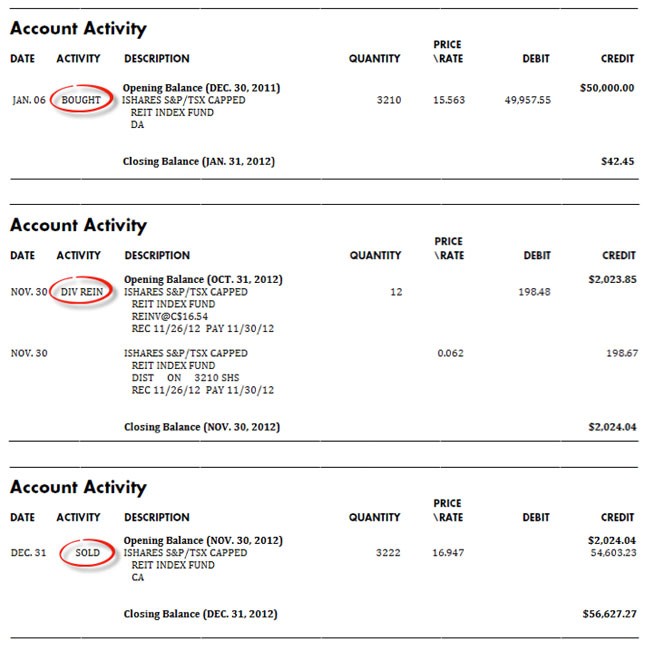

IShares CDN REIT Sector Index Fund (XRE)

Post on: 16 Март, 2015 No Comment

A Real Estate Investment Trust or REIT is an asset class that allows you to get exposure to real estate in your portfolio. Real estate is an interesting asset class because historically it has offered a higher return than bonds (but less than equities) albeit at a higher risk (again less risk than equities). Also, real estate has low correlation with other asset classes and adding it to your portfolio will reduce overall volatility. An allocation of 5%-10% to REITs seems reasonable but some recommend going as high as 20% .

The iShares CDN REIT Index Fund (TSX: XRE) is composed of REITs that are listed on the TSX. The MER on the fund at 0.55% is on the high side and might be acceptable for smaller investments. However, if you have a large portfolio you may want to invest in the underlying REITs directly because the two largest REITs RioCan (REI.UN) and H&R (HR.UN) make up 36% of the fund.

This article has 19 comments

CC mentioned that hes not in REITs.

I hold some REITs in my accounts but I bought them a while ago and am sitting on a sizeable gain and I really have no incentive to sell them. I used to hold more REITs, but I was taken out of my position in Alexis Nihon REIT by acquisition and then I sold off my Lakeview Hotels REIT because the fundamentals have changed Thanks to the morons in our government, they may completely lose their REIT status in 4 yrs, but otherwise I love the management team and their assets. Although I miss having the extra monthly income from those two REITs that I lost, I did make a sizeable gain from those transactions.

I make mention of all this because my individual REIT selections have outperformed the XRE index. Especially in the metric that matters most when considering REITs, the monthly distributions!

In general, real estate and financial services are my two favourite sectors for investment, although I do have some investments outside of those two sectors. So, investment professionals who advocate diversification would probably abhor my portfolio. But as I alluded to in yesterdays post, my strategy works for me, Im comfortable with my picks (I can sleep at night) and so I dont listen to all the noise.

Im not currently adding to my position in REITs, but I have been watching Scotts REIT (SRQ.UN-T) very closely these days, waiting to see if it dips any further in our rising interest rate environment.

Canadian Capitalist