real estate loans might affect the financial sector or how long it will take for housing prices to turned around. In San Diego, the economy seems to be doing better than a lot of other places, but even so, it may take some more time before we’re completely out of this.”

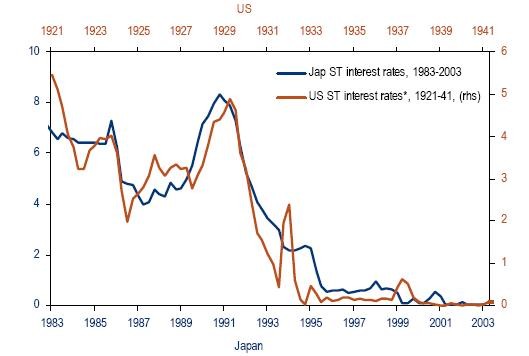

At the quarterly Economic Roundtable at UCSD’s Faculty Club on Tuesday, Hoshi said the U.S. seems to have learned some lessons from the Japanese experience regarding how to regulate financial institutions, adding that a recently passed package of laws on how to dispose of failing financial institutions appears to be an important step for facing up to future financial problems. But he warned that the Federal Reserve and Congress should not cut back on stimulus measures too abruptly.

After the meeting, he answered more questions.

Question. What are the similarities between the U.S. experience and Japan?

Answer. In both cases, a crisis that started from the collapse of an asset price bubble ended up jeopardizing the health of the financial system as a whole. In both countries, the initial government response was to buy nonperforming loans and other troubled assets. And then, when that didn’t work, both countries injected capital into financial institutions without really examining their financial viability. In Japan, that allowed the banks to continue to hold a lot of nonperforming loans on their books. Here there was a “stress test” before the second round of injections, but even with that stress test many financial institutions still hold a number of problem assets, such as commercial real estate loans. There’s still the possibility that some of those assets will come to haunt us. How bad they’ll hurt us is a function of how robustly the economy recovers.

Question. What are some of the key differences between the U.S. and Japan?

Answer. One difference is that the Japanese crisis was a classic banking crisis, while in the United States there were a number of non-banks, such as investment firms, that were at the center of the crisis, with trillions of dollars in securities that turned this into a worldwide crisis. There was a chance that the Japanese banking crisis could have turned into a worldwide crisis as well, but the Japanese government temporarily nationalized the banks to prevent it from spreading. Temporarily nationalizing larger institutions like AIG, Lehman Brothers or Citibank might have been a better option than letting them go through bankruptcy court, which happened with Lehman, leading to the financial collapse, or continuing to help them with taxpayers’ money, such as what happened with AIG.