Japan s lost decade

Post on: 28 Июль, 2015 No Comment

As the world frets over the three-day delay before US Congress meets again to debate a bail-out plan for Wall Street, it is worth remembering that it took Japan’s government several years to rescue its stricken financial institutions.

Though there are significant differences between the two, Japan’s real estate and stock market meltdown of the 1990s offers lessons in how — and how not – to manage the kind of crisis now enveloping US banks.

After a week in which flush Japanese banks snapped up foundering Wall Street assets, it is easy to forget just how hard they fell after the real estate bubble burst almost two decades ago.

When the asset-inflated bubble burst, over-generous Japanese lenders were left with masses of bad loans.

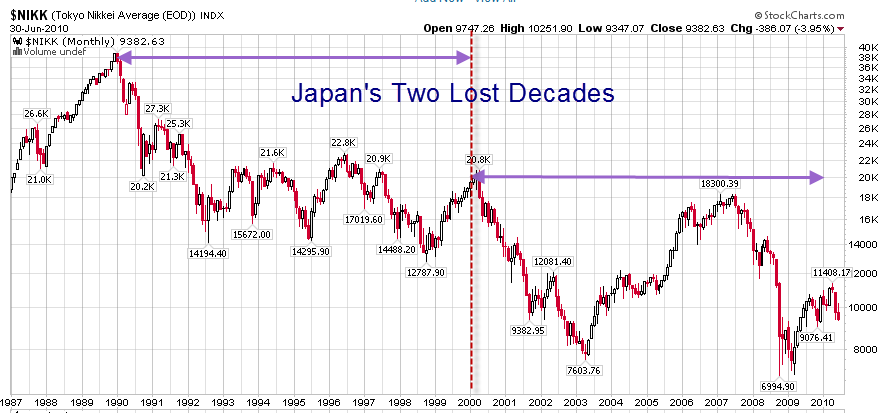

From its 1989 peak of 38,916, the Nikkei stock average fell 63% during the 1990s; land prices slumped — a far cry from the days when the grounds of the imperial palace in Tokyo were rumoured to be worth more than all the real estate in California.

Helped by toothless regulators who turned a blind eye to their losses, the initial reaction was to simply do nothing while banks creaked under the weight of unrecoverable loans.

The US Federal Reserve has won praise for responding to the sub-prime crisis with quick cuts in interest rates; the Bank of Japan. by contrast, waited 17 months before cutting rates, and did not bring them to below 0.5% until the mid-1990s.

By the time the government injected trillions of yen in public funds at the tail end of the 1990s, the world’s second-biggest economy was already mired in a prolonged slump known as the lost decade.

Consumers lost faith in the economy and during the deflationary decade, held on to their savings. Even now, consumer confidence in Japan is extremely weak and has never recovered fully.

Japanese banks started writing off their bad debts in the mid-1990s, but the government’s bail-out did not take hold until 1999, when the Resolution and Collection Corporation was formed to handle the disposal of bad loans.

But Tokyo’s bail-out package came at a price. Free to lend again, banks simply used funds to keep countless zombie companies afloat, so great was the desire to avoid bankruptcy and mass unemployment.

The government recouped much of its outlay by reselling collateral, most of it real estate, but the process took more than 10 years, and full recovery, some point out, remains elusive. The Nikkei stock index is still 70% off its 1989 peak, and property prices are at about 40% of their 1990 values.

The early public reaction to Japan’s bail-out package mirrored the anger that rose from the floor of the US House of Representatives yesterday, as opponents of the bail-out package questioned the fiscal wisdom — and morality — of using taxpayers’ money to dig irresponsible lenders out of their hole.

In Japan, opposition to a government bail-out softened when it became clear that inaction might prove a more bitter pill to swallow with the collapse in 1997 of Yamaichi Securities, one of the county’s big four brokerages.

By around 2005, Japan’s banks had been forced to get their house in order by the then prime minister Junichiro Koizumi and his combative economics minister Heizo Takenaka, and were breathing easier as bad debts dropped to about half their 1999 levels.

Taro Aso, Japan’s new leader, this week cautioned the US against the procrastination that had prolonged his country’s banking crisis. It is doubtful that we responded properly, he said. The government action was slower and so the costs grew greater.

Whatever congressional legislators decide on Thursday, they can’t say they haven’t been warned.