Is The Swiss Franc Overvalued Purchasing Power Parity CurrencyShares Swiss Franc Trust ETF

Post on: 20 Июнь, 2015 No Comment

Abstract

After the strong revaluation of the Swiss franc in recent years, many economists like the ones at the Swiss National Bank (SNB) or Goldman’s O’Neill claimed that the franc is overvalued. Some use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD PPP index or the PPP based on consumer prices for computing fair values.

We explain why the PPP based on producer price indices (PPP-PPI) or based on export prices are the most relevant ones. It is shown that the commodity currencies AUD, NZD and NOK are overvalued but the Swiss franc is not. The Bloomberg PPP-PPI indicates that the franc is undervalued against the euro, while the PPP-PPI from the Swiss KOF institute proves that it is slightly overvalued.

This suggests that the so-called minimum exchange rate of the EUR/CHF 1.20 is actually a fair value and not a minimum.

This year’s developments

At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not be raised (here also cited by Bloomberg ):

We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.

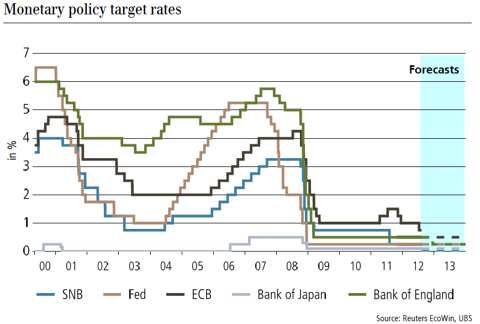

This stance was surprisingly different to the strong commitment about the floor he uttered previously: for months the SNB continued to vow that it might take further measures to weaken the franc, even if wording changed from the massively overvalued franc in August 2011 over significantly overvalued franc in January 2012 to very very strong franc in April.

Based on the IMF Code of Good Practices on Transparency in Monetary and Financial Policies. Jordan gave such a clear and transparent message, which we translated into: The SNB will not raise the floor. Long-term investors can be sure not to lose money.

Now it is nearly November and Swiss inflation has only picked up a little. Jordan has in the meantime weakened his language again: The franc is now only very strong.

The franc continues to be a very strong currency and in that sense an overvalued currency. It’s right for the central bank to continue this monetary policy for the foreseeable future. (source )

We want to examine in this research if the Swiss franc is really overvalued. We recapitulate a big part of the foreign exchange theory concerning purchasing power parities.

Law of one price

This law requests that in an efficient market. all identical goods must have only one price.

The Penn Effect

Tradable goods cannot have large price variations between locations as buyers can obtain them form the location with the lowest price. But the majority of services must be delivered at the local level. Also many goods that have been manufactured have high costs associated with transport. The Penn Effect most often happens in the same direction: high incomes mean the average price will generally be high.

This implies that in order to compare the fair value of currencies only tradable goods should be considered.

The Balassa-Samuelson Effect

This economic model assumes that productivity or productivity growth-rates will differ more in a country’s traded good’s sectors that other sectors (Balassa-Samuelson hypothesis ).

This implies that:

- Workers in some countries generate greater productivity than those in other countries and this acts as the source of income differences.

- For some labor-intensive jobs productivity innovations will have smaller effects. No matter their education or location a burger flipper will manage the same number of burgers/hour.

- Fixed-productivity sectors produce goods that cannot be transported (e.g. haircuts, the hairdresser has to be able to physically touch the hair to cut it).

- For local wages to be equalized the same job might be worth more in one location than another

- The CPI contains local goods (will be more expensive in rich countries) and tradables (same price in all countries).

- PPP (purchasing power parity) is used to peg the exchange rate for tradable goods (this is testable). See the law of one price above.

- Money exchange rates vary related to productivity of tradable goods (more than average productivity); and, for real goods the differential is less than for money.

- Productivity becomes income, meaning real income is not affected by changes in money as much.

- This is like stating that real income can be exaggerated by money exchange rates. Alternatively, items will cost more in richer countries.

For other theories why productivity plays a strong role in valuing currencies see our page on theories of the comparative advantage in international trade and the Neo Factor Proportion Theory .

Absolute purchasing power parity measures

Absolute measurements compare a product like the Big Mac or the OECD index and its value among different countries.

Big Mac and Starbucks Tall Latte

Certain countries like Switzerland use import quotas and taxes for meat or milk in order to protect local farmers. These measurements do not make sense as food prices do not say nearly anything about the competitiveness of an economy.

Absolute PPP for the OECD

The OECD statistics are based on a goods and services consumer price basket. For all countries the different category weights are identical. Therefore these weights differ from the ones in the real consumer price index basket of the concerned countries.

