Is Two Harbors Safer Than Annaly and American Capital Agency (AGNC NLY TWO)

Post on: 30 Май, 2015 No Comment

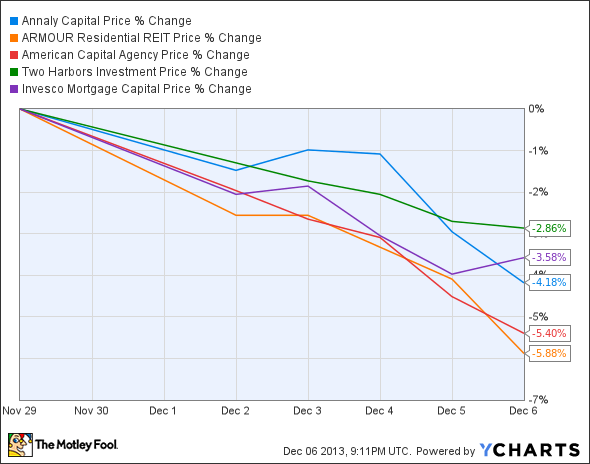

Two Harbors ( NYSE: TWO ) will release its quarterly report on Tuesday, and investors have had to deal with a big increase in volatility in recent months. Yet even though it shares many of the same characteristics that have punished larger mortgage real estate investment trusts Annaly Capital ( NYSE: NLY ) and American Capital Agency ( NASDAQ: AGNC ). Two Harbors could benefit from the measures it has taken to try to control the risk of higher interest rates and their effect on the REIT’s book value.

Source: Yahoo! Finance.

Can Two Harbors outearn its dividend?

Analysts have become more pessimistic in recent months about the prospects for Two Harbors’ earnings, cutting their third-quarter estimates by $0.04 per share and their full-year 2013 projections by about 10%. The stock has fallen in concert, dropping roughly 4% since early August.

Two Harbors demonstrated its ability to weather the interest rate storm when it announced second-quarter earnings results in August. Despite a big rise in rates that crushed book values across the industry, Two Harbors emerged with just a 6.4% drop in book value, compared to losses of 12% at American Capital Agency and as much as 20% for some of its smaller rivals.

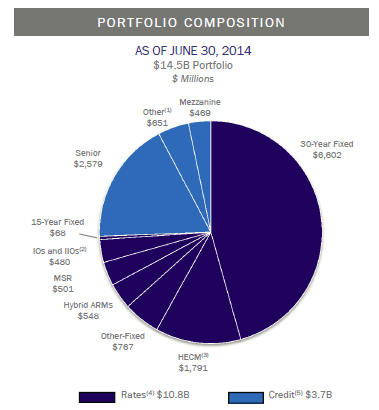

Two Harbors has taken several steps to hedge against the pure exposure to interest rates that American Capital Agency and Annaly Capital have taken on. Specifically, Two Harbors buys the rights to a portion of the mortgage servicing rights that other companies receive for collecting mortgage payments and distributing proceeds to companies like Fannie Mae. Those rights are generally worth more when interest rates are rising, as borrowers are less likely to refinance their mortgages. By contrast, the more sophisticated derivatives trades that American Capital Agency and others use can be extremely expensive compared to the Two Harbors strategy. In addition, Two Harbors has built up its securitization business, hoping to take over as the private equivalent of Fannie Mae and Freddie Mac if the federal government goes forward with its plans to wrap up the government-sponsored enterprises.

Two Harbors has taken these steps because the company is determined to preserve book value in order to keep its capital base from deteriorating. That way, management believes it should be able to keep paying high dividends while also reducing the overall risk level that some other mortgage REITs take on. Two Harbors has also been willing to go beyond the popular agency mortgage-backed securities realm to find more attractive opportunities from a risk-reward standpoint.

In the Two Harbors earnings report, watch to see whether the company has been more successful at sustaining book value than Annaly and American Capital Agency. In the end, book value could provide a better sense of intrinsic value for the mREIT than earnings or dividends.

Is Two Harbors your best dividend play?

Dividend stocks can make you rich. It’s as simple as that. But you can’t afford bad choices to pull down your portfolio’s return. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks. drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now .

Click here to add Two Harbors to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.