ISA INVESTING TIPS Emerging market funds and investment trusts

Post on: 16 Март, 2015 No Comment

View

comments

If you want emerging market funds to add some worldwide flair to your investments, read This is Money’s experts’ recommendations.

From the bafflingly wide range, they have picked some ideas to use as starting points for what will hopefully be successful investing.

Of course, which fund is best for you depends on your individual circumstances and what investing story you think will unfold. So, always do your own research, choose your investments carefully and hopefully you will make your own good investing luck.

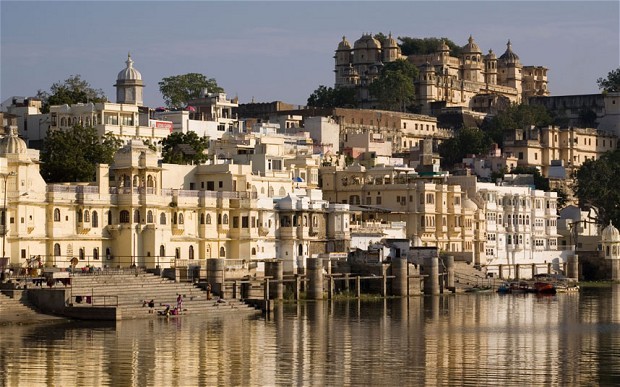

On the up: Emerging markets such as Brazil are where much of the world’s growth is expected to be over future years.

How to use our fund and investment trust ideas

This is Money asks our panel of experts to suggest investments for a variety of investors.

These are people with a long history in the investment field and looking at their choices gives you some pointers. But remember, these are just ideas and whether a particular fund is right for you is your own decision and making that requires deeper research.

Read the tips, follow the links to the funds’ performance and read This is Money’s Investing section to gather ideas. If you have any doubts, talk to an IFA [find an adviser ].

Why emerging markets?

Emerging markets is a broad term. It can cover everything from big hitting China and Brazil, to up-and-coming Indonesia and onto the new investing frontiers of Africa.

The lure for investors is greater growth and younger economies than typically found in the developed West and emerging markets have delivered strongly on this over the past decade.

The trade-off for this growth is higher volatility and more risk. Emerging markets investments tend to get punished in the short-term when turbulent times hit, in the long-run though they are tipped to outperform.

Many investors consider emerging markets funds an essential part of their portfolio, but experts say they would be very wise not to stick their house on them.

The case for emerging markets is that these strong growth economies are one of the best long-term bets around, especially for those making regular investments using their annual tax-free Isa allowance.

But remember emerging markets success is not guaranteed and never put all your eggs in one basket. It is also worth remembering that risk varies throughout this broad category, an overall emerging markets fund will be spread across a variety of countries and continents, others are region, country or sector specific.