(click to enlarge)

Differences in CPI baskets

The following table shows the relative weights of the components inside some selected consumer prices indices (CPI):

Chinese CPI basket before and after March 2011 adjustment

The real Chinese CPI basket effectively contains 31.8% for food, but the Swiss basket only 10.3% in this category. Typically poorer countries have a basket with a higher weight for food and other consumption goods (like e.g. costs of transports), they obtain the so-called food inflation. But richer nations give them a smaller weight. Japan has a higher food share because restaurants and alcoholic beverages are included in the food main category.

Absolute measures for Purchasing Power Parity have different major defects:

- They include both tradable and non-tradeable goods. Non-tradeable goods must be more expensive in richer countries. Therefore, the difference between poorer and richer countries is accentuated.

- They use a single product as comparison basis for all countries. A non-tradable good, especially locally produced food is not useful, given that quotas or taxes might exist.

- Or they use a standardized consumption basket with the same weights per component applied to all countries, even if the consumption basket in a richer country is different from the ones in a poorer one.

Relative purchasing power parity measures

Relative measures compare prices changes for different countries between today and a base year (for example last year).

According to WikiWealth the PPP is the same as the Inflation Rate Parity :

Inflation Rate Parity (relative purchase price parity): Inflation decreases the value of money over time; whereas, investors seek to increase the value of their money over time. The currencies of low relative inflation countries will increase in value as demand for their currency increases.

WikiWealth uses inflation rate parity to have another indication of currency value. It helps to show the loss of value to currencies with high inflation rates. If one country had a significantly higher inflation rate than the target country, money would flow from the high inflation rate country to the low inflation rate country. WikiWealth uses the global weighted average to calculate expect returns, because investors are likely to search for a wide sample of countries for investment returns. Since inflation rates change quickly, and sometimes in unexpected ways, WikiWealth makes an adjustment to the inflation rate. The adjustment changes inflation rates over a span of five years from the current inflation rate to the long-term inflation rate.

Countries with higher interest rates typically need them to control inflation, which destroys value and potential over time. The net potential of the inflation rate parity approach is much less, because low inflation (good for investors) usually matches countries with low interest rates (bad for investors).

According to Investopedia the PPP is:

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency’s purchasing power.

The relative version of PPP is calculated as:

Where:

S represents exchange rate of currency 1 to currency 2,

P1 represents the cost of good x in currency 1 and

P2 represents the cost of good x in currency 2

The difference between PPP and Inflation Rate Parity

For us the relation between PPP and inflation rate parity is the following:

A country which is able to continuously provide a better price/quality relationship for their tradable goods than another country has a competitive advantage. This competitive advantage is translated into a higher exchange rate that makes their products more expensive on the global market again (i.e. PPP via producer prices). The higher exchange rate leads to cheaper imported products and via cheaper imported prime materials to cheaper production (Partial Canceling Out of FX Effects).

Cheaper imports reduce inflation, especially in small open economies with a high import share. This directly leads to the Inflation Rate Parity.

Reasons for this competitive advantage can be found in cheaper tax levels, better infrastructure. more availability of (human) capital and lower debt and risk.

Differences between PPP based on producer and consumer prices

PPP can be measured based on the producer price index abbreviated as PPP-PPI, or in consumer price indices abbreviated as PPP-CPI. Commonly producer price indices base on prices of the output of local producers and on prices of exported goods. Since the CPI includes services (like haircutting), the better PPP measure for tradable goods is the one for PPP-PPI.

PPP measured in consumer prices and the PPP in terms of producer prices differ especially in Switzerland. These two measures differ quite strongly, not least because Swiss consumers are not very price-sensitive and Swiss importers had managed to collect high margins until September 2011 with the consequence that a special price control agency was created.

The PPP above provided by UBS is based on consumer prices and stands currently around 1.32.

The one from HSBC-Trinkaus is based on the producer price index (PPI). For them the AUD, NZD and NOK are strongly overvalued against the euro, but the franc is nearly at fair value.

Fields: Exchange rate, Average PPP, lower bound, upper bound, fairly valued ?

The average PPP for the EUR/CHF for several months have been nearly unchanged. The reason is that since the beginning of the year the Swiss PPI has been only a bit smaller the one of the euro zone. Moreover, the Swissie has depreciated against all currencies, which drives production and import costs upwards. Still it gives a certain relief for exporters, because labor costs are unchanged.

The Bloomberg PPP is based on the producer price indices (PPI).

Bloomberg PPP USD/CHF ( source )

Bloomberg PPP USD/EUR ( source )

The USD/CHF Bloomberg PPP stands currently at 1.01, the one for USD/EUR is at 0.87 (inverted notation). This implies a PPP for EUR/CHF of 1.16, meaning that the Swiss franc is undervalued against the euro.

The Bloomberg evaluation has been based on producer price inflation since the year 2000 and before that on the average exchange rate between 1982 and 2000. Since the dollar was relatively strong between 1982 and 2000, the correct USD/EUR PPP might be a bit lower.

For the EUR/CHF pair things are different, it mostly followed the trend line of the trade-weighted currency rate between 1982 and 2000. Therefore it is difficult to doubt the accurateness of the Bloomberg fair value of 1.16 for the EUR/CHF.

This implies that Swiss producers have been and are competitive enough, not least thanks to a low tax level, cheap import prices and a continuing immigration of qualified labor. The strong current account is only one symptom of this competitiveness.

PPP based on Input Producer Prices vs. PPP based Output Producer Prices

Statistics bureaus in certain countries like the UK are able to provide a differentiation between input and output price indices (PPI). The input PPI include costs of prime materials, capital and labor. The most recent UK data showed that the YoY input PPI fell by 1.2%, but the output PPI (for home sales) rose by 2.5%. The stronger sterling and cheaper energy prices helped improve margins of British companies.

Statistics bureaus in certain countries, like the UK, are able to provide a differentiation between input and output price indices (PPI). The input PPI include costs of prime materials, capital and labor. The most recent UK data showed that the YoY input PPI fell by 1.2%, but the output PPI (for home sales) rose by 2.5%. The stronger sterling and cheaper energy prices helped to improve the margins of British companies.

Unfortunately, the Swiss Statistics Bureau does not provide producer price indices based on input prices. It is clear that during the strong revaluation of the franc, the Swiss producers took profit from smaller production costs. Still the bureau distinguishes between production prices for home sales and export prices. The latest data shows that Swiss exporters do not have an issue with obtaining their desired prices. Thanks to the stronger dollar, export prices have even increased since September.

Exports and Export Prices Switzerland in CHF 2001-2012 ( source Natixis )

Summary

After the strong revaluation of the Swiss franc in recent years, some economists like the ones of the Swiss National Bank claim that the CHF is overvalued. Some economists use misleading PPP measures like the Big Mac indices, the OECD indices or the PPP based on consumer prices.

For us, PPP based on producer price indices (PPP-PPI, if available input prices) or based on export prices are the most relevant ones. We showed that the commodity currencies AUD, NZD and NOK are overvalued but the Swiss franc is not.

The following graph from the Swiss KOF institute gives a comparison of the different PPP measures for the EUR/CHF rate on the base year 2000 (and previously DEM/CHF, which is actually quite misleading).

- Exchange rate (CHF/EUR), red

- Relative Producer Prices (PPP based on PPI, not distinguished between exports and local consumption), black

- Purchasing Power Parity (PPP according to OECD), blue

- Relative GDP deflator, orange

- Relative Consumer Prices (PPP based on CPI), dark green

- Relative unit labor costs (ULC of the OECD), brown

It shows that the PPP-PPI calculated by the KOF is only slightly higher than the current EUR/CHF exchange rate. The so-called minimum exchange rate of the EUR/CHF is actually a fair value and not a minimum.

Improvements of the KOF analysis

The KOF should have provided relative producer prices as well as the relative export prices. This would have given even more hints as to whether the franc is overvalued for tradable goods. The second shortcoming is that they compared the period before 2000 with the German mark, but not with a composite of the euro countries’ PPIs. Especially the second short-coming suggests that the Bloomberg PPP-PPI is a better measure than the PPP-PPI from the KOF.

We repeat most parts of our investment recommendations from our latest Seeking Alpha article :

Long-Term investors : We think that a quick end of the euro crisis can be excluded (we will offer reasons in a forthcoming article) and recommend long-term investors hold Swiss francs in form of ETFs (NYSEARCA:FXF ) or long-term Swiss government bonds with maturities over 20 years (e.g. CH0127181169, CH0127181193) and to reduce the gold share in favor of Swiss bonds. Investors should use the current volatility in CHF pairs to choose a nice entry clearly above EUR/CHF 1.21.

Mid-Term investors:

We see risks in the mid-term (at least 3 months) for emerging markets, but a very modest recovery in the United States; therefore we suggest to hedge metals and Brent Oil positions (NYSEARCA:BNO ).

We recommend not to buy gold now and to hold long Yen (NYSEARCA:JYN ), short euro (NYSEARCA:DRR ), short silver (NYSEARCA:SLV ) and short the New Zealand Dollar, more details here on our comment on Daily FX .

We now add a long Swedish Krona position (FXS ) against the euro and take partial profit on silver. The EUR/SEK has risen from 8.18 to 8.64 since July (see spotlight SEK ).

As we predicted in our latest recommendation written on October 8, silver fell from $35 to $33 and gold from $1780 to $ 1753. But the euro has continued it ascent against the yen, even if ECB rate hikes will not come any time soon. European real estate prices are contracting and real interest rates are strongly negative.

As we expected, the New Zealand CPI was weak. It will sustain more RBNZ easing. We keep short NZD. We do not short the Aussie now, because as opposed to NZD, it has already done its necessary devaluation.

See more in-depth analyses by George Dorgan on Seeking Alpha:

Can the SNB makes profits on currency reserves ? (we think that the SNB will need to be bailed by tax payers once Swiss inflation picks up again).

Disclosure : I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.